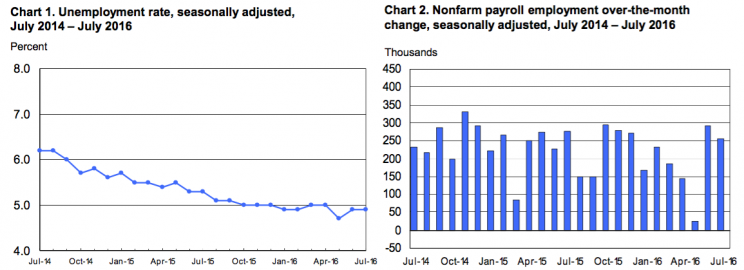

US adds a healthy 255,000 jobs, unemployment rate holds at 4.9%

The US economy added 255,000 jobs in July, as the unemployment rate held at 4.9%. This is according to the Bureau of Labor Statistics’ July US employment situation report.

This compares to economists’ expectation for 180,000 payrolls and an unemployment rate falling to 4.8%.

“This is a ROBUST BLS employment report,” Allianz’s Mohamed El-Erian tweeted.

University of Michigan professor Justin Wolfers noted that the US has now seen jobs grow for a record 70 consecutive months. All of this reflects a healthy and generally improving US labor market.

“Here’s what’s so exciting: Job growth is expected to slow as the population ages and as we approach full employment,” Wolfers noted. “But it’s not listening.”

“All that presidential election rhetoric and huge crowds saying there are no jobs out there have it completely wrong,” Bank of Tokyo-Mitsubishi’s Chris Rupkey said. “The jobs data shows the economy is better than voters think.”

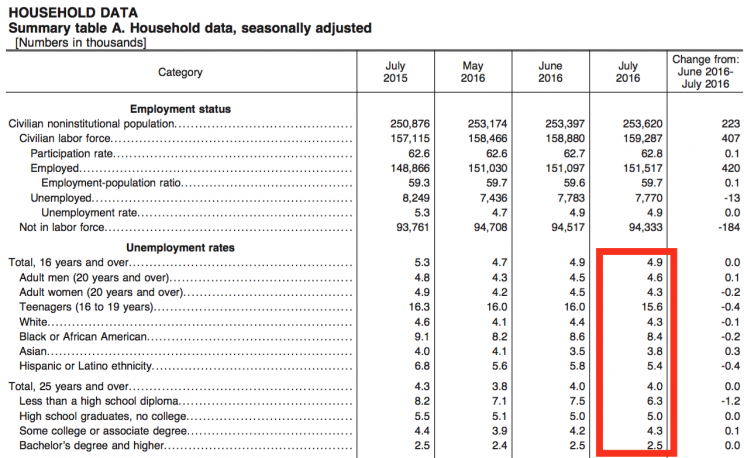

During the period, 407,000 people entered the labor force, which caused the labor force participation rate to climb to 62.8% from 62.7% a month ago. Average hourly earnings climbed at a 2.6% pace year-over-year.

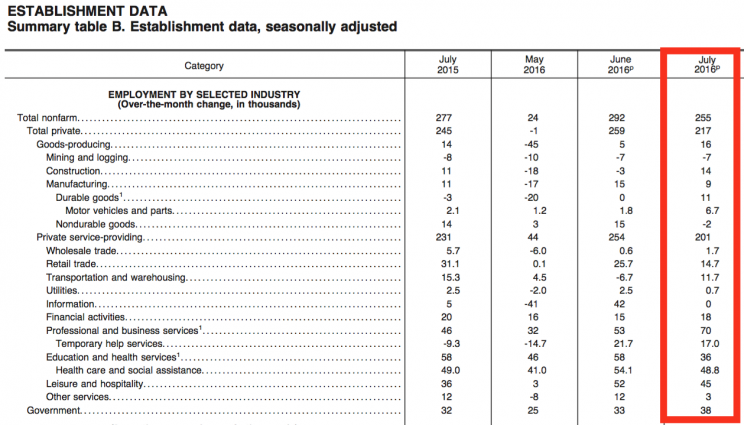

Below is a look at jobs added by industry. Mining and logging, which includes jobs in the oil sector, continue to be weak due to low prices.

