London’s office market pulls back from the brink

With the UK now well into its third lockdown, investors and landlords in Britain’s commercial property market are growing increasingly twitchy.

It’s not just the worries over late rental payments and the lack of workers actually using prime office space as millions of people continue to work from home. For many, the astonishingly rapid changes in market conditions over the past 12 months has come as a deep shock to the system.

“It’s hard to state how much of a culture shock it was for these guys,” one real estate expert says, recalling working with a client last March and April.

Suddenly the client, a property fund, had to switch to something they had never done before. They didn’t own a single laptop. So right before lockdown the property fund had to go out and try and buy several thousand laptops and put in the IT infrastructure to support its staff overnight.

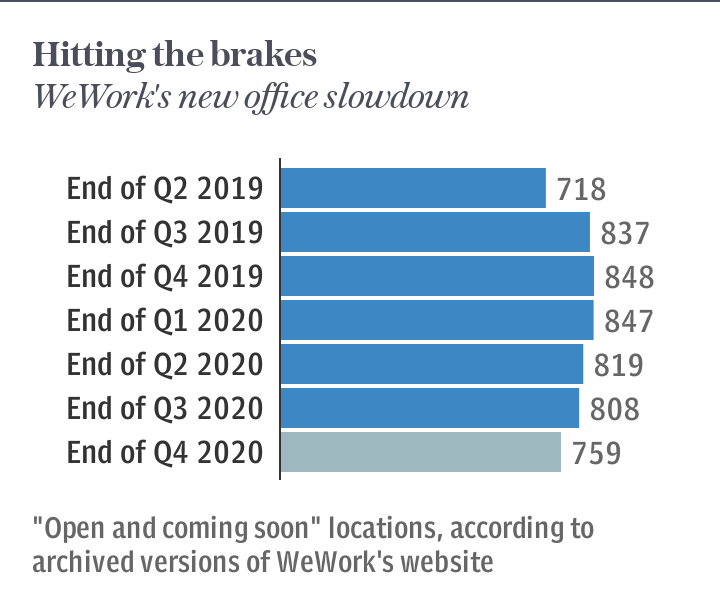

Last week, the negative fallout from the pandemic continued to reverberate across the sector as WeWork and IWG announced they were scaling back office projects. Landsec and Derwent London also revealed they were yet to receive over 10pc of their office rents.

Silver lining

Yet even so, there are some optimists who believe the current crunch represents an opportunity and that a recovery could be around the corner.

Mat Oakley, Savills’ head of European commercial research, believes fundamental demand remains high. “London offices investment was about £5bn, which is pretty much bang on the same number for Q4 each of the last three years. From that, you’d probably say, ‘clearly investors aren’t worried at all’,” he says, before adding: “Admittedly, the first three quarters were horrific.”

Other market bulls point to positive signs overseas. One executive at a global investment firm highlighted that Amazon, Facebook and Apple had either bought or leased 1.6m sq ft in New York last year.

Despite big immediate problems, many think once the pandemic eases its grip, recovery could be swift. “There’s a wall of capital looking to deploy into London,” said Kelly Cleveland, head of investment for British Land. Recent sales back this up. Landsec managed to sell some big London projects, including 1 & 2 New Ludgate to Sun Venture for £552m.

Despite some investment, further sales are being held back by the inability to complete deals in the middle of a pandemic. “There has been impediments on foreign investment due to the pandemic – and a notable drop-off in Asian investment across the market,” said Cleveland. “That being said, Europe has filled that gap as roughly 50pc of the investment has come from there.”

London calling

“The yield gap is higher now in London than it is in the majority of European cities which has not previously been the case. This is driving capital to London.”

Chris Gore, principal at Avison Young, agreed that yields are playing a role: “London is still a very easy place to invest, as a landlord-friendly jurisdiction offering higher yields than most of the core European cities.

“Despite travel restrictions we are seeing more interest from Hong Kong investors who are looking to get money into London.”

“They haven’t been doing deals because they couldn’t do deals,” says Oakley, who highlights the structure of foreign investment committees as an impediment to investment during the pandemic.

“The very strong final quarter points to the fact that people probably wanted to buy offices in June last year ... If you’re a non-domestic investor, your investment committee says we cannot buy anything unless a member of the investment committee has physically viewed this building, and you’re sat in Singapore, you couldn’t do a deal however much you wanted to do a deal.

“So I think there was an artificial ceiling put on deal volumes in the investment market.”

Rebuilding demand

Is a return to normal likely? Almost certainly for high-quality assets, say executives who think a strong market will remain for the best buildings in the capital. One said: “I honestly don’t see any meaningful shift in the amount of capital that is looking to make investments in the office sector across Europe. I say that with a high degree of confidence for high-quality assets.”

Given the lack of inflation of office rents due to Brexit, Britain has become a comparatively strong pull for investors who simply need to put their money somewhere. With retail being seen by many funds as effectively uninvestable, hospitality in a similarly unstable position, and logistics being well thought of but a small market, the potential areas for investment have shrunk massively. In practice, this means that only residential and offices are considered safe by some funds.

Due to this, despite further uncertainty for offices and the pandemic as a whole, a return for investments in offices seems likely, even if workers aren’t returning yet.