The U.S. economy adds 196,000 jobs, beating expectations

The U.S. economy added a surprisingly robust 196,000 jobs in March, the Labor Department reported on Friday, rebounding from a weak month that prompted markets to question the strength of the labor market.

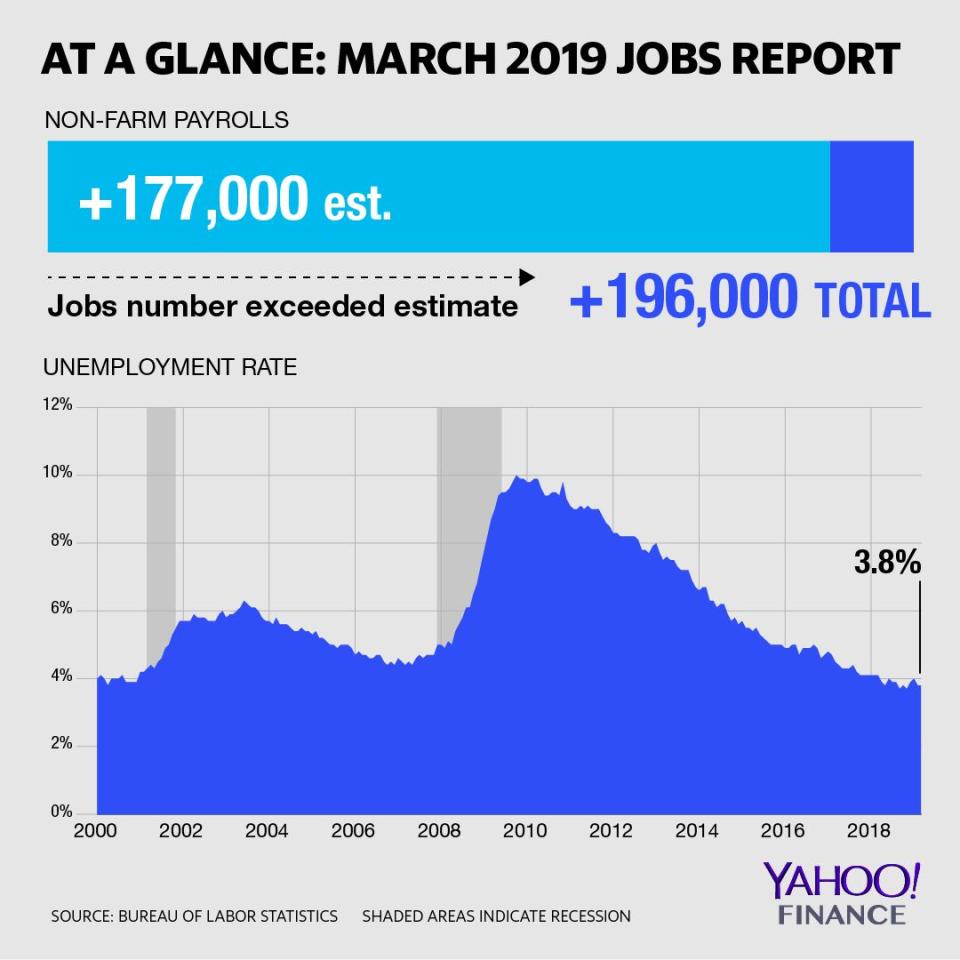

March’s jobs data exceeded the expectations of Wall Street economists, who were expecting the economy to add 175,000 non-farm payrolls in March, according to data compiled by Bloomberg. Meanwhile, February’s sharply lower-than-expected 20,000 job additions were revised up to 33,000.

The unemployment rate checked in at 3.8%, the same pace of increase as in February, according to consensus economists polled by Bloomberg.

The labor force participation rate was 63.0%, marginally weaker than Wall Street’s consensus forecasts of 63.2%.

The hot jobs market is also putting more money in workers’ pockets. Data showed that average hourly earnings grew 3.2% year-over-year, just below economists expectations of 3.4% growth. Month-over-month, average hourly earnings grew 0.1%, below the 0.4% increase seen in February.

‘An anomaly’

February’s soft reading “really it looks like an anomaly,” Joshua Wright, chief economist for iCIMS, said in an interview with Yahoo Finance. His firm’s model estimated that the economy added 160,000 non-farm payrolls in March.

The current three-month trend in non-farm payroll additions stands at a still-healthy 186,000, thanks to much higher job creation in January and December.

“One of the things that’s been most remarkable over the last 10 years has been just how steady the labor market expansion has been,” Wright said. Following February’s results, the U.S. economy added new jobs for its 101st consecutive month.

“Normally when you have an expansion go on this long, job growth dips into negative territory every now and then,” he said.

Many economists noted that exogenous factors – including weather effects from a colder-than-average February and lingering impact from the beginning of the year’s protracted partial government shutdown – likely played a role in influencing the past several jobs reports.

Marvin Loh, global macro strategist at State Street, noted that the March jobs report will be “the first clean one in a while” as residual impact from the government shutdown wanes.

“Hopefully we’ll get something that we can dissect a little bit more accurately than the last couple of months,” Loh said in an interview with Yahoo Finance.

Friday’s jobs report follows ADP/Moody’s results on private payrolls, which were released earlier this week. That data revealed a gain of 129,000 new positions in March. This came in below estimates of 175,000 — although February’s reading was upwardly revised by 14,000 to 197,000.

While many economists point out that ADP/Moody’s report has historically been an imperfect indicator of the BLS’s results, others acknowledge that it helps counterbalance noise in the “official” establishment survey.

Manufacturing jobs

One key area economists were eyeing in Friday’s report is job growth or contraction in goods-producing industries, which lost jobs in February.

Manufacturing payrolls dropped 6,000 during March. Consensus economists were looking for the economy to have added 10,000 manufacturing positions during the month.

Manufacturing has been a weak spot for both the global and domestic economy, and it’s been a central component of growth slowdown concerns amid ongoing trade disputes — which have hit industrial sectors particularly hard.

“Given the global manufacturing slump, we expect further US factory job losses over the next few months,” Capital Economics wrote in a note. “Overall, nothing here to shift the dial very far in either direction. But the gradual slowdown in trend employment growth is another sign that the economy is weakening.”

This story is developing. Please check back for updates.

—

Emily McCormick contributed to this report.

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

More from Heidi:

Key factors to consider before jumping into hot IPOs, according to UBS

Inverted yield curve could be a good thing for stocks: Citi

Why Warren Buffett isn’t buying the Lyft IPO

Legendary investor Alan Patricof: A company's leader is more important than its product