A major psychological shift is occurring across markets and the economy

Markets and the economy are increasingly being characterized by one word: certainty.

This is likely to worry some investors and market watchers who see over-confidence in the future as a sign that things are about to change.

On Wednesday, the latest consumer sentiment survey from the University of Michigan indicated that while overall confidence in the economy is sitting right near a 13-year high, “what has changed recently is the degree of certainty with which consumers hold their economic expectations.”

Richard Curtin, chief economist for the survey, added that, “In contrast to the media buzz about approaching cyclical peaks and an aging expansion, with the implication of greater uncertainty about future economic trends, consumers have voiced greater certainty about their expectations for income, employment, and inflation.

“Inflation expectations have shown the smallest dispersion on record, and increased certainty about future income and job prospects has become a key factor that has supported discretionary purchases.” (Emphasis added.)

Back in October, this idea that consumers were becoming increasingly confident not just in the U.S. economy right now but their expectations for the economy began to come into focus.

In mid-October, the University of Michigan survey indicated that consumers were characterizing the current economic situation by calling it “as good as it gets.”

By the end of October, The Conference Board’s survey on consumer confidence pegged sentiment about the economy at a 17-year high with the labor market driving much of this optimism. In October, the U.S. economy added 261,000 jobs while the unemployment rate fell to 4.1%, the lowest since December 2000.

Also in late-October, a University of Michigan survey released just days before The Conference Board’s figures indicated that consumers “anticipated the expansion to continue uninterrupted over the next five years.” This commentary also indicated that it wasn’t just uninterrupted economic growth, but also lower rates of overall growth, that consumers were becoming increasingly sure we would see.

This week’s economic data, then, appear to be a continuation — and a strengthening — of a trend in growing certainty among consumers about the economic outlook. Economic growth might not accelerate, but the average American seems just fine with this — and confident the situation won’t change anytime soon.

Wall Street’s certainty

On the Wall Street side of the economic equation, this past week has seen at least five major research teams unveil bullish outlooks for the market in 2018 and forecast double-digit returns for the U.S. benchmark stock index.

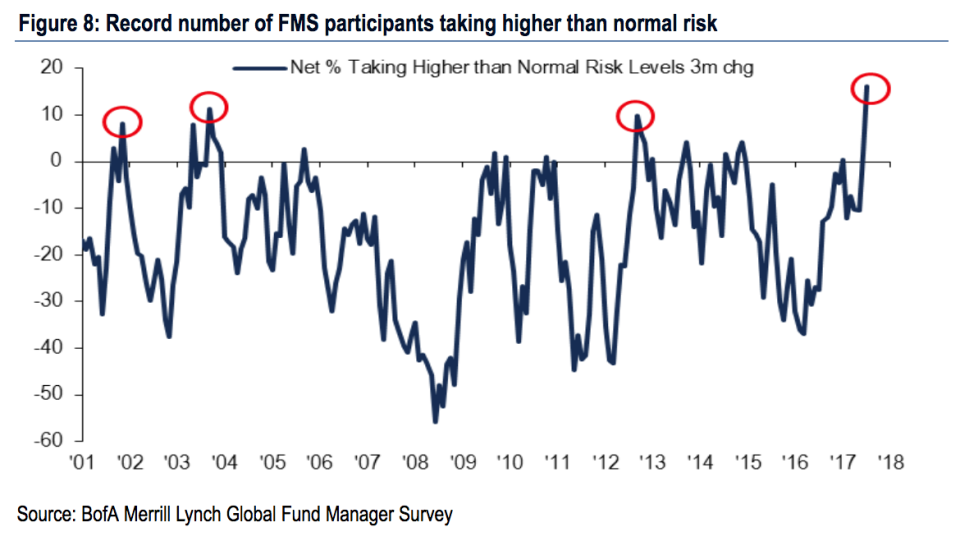

And these forecasts come on the heels of a Bank of America Merrill Lynch survey last week which shows that a record number of fund managers are taking a higher-than-normal amount of risk.

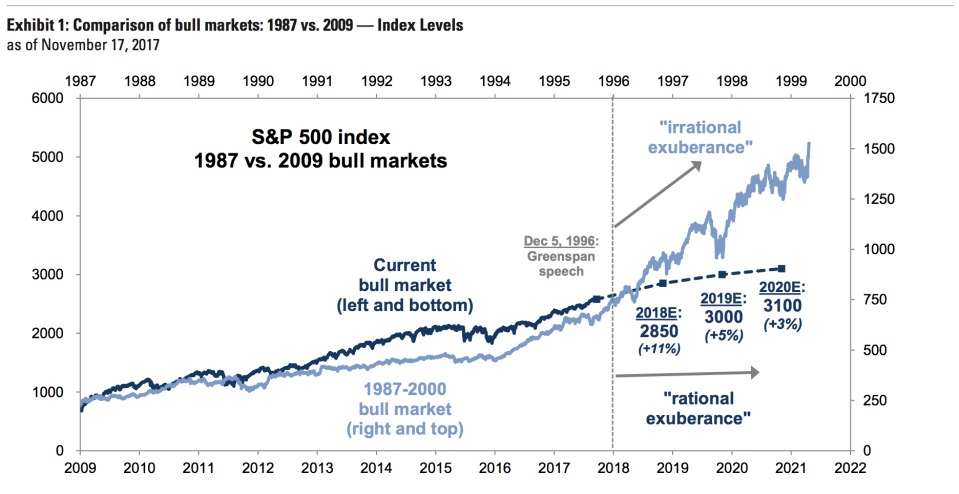

David Kostin, chief equity strategist at Goldman Sachs, called the firm’s guiding theme for 2018 and the years ahead “rational exuberance,” a play on the famous formulation from former Fed chair Alan Greenspan.

As we noted on Tuesday, Greenspan’s question was rhetorical, a public pondering of it can be known, prima facie, that markets or an economy have become overheated to the extent that we will see unavoidable damage in the future.

Goldman’s re-formulation of this question, however, seems to posit that if we take irrationality out of an enthusiasm for markets or the economy we can know what the future brings. And in this case, that means modestly higher stock prices and slow, but steady, economic growth.

Yet if uncertainty is the only thing we can be reasonably assured is a consistent feature of markets and the economy, one wonders if the recent outbreak of certainty about what will — and won’t — happen in the years to come is a sign unto itself that something is about to change.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: