JOBS WEEK IS HERE: What you need to know this week in the US economy

Jobs week is here again.

A busy week for the US economy will be punctuated by this Friday’s November jobs report. Economists expect the US economy added 175,000 jobs in November.

But outside of the marquee jobs report, we’ll get readings on inflation, auto sales, another revision to GDP, and manufacturing surveys during the jam-packed week.

The latest OPEC meeting is also set for this week, and some expect there’s a chance the oil cartel could announce an agreed-upon on production cut, potentially bolstering the price of oil.

In a holiday-shortened week, US stocks closed at record highs as the Dow eclipsed 19,000 for the first time and the S&P 500 settled north of 2,200.

Data Flood

Here’s the quick rundown of the week’s big US economic events.

Monday:

Dallas Fed manufacturing survey (2 expected; -1.5 previously)

Tuesday:

Third quarter GDP, second estimate (+3.1% expected; +2.9% previously)

Third quarter personal consumption, second estimate (+2.1% previously)

S&P/Case-Shiller home price index (+0.61% previously)

Conference Board consumer confidence (100 expected; 98.6 previously)

Wednesday:

Personal income (+0.4% expected; +0.3% previously)

Personal spending (+0.6% expected; +0.5% previously)

Core PCE (+1.7% previously)

Chicago PMI (52.0 expected; 50.6 previously)

Pending home sales (+0.3% expected; +1.5% previously)

Federal Reserve Beige Book

OPEC meets

Thursday:

Initial jobless claims (251,000 previously)

Markit manufacturing PMI (53.9 previously)

ISM manufacturing PMI (52 expected; 51.9 previously)

Construction spending (+0.5% expected; -0.4% previously)

US auto sales, November (17.7 million expected; 17.9 million previously

Friday:

Nonfarm payrolls, November (+175,000 expected; +161,000 previously)

Unemployment rate (4.9% expected; 4.9% previously)

Average hourly earnings, month-on-month (+0.2% expected; +0.4% previously)

Average hourly earnings, year-on-year (+2.8% previously)

ISM New York (49.2 previously)

Jobs, Manufacturing

The big headlines on the data side will, of course, come from Friday’s jobs report.

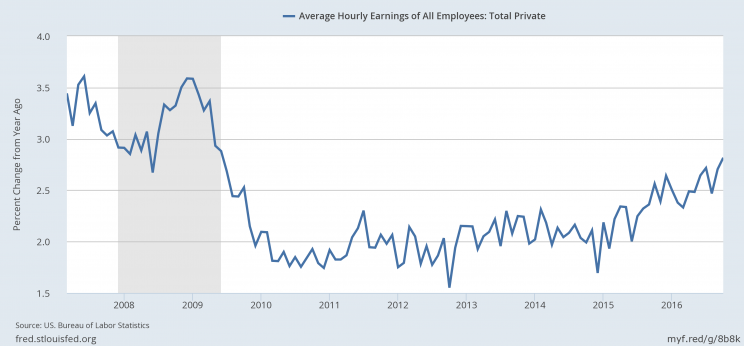

The October report showed that while headline job gains continue to be strong, wages appear to be firming more broadly as the 2.8% year-on-year improvement was the best since the financial crisis. An increase in wages is seen as an indication of potential inflationary pressures building in the economy.

“We expect a softer 0.2% [month-on-month] gain in average hourly earnings after the strong 0.4% [month-on-month] pop last month, leaving the year–over–year rate at 2.8%,” write economists at Bank of America Merrill Lynch.

“This shows continued improvement in wage growth, but still a less–than–healthy 3%–4% pace of growth. Remember that the strong gain in average hourly earnings last month was concentrated in three categories: mining, utilities and information technology. We think that there is propensity for a modest reversal given the magnitude of the increase in all three.”

The second estimate of third quarter GDP is also likely to show an improvement in what as already the best quarter for headline economic growth since 2014. The Atlanta Fed’s latest GDPNow estimate has the fourth quarter on pace to show even more improvement to growth of 3.6%.

Tuesday’s consumer confidence reading and Thursday’s manufacturing surveys will also be closely tracked. As we noted last week, economists at Deutsche Bank singled out these reports as bearing close watching in the coming months. That’s because these surveys tend to be more forward-looking than other data and, as a result, will give us a better idea of how the presidential election is — or could be — changing consumer and business behavior.

“At economic inflection points, many hard data series are less useful because they are not forward looking,” Deutsche Bank wrote.

“This applies to measures of employment, production and retail sales, which are either contemporaneous or backward looking. Instead, investors should focus on forward-looking series such as business and consumer expectations, as well as capital spending plans.”

In our first look at consumers last week, we saw a big bump in sentiment following the election. Or maybe consumers are just happy it’s over.

Looking Ahead

Thursday will mark the first day of December and the beginning of the year’s final month.

And on Wall Street, that means all eyes have started to turn towards 2017.

This past week, we saw the S&P 500 close above 2,200 for the first time. And as it currently stands, many Wall Street stock strategists expect the index to eclipse 2,300 by the end of next year.

David Bianco at Deutsche Bank think the benchmark index will likely hit 2,250 by Donald Trump’s inauguration. By the end of next year, the index should hit 2,350.

“We think the market is under appreciating the likely big boost to S&P EPS from a lower corporate tax rate and the boost to bank profits from rising yields (and lower pension expense) and the much higher chance now of a long lasting economic expansion that rivals the 10 year US record,” Bianco writes.

“We’re more confident now that the S&P will reach 2500 in 2018 before suffering its next bear market.” (Emphasis added.)

Strategists with less specific targets than Bianco largely agree, however, that US corporate earnings should improve next year after flagging in 2015 and 2016.

“Steady but unspectacular profit growth will be a hallmark of 2017 earnings,” writes David Kostin at Goldman Sachs. Kostin and his team have a 12-month price target of 2,200 on the S&P 500.

“We believe that rising earnings and multiples will push equity returns into the double digits from our previous high-single-digit baseline,” writes RBC strategist Jonathan Golub.

“A pickup in inflation and rising business confidence should result in an acceleration in bottom-line growth.”

—

Myles Udland is a writer at Yahoo Finance.

Read more from Myles here; follow him on Twitter @MylesUdland