Love Dividends? 3 Stocks You Might Want to Buy

The companies you add to your income portfolio should be carefully selected to match your passion for dividends. That means looking for strong businesses with long histories of dividend increases. Here are three stocks that dividend lovers should be looking at today -- two with big yields and one with a smaller yield that's high compared with its own history.

1. Handling the ups and downs

This trio of stocks starts off with ExxonMobil (NYSE: XOM). The first thing to know about this diversified energy giant is that its earnings and stock price will tend to go up and down along with the price of oil and natural gas. That can lead to frustrating periods of weak performance because these commodities have volatile swings. Oil prices are relatively weak today, part of the reason Exxon yields a fat 4.6% -- toward the high end of its historical range. And it has increased its dividend annually for 37 consecutive years.

Image source: Getty Images.

That said, Exxon is built to survive periods like this. For starters, its business is spread across the upstream (oil and gas drilling), midstream (pipeline), and downstream (chemicals and refining) sectors. That diversification helps to soften the blow of weak oil markets, since downstream businesses tend to benefit from low oil prices. However, Exxon also has a rock-solid balance sheet, with a debt-to-equity ratio of around 0.21. That's among the lowest in the industry, which matches well with its conservative approach.

Exxon is in the middle of a big spending push to grow its oil and gas production and expand its downstream footprint. It's starting to see positive early results. But, more important, it has the financial strength to see its plans through and continue to support the dividend even if oil prices are weak.

2. A slow transition

Next up is IBM (NYSE: IBM). It's often overlooked today because it is conservative and boring and, equally important, doesn't focus on the consumer market. Its customers are largely other businesses looking for a reliable partner, which is why it counts some of the world's largest financial institutions and governments as customers. Today IBM offers a 4.3% yield, the high end of its historical range, backed by 24 years of annual dividend hikes.

IBM Dividend Yield (TTM) data by YCharts. TTM = trailing 12 months.

It faces some notable challenges as it shifts its business from legacy products (like computer hardware) to more in-demand tech services (like cloud computing). It hasn't had a particularly smooth ride, with the company turning in years of what can best be described as mixed earnings. That said, it just completed the biggest acquisition in its history, buying Red Hat to help it expand its reach in the cloud space.

The deal is going to leave IBM with a temporary debt overhang, but the picture isn't as bad as it looks -- around a third of the company's debt is related to the financing of customer sales. That said, management is well aware of the issue. It will hold off on stock repurchases as it pays down debt, which is a big statement because IBM generates a lot of free cash flow. It has used that cash to buy back billions of dollars of stock in recent years, so the shift should allow debt levels to fall pretty quickly. And in the meantime, it has stated that the dividend will continue to grow.

The company has been around for over 100 years and has successfully changed with the times before. It is never easy, but history suggests IBM will figure this transition out. If you can think long term, you can collect a fat dividend while it uses its cash-generating ability to return its balance sheet to a more normal level after making what could be a transformative acquisition.

3. Protein powered

The last name on this list is Hormel Foods (NYSE: HRL), probably best known as the company that makes Spam. But that is just one of this company's many leading names, since it has 40 brands that hold the No. 1 or No. 2 position in their category. And with 53 consecutive years of dividend increases, it clearly has an impressive commitment to returning cash to investors. The roughly 2% yield might seem a little low on an absolute basis, but it happens to be high relative to the company's history.

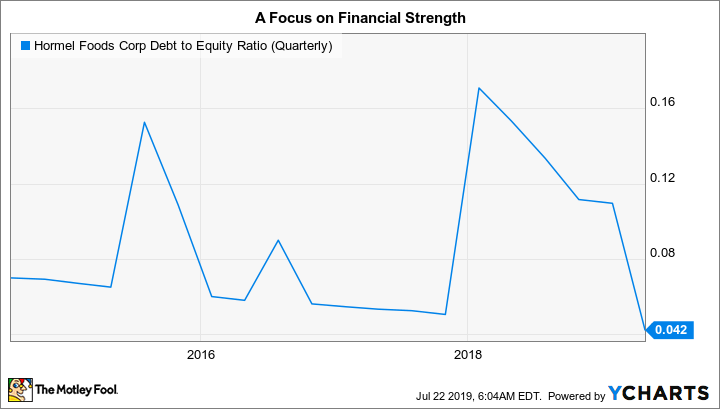

Like IBM, Hormel is shifting with the times. It has been selling older brands (like Diamond Salt) and buying newer, on-target fare (like Columbus Craft Meats and Wholly Guacamole). But unlike IBM, Hormel hasn't had to lever up to get these smaller, bolt-on deals done. The company's debt-to-equity ratio is a minuscule 0.04. And it has a long history of fairly large dividend increases, with the annualized increase over the past decade sitting at a robust 15%.

HRL Debt to Equity Ratio (Quarterly) data by YCharts.

Although Hormel's yield may not excite like those of Exxon or IBM, a lower yield backed by robust financial strength and large annual increases is pretty compelling. If you love dividends, look past the absolute yield here and think about the bigger picture and view it as an opportunity to add more dividend growth to your portfolio.

Time for a deep dive

Exxon, IBM, and Hormel are far from perfect dividend stocks. But frankly, there is no such thing as a perfect stock of any kind. Exxon and IBM both offer big yields from industry leaders. Both are working on improving their businesses and have the financial strength to keep growing their dividends despite what are expected to be temporary headwinds. Hormel's dividend yield is lower on an absolute basis, but high compared to its history -- and its dividend growth should be robust even as it shifts its portfolio to better serve customers. All three are worth further research if you love dividends.

More From The Motley Fool

Reuben Gregg Brewer owns shares of ExxonMobil, Hormel Foods, and IBM. The Motley Fool is short shares of IBM and has the following options: short January 2020 $200 puts on IBM, short September 2019 $145 calls on IBM, and long January 2020 $200 calls on IBM. The Motley Fool has a disclosure policy.