January Industrial Dividend Stocks To Look Out For

The industrials sector tends to be highly cyclical, impacting companies operating in an array of areas such as building products, aerospace and defence. Therefore, where we are in the economic cycle determines these companies’ level of profitability. This impacts cash flows which in turn determines the level of dividend payout. During times of growth, these industrial names could provide a strong boost to your portfolio income. If you’re a buy-and-hold investor, these healthy dividend stocks in the industrials industry can generously contribute to your monthly portfolio income.

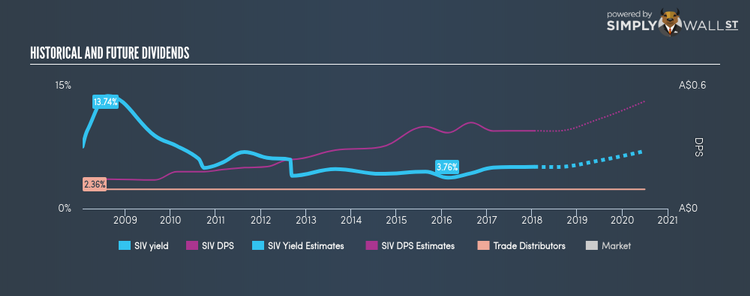

Silver Chef Limited (ASX:SIV)

SIV has a juicy dividend yield of 5.09% and their payout ratio stands at 68.70% . SIV’s dividends have increased in the last 10 years, with DPS increasing from $0.1 to $0.38. Much to the delight of shareholders, the company has not missed a payment during this time. Silver Chef is a strong prospect for its future growth, with analysts expecting the company’s earnings to increase by 60.17% over the next three years. More detail on Silver Chef here.

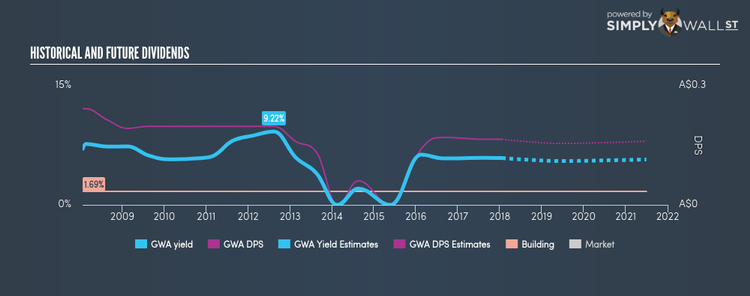

GWA Group Limited (ASX:GWA)

GWA has an appealing dividend yield of 5.89% and is distributing 81.14% of earnings as dividends . GWA’s dividend alone will put you better off than your bank interest, but the company’s yield isn’t only higher than the low risk savings rate. It’s also amongst the market’s top dividend payers. GWA Group seems reasonably priced when looking at its PE ratio (13.8). The industry average suggests that Global Building companies are more expensive on average 25. More on GWA Group here.

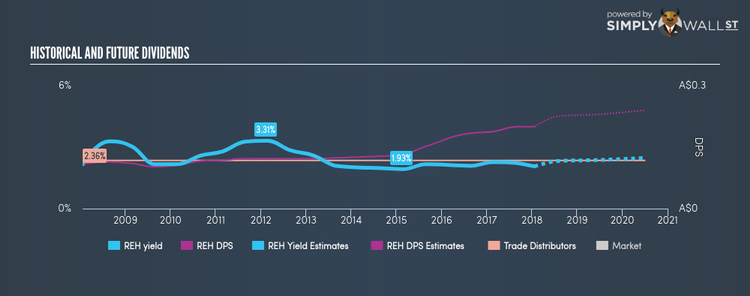

Reece Limited (ASX:REH)

REH has a solid dividend yield of 2.06% and is paying out 47.03% of profits as dividends , and analysts are expecting the payout ratio in three years to hit 49.86%. In the last 10 years, shareholders would have been happy to see the company increase its dividend from $0.104 to $0.2. They have been dependable too, not missing a single payment in this time. More on Reece here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.