The unemployment rate for black or African Americans fell to 8.4% from 8.6%. The Hispanic and Latino unemployment rate fell to 5.4% from 5.8%. Both remain above the national average.

People looking at today’s report, however, should remember that one month’s number isn’t always reflective of underlying economic trends.

The US labor market keeps humming

While US economic growth remains lackluster, labor market trends continue to show strength despite hiccups along the way. Indeed, while the various measures of the labor market offer slightly different pictures, all continue to point to an economy that’s still hiring.

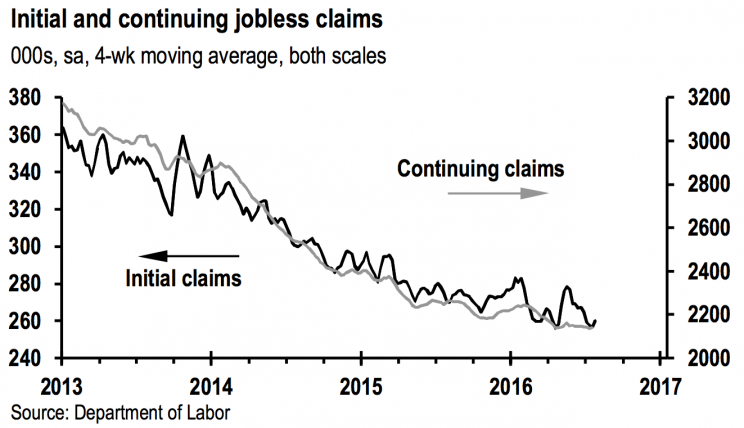

“While we believe that the trend in nonfarm payroll growth is moderating over time, many recent economic indicators point to July being a solid month for job growth,” JPMorgan’s Daniel Silver said. “The trends in jobless claims have been favorable lately and looked especially upbeat around the reference period for the July employment report. And the ADP employment report showed that private payrolls increased 179,000 during the month.”

“There are signs that economic growth is slowing,” Bank of Tokyo-Mitsubishi’s Rupkey said on Thursday. “We can’t blame the strong dollar anymore as America’s exports are rising again. But residential housing construction and weakness in business orders for new equipment continue to take it on the chin. Business equipment purchases are going to decline in 2016, and they have never done so before unless the economy is in a recession. There is an industrial recession out there in America, many corporations say. But so far the weakness or slowdown in manufacturing is not leading companies to lay off workers, so whatever weakness there is in the industrial heartland, it is not spreading to the broader economy… yet.”

“On the whole, this morning’s strong July employment report indicates that labor market health remains intact and, in our view, reduces near-term recession risk for the US economy,” Barclays’ Jesse Hurwitz said.

What about monetary policy?

Despite what continues to be an uncertain global economic and geopolitical environment, US economic data continue to hold up. This has put pressure on the Federal Reserve to tighten monetary policy a bit with an interest rate hike, which it last did in December.

“Today’s report helps the case for more Fed tightening before too long — if strength is sustained — although officials are being ultra cautious/dovish as they worry about downside risks,” High Frequency Economics’ Jim O’Sullivan said. “We still expect they will remain on hold until December.”

By no means does Friday’s July jobs report point to any sort of done deal for policymakers. Members of the Federal Reserve will have the August jobs report — released on September 2 — before they publish their next policy decision on September 21.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Warren Buffett slams Trump with a monkey and a newspaper

The stock market is making no sense for a lot of investors

How a bad story can cripple the economy

Forecasting 2017 earnings has become Wall Street’s most controversial task

Now’s a great time to reread Warren Buffett’s op-ed he wrote after one of history’s worst sell-offs