IT'S A BEAT: January jobs report tops expectations as wages rise more than forecast

The January jobs report is out and it’s a beat.

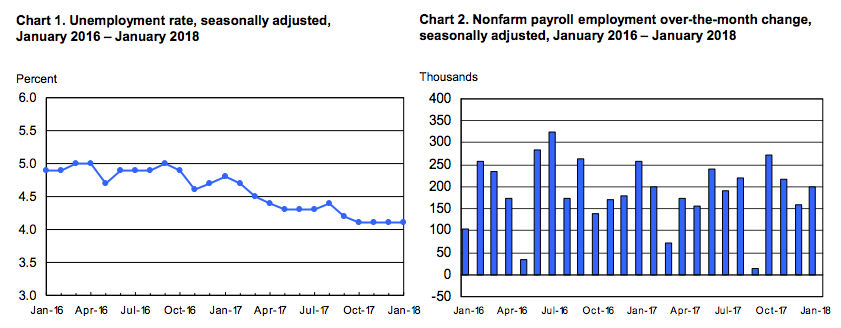

The U.S. economy created 200,000 jobs in the first month of 2018, according to the Bureau of Labor Statistics. The unemployment rate in January held steady at a 17-year low of 4.1% for the fourth straight month.

Economists had expected nonfarm payrolls to grow by 180,000 during the first month of the year and the unemployment rate was forecast to remain at 4.1%. Over the last three months, job gains have averaged 192,000 per month.

Wages were the real standout in this report, however, coming in much better than expected. Average hourly earnings rose 0.3% over the prior month and 2.9% over the prior year. This year-on-year wage increase is the best since 2009.

Wages were forecast to rise 0.2% over the prior month, a slight decline from last month, but increase 2.6% on an annual basis, an improvement over the final month of 2017. Wages have been a slight disappointment in recent months as many economists have expected the low level of unemployment to create more wage pressures in the economy. Friday’s report lends credence to the idea that this is finally coming to pass.

Average weekly hours worked declined, however, to 34.3 from 34.5, boosting the average hourly earnings figure. And average weekly earnings actually declined in January to $917.18 from $919.43 in December.

Following the report, stock futures remained lower, with Dow futures pointing to an opening loss of more than 200 points and S&P 500 futures down 0.6%.

Bonds, however, were the big story with the 10-year Treasury yield shooting higher to 2.83%, the highest since 2014 and a continuation of a move we’ve seen play out over the last few weeks. The 2-year Treasury yield was also on the move higher, rising to 2.18%.

Higher bond yields reflect investor expectations of more interest rate hikes from the Federal Reserve and the anticipation of future inflation in the economy. Friday’s wage data will certainly add to a thesis that inflation is coming down the pike after having come in below the Fed’s 2% target for years.

Other numbers investors were keeping an eye in this report include manufacturing employment, which rose by 15,000 in January, less than the 25,000 jobs we saw added to the sector in December. The labor force participation rate also held steady at 62.7%.

The underemployment rate, which includes those out of work as well as those working part-time but who would prefer full-time work, sat at 8.2% in January, an increase of 0.1% over December. President Donald Trump’s chief economic advisor Gary Cohn has said the administration is focused on bringing this figure down.

The black unemployment rate, which was at an all-time low of 6.8% in December and was touted by President Trump during Tuesday night’s State of the Union address, rose to 7.7% in January.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

One candidate for Amazon’s next headquarters looks like a clear frontrunner

Tax cuts are going to keep being a boon for the shareholder class

Auto sales declined for the first time since the financial crisis in 2017

Foreign investors might be the key to forecasting a U.S. recession

It’s been 17 years since U.S. consumers felt this good about the economy