NYSE Dividend Stock Picks

Dividend stocks such as Chevron and Coca-Cola can help diversify the constant stream of cash flows from your portfolio. Dividends play a key role in compounding returns over time and can form a large part of our portfolio return. Here are other similar dividend stocks that could be valuable additions to your current holdings.

Chevron Corporation (NYSE:CVX)

Chevron Corporation, through its subsidiaries, engages in integrated energy, chemicals, and petroleum operations worldwide. Established in 1879, and run by CEO John Watson, the company provides employment to 55,200 people and with the company’s market capitalisation at USD $218.75B, we can put it in the large-cap category.

CVX has a decent dividend yield of 3.75% and has a payout ratio of 124.96% . The company’s DPS have increased from $2.32 to $4.32 over the last 10 years. The company has been a dependable payer too, not missing a payment in this 10 year period. Chevron’s future earnings growth looks strong, with analysts expecting 68.5% EPS growth in the next three years.

The Coca-Cola Company (NYSE:KO)

The Coca-Cola Company, a beverage company, manufactures and distributes various nonalcoholic beverages worldwide. Started in 1886, and currently lead by James Quincey, the company size now stands at 100,300 people and with the market cap of USD $195.05B, it falls under the large-cap group.

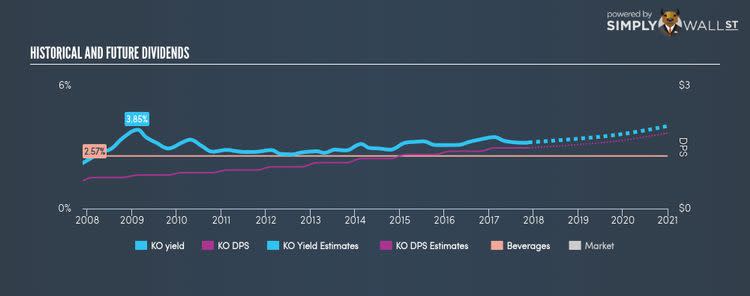

KO has a good dividend yield of 3.23% and is paying out 137.39% of profits as dividends . KO’s last dividend payment was $1.48, up from it’s payment 10 years ago of $0.68. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. Coca-Cola’s future earnings growth looks strong, with analysts expecting 98.6% EPS growth in the next three years.

Verizon Communications Inc. (NYSE:VZ)

Verizon Communications Inc., through its subsidiaries, provides communications, information, and entertainment products and services to consumers, businesses, and governmental agencies worldwide. Founded in 1983, and now led by CEO Lowell McAdam, the company provides employment to 160,100 people and with the company’s market capitalisation at USD $188.39B, we can put it in the large-cap group.

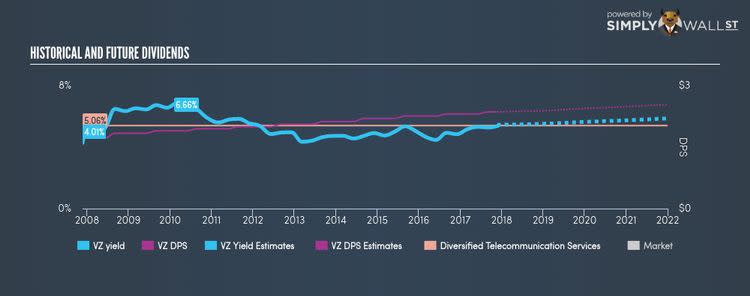

VZ has an alluring dividend yield of 5.03% and the company has a payout ratio of 59.53% , with the expected payout in three years hitting 62.67%. In the last 10 years, shareholders would have been happy to see the company increase its dividend from $1.72 to $2.36. The company has been a dependable payer too, not missing a payment in this 10 year period.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.