LARRY FINK: I see a lot of 'dark shadows' in the market right now

BlackRock (BLK) CEO Larry Fink is worried.

Speaking at Yahoo Finance’s All Markets Summit on Wednesday, Fink told Yahoo Finance editor-in-chief Andy Serwer that, “I’m much more worried about the world and the level of equity markets than I think consensus today.

“I see a lot of dark shadows that could impact the direction of the marketplace.”

Throughout his conversation with Serwer, Fink noted that he was feeling a bit “bipolar” about the world economy right now, outlining a variety of scenarios he thinks could materialize under the Trump administration.

“I can make a strong case why the 10-year Treasury is going to be below 2%,” Fink said.

“And I could make a strong case why the 10-year Treasury is over 4%. If I had to be betting right now, I think there’s a better probability of the 10-year being below 2%.”

“I’m not relaxed,” Fink said.

BlackRock, the world’s largest asset manager, is certainly in-tune with the retirement prospects of workers in the US and around the globe.

On this front, Fink added that, “we have this impending crisis of Americans are not prepared financially to live in retirement with dignity because they just have an inadequate amount of savings.”

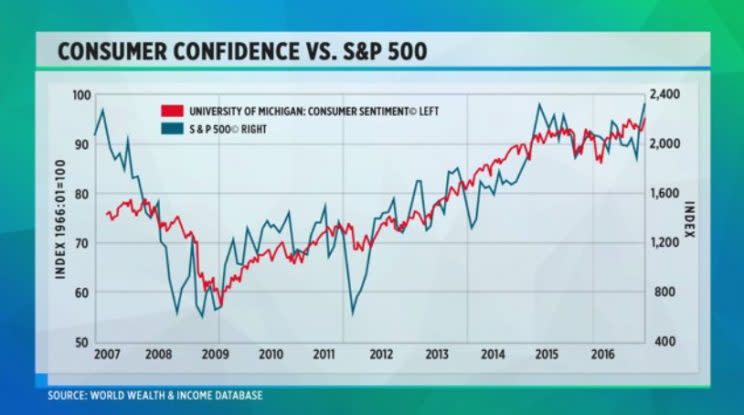

Ahead of his interview with Fink, Serwer highlighted a chart showing the relationship between the S&P 500 and consumer confidence. Perhaps predictably, consumer confidence rises as the price of stocks rise.

Fink said Wednesday that he found this chart “horrifying.”

“When consumer confidence was the lowest, that the was low point of the equity markets and you should be buying,” Fink said. “Maybe you should be selling now. The key is for individual investors is you have to stay invested. I found that slide horrifying.”

Fink added that, “The biggest problem we have is… most investors are no equipped to navigate how they should be building towards the outcome of retirement.

“Most investors, they panic at the wrong time, they look at trading around, navigating around, their pension fund. And I think in most cases they’re underinvested because of that.”

Fink’s comments come about two weeks after his latest letter to CEOs at S&P 500 companies and major European corporations arguing for more long-term thinking among major Western business executives.

In that letter, Fink wrote that, “Over the past 12 months, many of the assumptions on which those plans were based — including sustained low inflation and an expectation for continued globalization — have been upended.

“At the root of many of these changes is a growing backlash against the impact globalization and technological change are having on many workers and communities. I remain a firm believer that the overall benefits of globalization have been significant, and that global companies play a leading role in driving growth and prosperity for all.

“However, there is little doubt that globalization’s benefits have been shared unequally, disproportionately benefitting more highly skilled workers, especially those in urban areas.”

More from Yahoo Finance’s All Markets Summit.

The 2017 outlook: Political uncertainty does not equal market uncertainty

Georgia Senator: CFBP is a ‘rogue agency’

Arconic CEO under attack: Don’t take it personally, it’s just business

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland