Roubini: A global recession sparked by coronavirus isn't 'totally farfetched'

Famed economist Nouriel Roubini believes the potential for a global recession stemming from spillover effects from the coronavirus (COVID-19) outbreak "doesn't look totally farfetched."

There are many global tails risks out there, and the coronavirus has emerged as the most immediate. The disease’s spread has sent markets into correction territory, as investors become fret over the rising potential for a worldwide pandemic.

Known as “Dr. Doom” for his doomsayer economic predictions — including the 2008 financial crisis — Roubini laid out a grim scenario in which the virus undermines worldwide growth. He told Yahoo Finance that in 2003 amid the severe acute respiratory syndrome (SARS) outbreak, China accounted for only 4% of global GDP.

Now, as the world’s second-largest economy, the country contributes to about 20% of global growth — making it extremely important to the global outlook.

"I think the market reaction right now is quite severe, and it's going to be more severe than SARS for many reasons," Roubini, who’s also an NYU economics professor, told “On the Move” on Friday.

Furthermore, at the time of SARS, globalization was "not as deep as it is right now. China is also key for global supply chains and the virus is having impacts on businesses around the world,” the economist added.

‘This time around, we’re in a correction’

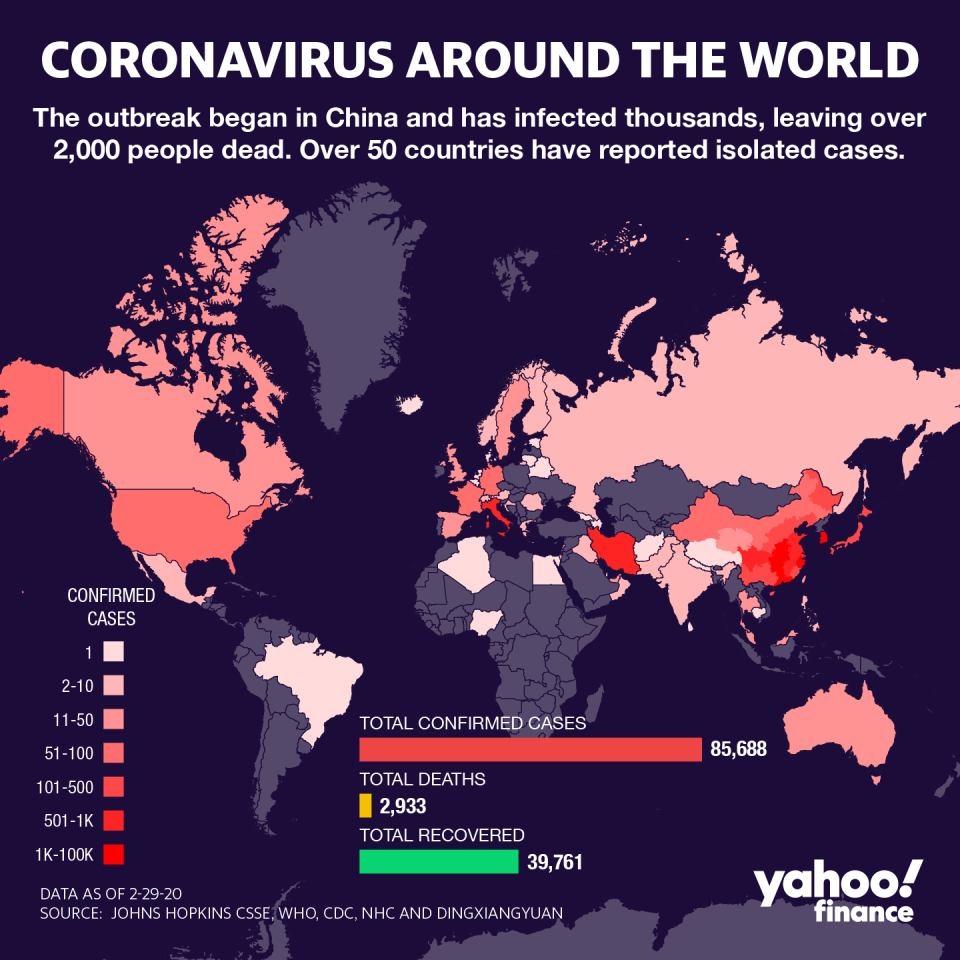

What's more, during the entirety of the SARS outbreak, 8,096 were infected across 29 countries and regions, and 774 died. About a month into the coronavirus (COVID-19), there have been more than 85,000 infected, and the death toll is approaching 3,000.

"We have not seen the spillovers then to the rest of Europe to the United States and so on. So, I think now the markets are now finally until last week they were totally delusional," Roubini said. "This time around, we're in correction."

Although China’s companies are slowly being brought back online, Roubini made the case for why a ‘V-shaped’ recovery in China is unlikely. On Friday, the government reported that a key gauge of the country’s factory activity plunged to a record low.

Roubini said that, even in a best-case scenario, China will only grow by 2.5% this year and 4% at best — well below the pre-virus rate of 6%. It also assumes the economy will contract in the first quarter.

"Think about what 2.5% growth in China means for China and then the spillovers to the global economy. And that's before there's going to be shocks to growth in Europe. It's going to tip into recession because of the spread of the virus,” the economist warned.

With Italy and Germany already sluggish, the global effects of widespread coronavirus infections will be big, Roubini predicted.

“You add all these things up, assume that maybe we wind up just because of coronavirus potentially close to a global recession doesn't look totally far-fetched frankly speaking," he added.

Julia La Roche is a Correspondent at Yahoo Finance. Follow her on Twitter.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.