North Port to ask voters to allow city to borrow funds without a referendum every time

NORTH PORT – City commissioners will ask North Port voters to approve a referendum that would let them borrow money − within limits − without seeking public permission every time.

Because the City Commission has already approved spending $4 million of reserves to finish designing a new police station, the decision to pursue this new referendum wouldn't sidetrack the project. But it would give city leaders an option to find ways to pay for the facility and – in the words of Sean Burroughs, incoming president of the North Port Area Chamber of Commerce, “Budget and plan, not plan (and) then budget.”

It would also put North Port on the same financial footing as the other 67 counties and 411 municipalities in the state of Florida, they noted.

The change in tack occurred during an April 23 special meeting that had been scheduled to discuss finance options for the planned $122.7 million police station.

“We all agree we need a new police headquarters; that is not a question. But the fact is we can’t identify sources of funds for even the (scaled down) $100 million model, so that’s an issue,” Commissioner Barbara Langdon said.

“I think we would all agree that totally independent of the police headquarters conversation, this city needs to be able to borrow money, so we need to be able to move forward with a referendum to accomplish that,” she later added.

Vice Mayor Phil Stokes stressed that there are many significant capital projects in utilities, roads and infrastructure that can’t be handled in a pay-as-you-go fashion or financed with bonds in a piecemeal fashion.

“Citizens have to step up, recognize we need the tools,” Stokes said. “We have to be able to get creative so we can amortize the cost of this project and others over the next 30 years, so that future generations of our citizens, our businesses help pay for this bloody thing and all the other projects we have.”

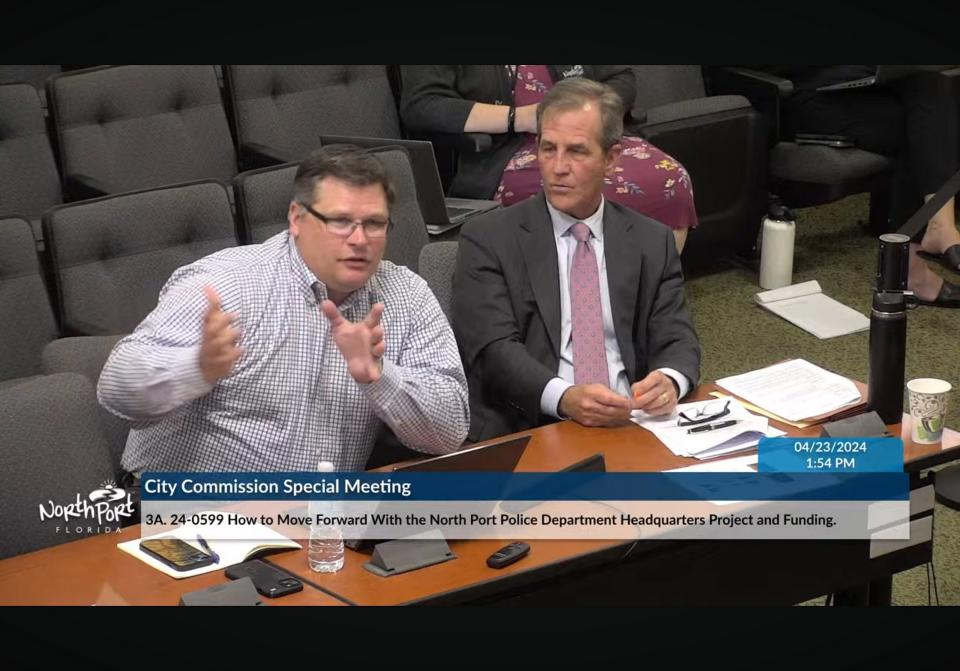

For much of the April 23 meeting, Jeremy Niedfeldt, managing director for PFM Financial Advisors LLC, the city’s financial advisor, and Steven Miller of Tampa-based Nabors, Giblin & Nickerson, the city’s bond counsel, walked the commission through multiple funding models, such as lease-purchase plans or issuing “certificates of participation,” used to build schools.

The board voted 5-0 to direct staff to bring back an ordinance to schedule a referendum that would allow the city to issue debt without voter approval. The board also unanimously approved directing staff to develop a 15-year capital improvement plan that would chart roughly $1.8 billion in projects of that time frame.

Why can’t the city borrow money like other governments?

A provision in the city charter, adopted in 1959, when General Development Corp. incorporated the municipality of North Port Charlotte, required the government to only borrow funds after hosting a referendum – something that City Manager Jerome Fletcher characterized as putting the city on a “‘pay-as-you-go,” footing.

Five other cities started by GDC – Cape Coral, Deltona, Palm Bay, Palm Coast and Port St. Lucie – once had similar city charter prohibitions but can now all borrow money up to a certain amount without a voter referendum.

Counties enjoy the same ability. For example, Sarasota County can borrow up to $28 million without voter approval.

For larger projects such as extension of the Legacy Trail, voters approved a $65 million bond in November 2018.

The ability to issue debt would allow North Port to guarantee bonds with money generated by enterprise funds or revenue sources other than property taxes.

For example the city of Sarasota is financing a $20 million bond to reconstruct Bobby Jones Golf Course with non-ad valorem revenues and use fees.

Both in a memo to the City Commission and during the special meeting, Fletcher brought up the fact that revenues generated by Warm Mineral Springs comprise an enterprise fund and if the city could issue debt, the park and historic structures might not have languished prior to Hurricane Ian.

Mayor Alice White echoed that thought later.

“Warm Mineral Springs, if we did have the bonding authority we could have bonded that and used the revenue to pay it back,” White said. “We need to have this amendment in our city charter.”

This article originally appeared on Sarasota Herald-Tribune: North Port voters will be asked to remove city borrowing restriction