We just got a bunch of great news about the US economy

On Wednesday, the news for the US economy was stellar across the board.

A batch of data released at 8:30 a.m. ET showed that retail sales, inflation, and manufacturing activity all topped expectations.

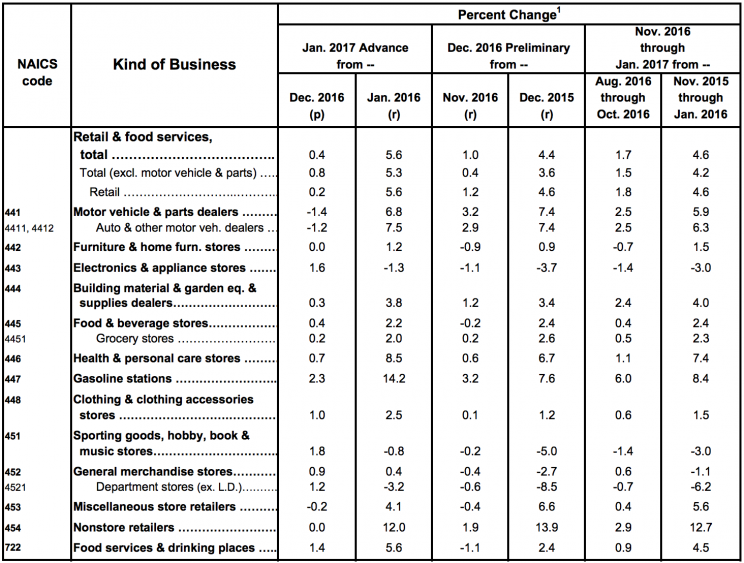

In January, retail sales rose 0.4% over the prior month, better than the 0.1% that economists were expecting. Perhaps the more encouraging part of this report was the revision to December’s number — a month that of course falls right in the heart of the all-important holiday shopping season — which now shows sales rose 1% during that month, up from an initial print of 0.6%.

Notable category increases over the prior year came from nonstore retailers — which includes online retailers like Amazon — which saw sales rise 12% over last year. Big increases over last year were also seen at gas stations due a higher price of oil and auto sales.

Inflation, which has big implications for the Federal Reserve, also topped expectations with both headline and “core” inflation topping estimates. “Core” inflation, which excludes the price of food and gas, is preferred by the Fed and economists as giving a better picture of underlying price trends in the economy.

Headline inflation rose 0.6% over last month in January and 2.5% over the prior year. Expectations were for increases of 0.3% and 2.4%. The headline year-on-year inflation print was the best March 2012.

“Core” inflation rose 2.3% over last year in January and 0.3% over the prior month and is above the Fed’s 2% inflation target. We’d note, however, that the Fed prefers the PCE measure of inflation, which has different weights for goods that comprise the index, notably a smaller weight towards housing prices.

Following this report, interest rates spiked, seeming to indicate the markets now think the Fed could raise rates three times this year, as it has projected. On Tuesday, traders did increase their bets of a March rate hike from the Fed after Chair Janet Yellen’s testimony, but were still largely fading the prospects for more aggressive action from the central bank.

Stock futures on Wednesday morning were little-changed following this data.

Manufacturing data for the New York region also crushed estimates on Wednesday.

The New York Fed’s Empire State manufacturing report came in at 18.7, better than 7.0 that was expected. Any reading over 0 indicates expansion of activity in the region. This was the best reading for the index is over two years, and the unfilled orders index rose above 0 for the first time in 5 years.

All of this data follows Tuesday’s latest Small Business Optimism report from the NFIB, which showed an additional increase in optimism about the economy from America’s small business owners.

“The stunning climb in optimism after the election was significantly improved in December and confirmed in January,” said NFIB President and CEO Juanita Duggan. “Small business owners like what they see so far from Washington.”

This reading had been one of the most positive economic indicators in the wake of Donald Trump’s election win.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Why it’s a mistake to get too excited about Trump’s tax cuts

One stock that will reflect the market’s view on US-Mexico relations

The hottest topic during earnings season has not been Donald Trump

For the first time since the recession, America’s biggest companies are shrinking

The stock market’s favorite Trump promise might be a total dud