Nearly Half of All Americans Missed Rent or Mortgage Payments Due to COVID-19, New Study Reveals

Almost half of Americans missed a mortgage payment or skipped a monthly rent during the pandemic, according to a new survey, underlining the disastrous financial and economic consequences many people are facing.

Read More: Here’s How Americans Really Spent Their First Two Stimulus Checks

Discover: If You Get a Stimulus Check, How Will You Use It? Take Our Poll

A new GOBankingRates survey found that a staggering 46% of Americans missed one or more rent/mortgage payments, and that 25% have missed more than one. And Erik Wright, owner of Chattanooga, Tennessee-based New Horizon Home Buyers says that the survey results are not surprising.

“Many of the phone calls and emails we are getting are from people who are behind on their mortgage and are trying to sell their house to prevent eventual foreclosure,” Wright tells GOBankingRates. “Many of them are wanting to sell so they can move where they can find work. We are also seeing people in more expensive markets, trying to sell and move somewhere more affordable before they get too far behind in payments. We have seen some banks trying to work with people through loan modifications, but we’ll see how effective those will be. One thing is for sure, banks are trying to figure out some kind of way to work with people. Financially, they can’t just forgive back owed payments, but they don’t want to foreclose on tons of homes all at once either. Nobody wants a repeat of what happened in 2008.”

“I think it is both surprising and not. COVID-19 was devastating for a lot of people and businesses. Especially in late March 2020 when everything first started and shut down, the CARES act was just being passed and so many people lost their jobs and rent was still due on April 1st,” GOBankingRates content data researcher Andrew Murray says. “So I imagine a lot of people who said they had just missed one payment had that occur sometime in those first two months of COVID.”

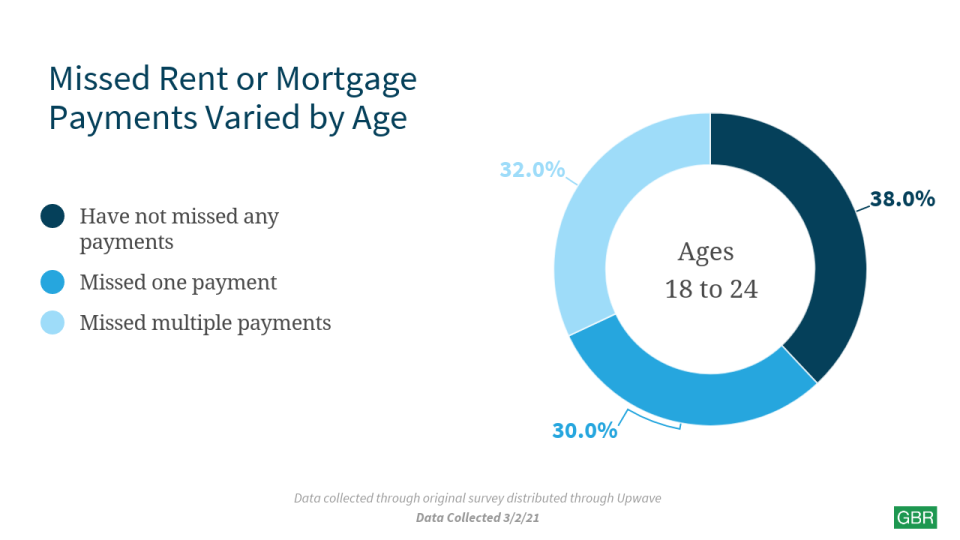

In terms of age groups, 62% of Americans aged 18 to 24 years say they missed a payment, while that number decreases to 54% for the 25 to 34 age group, according to the survey. On the other side of the generational spectrum, the figure decreases to 23% for the 55 to 64 age group.

These numbers indicate that the issue of missing rent/mortgage payments is a “young issue,” Murray says.

Read More: Those $1,400 Stimulus Checks Are Costing Taxpayers $15,000 Per Household

Discover: Biden’s $1,400 Stimulus Checks Won’t Work – How Economists Think We Should Use the Money Instead

“It could be as simple as younger Americans having less savings than their older counterparts due to their careers just beginning thus they are earning less. But we also saw in our survey that the younger respondents also had a higher rate of unemployment or change in job status than their older counterparts. So it could also be that at some point during the COVID pandemic the younger respondents had no income and less savings than their older counterparts and had to miss more rent/mortgage payments,” he adds.

In terms of gender differences, men missed more payments than women, with 48% of men saying they missed one payment, and 45% of women. In addition, 27% of men said they missed multiple payments, but only 23% of women said they missed multiple payments, according to the survey.

In regards to debt, again, an overwhelming majority of Americans–67%– say they have taken on some kind of debt, with the largest section being in the $1,000 – $4,999 range, at 21%.

“Obviously when two-thirds of the country has taken on debt due to the pandemic you are going to find that at least a little alarming,” says Julia O’Brien, an associate researcher for GOBankingRates.” What doesn’t surprise me is the amount ($1,000 -$4,999) being the largest section at 21%. With the average rent in for all homes in America during COVID-19 being $1,786 according to Zillow, that range of $1,000 – $4,999 amounts to a missed payment or two plus some other debt which could include not being able to pay off a credit card, car note.”

Read More: Are You Sure You’re Getting a Stimulus Check? 16 Million Americans Won’t Get a Third One

Discover: Treasury Secretary Yellen Confident $1.9 Trillion Bill Will Help Bring Country ‘Back to Full Employment’ Next Year

The survey also notes that every age group had a majority of its respondents say they accrued at least some debt and that debt does go down with age.

In terms of gender, men seem to say they accrued larger amounts of debt with women having higher response rate to smaller amounts of debt.

Breaking down further on how much debt each gender took on during the pandemic, 20.51% of women compared to 15.88% of men say they took debt in the $1 -$999 range; 21.30% of women and 20.95% of men took debt in the $1,000 – $4,999 range; 12.38% of women and 13.34% of men took debt in the $5,000 – $9,999 range; ge 5.19% of women and 8.78% of men in the $10,000 – $19,999 range;

3.99% of women and 3.21% of men in the $20,000 – $29,999 range; and 2.80% of women and 5.24% of men for the $30,000+ range.

“What I do find extremely interesting about this data is how much of a dropoff there is after you go above $10,000 in debt. It is very interesting to see that as a line in the proverbial sand,” Murray says.

Read More: Do You Think the Minimum Wage Should Be $15? Take Our Poll

Discover: Trillions of Dollars Have Been Spent on COVID-19 Relief – And It’s Still Not Enough

However, there are some actionable steps Americans can take when faced with missing rent or mortgages, some experts say.

“If you’ve had to pay late, check to see if the late payment appears on your credit reports. Late payments are only reported to the credit bureaus if they’re at least 30 days past due, depending on the lender’s policy,” says Nathan Grant, senior credit card industry analyst at Credit Card Insider.

“If things are looking tight due to the pandemic, or any other source of financial strain, you might be able to take advantage of credit card and mortgage grace periods,” he says, adding while you should always pay your mortgage on the first of the month, but mortgage grace periods typically let you pay by the 15th without being penalized.

“Credit card grace periods allow you to avoid being charged interest on purchases as long as you pay your full statement balance each month. If you can’t pay the balance in full, pay at least the minimum to avoid late fees and possible credit score damage,” Grant adds. “If you foresee financial struggle on the horizon whether from late payments or newly accrued debt, it can always be a good idea to contact your lenders and issuers directly to see what options they might have available to help, especially since the pandemic [began].”

Read More: It Turns Out Money Can Buy Happiness, Study Finds

Discover: OECD Increases US Growth Forecast for 2021, Thanks to $1.9 Trillion Stimulus and Faster Vaccinations

This sentiment is echoed by Thomas Rollins, a consumer bankruptcy lawyer in Jackson, Mississippi. Rollins says that consumer bankruptcy filings have dropped significantly over the pandemic, with bankruptcies being down about 50% in most states. “This seems counterintuitive, but banks are willing to work with people right now. Foreclosure moratoriums, stimulus and increased unemployment have all helped people avoid filing bankruptcy. We do know that the pandemic has caused significant financial trouble for many people and expect to see increased filings at some point over the next year,” he says.

More from GOBankingRates

This story has been updated to clarify the percentage of people who missed more than one rent or mortgage payment.

GOBankingRates surveyed 1,343 Americans aged 18 and older from across the country on March 2, 2020, asking fifteen different questions: (1) Have you lost your job since the COVID-19 pandemic began in March 2020?; (2) Did you have to miss rent or mortgage payments during the COVID-19 pandemic?; (3) Have you received some sort of unemployment benefits during the COVID-19 pandemic?; (4) Have you or someone in your household been given the opportunity/choice to work from home during the COVID-19 pandemic?; (5) Do you feel confident in your employment status for the rest of 2021?; (6) Have you had to adjust your work hours or job status due to any of the following during the COVID-19 pandemic? (Select all that apply); (7) If you are a parent, which of the following has your child/children been enrolled in at some point during the COVID-19 pandemic? (Select all that apply); (8) Which of the following best describes you?; (9) Has your overall spending increased during the COVID-19 pandemic?; (10) How much debt have you taken on due to the COVID-19 pandemic?; (11) If you received a stimulus payment(s) during the COVID-19 pandemic, how did you spend it?; (12) Which political party do you feel has been more helpful during the COVID-19 pandemic?; (13) Which of the following have you done since the COVID-19 pandemic started? (Select all that apply); (14) Which of the following statements best describes your recent moving history?; and (15) What’s the highest level of education you have completed?. GOBankingRates used Upwave’s digital survey platform to conduct the poll. Upwave’s Digital Network, respondents are interviewed in exchange for access to content or a service. Respondents receive no monetary payment for their participation.

This article originally appeared on GOBankingRates.com: Nearly Half of All Americans Missed Rent or Mortgage Payments Due to COVID-19, New Study Reveals