Snapchat is going public — Here's what we know

In documents filed with the SEC on Thursday, Snap Inc., parent company of Snapchat, filed to go public.

As previously reported, the company will list its shares on the New York Stock Exchange. Its proposed trading symbol is “SNAP.” The maximum proposed offer amount is $3 billion.

This filing does not give us a valuation for the company — which has been reported to be as high as $25 billion — as the exact number of shares being offered by the company is not available. This information will become clear closer to Snapchat’s actual market debut.

At the top of its filing, Snap identified itself not as a social media platform — as it is often described in the press — but as a camera company.

“We believe reinventing the camera represents our greatest opportunity to improve the way people live and communicate,” the company said in the filing.

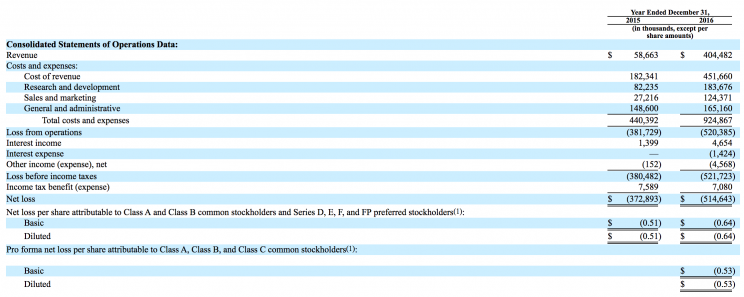

In terms of the two numbers everyone was looking for — revenue and daily active users — Snap said that for the year ended December 31, 2016, revenue totaled $404.5 million while daily active users averaged 158 million.

Snap’s loss per share for the year ended December 31, 2016 was $0.53. Its cost of revenue was $451 million.

In outlining its business plan, Snap said it generates revenue primarily through advertising and emphasized its willingness to take risks to drive user engagement at numerous points throughout the filing.

As is the case with many Silicon Valley companies, Snap also said that it will have a dual-class share structure, and said that its Class A shares — which are not entitled to vote on matters submitted to shareholders — are the only ones being offered in its IPO. Class B shareholders have one vote per share and Class C shareholders have 10 votes per share.

In its filing, Snap said, “Although other U.S.-based companies have publicly traded classes of non-voting stock, to our knowledge, no other company has completed an initial public offering of non-voting stock on a U.S. stock exchange.

Adding, “We cannot predict whether this structure and the concentrated control it affords [CEO Evan] Spiegel and [co-founder and CTO Robert] Murphy will result in a lower trading price or greater fluctuations in the trading price of our Class A common stock as compared to the trading price if the Class A common stock had voting rights. Nor can we predict whether this structure will result in adverse publicity or other adverse consequences.”

Among other risk factors listed by the company is the age of its core user base, which falls between 18-34 and which the company acknowledges, “may be less brand loyal and more likely to follow trends than other demographics.” In short, this user base, because of its age, is less sticky.

The company also outlined how engagement among younger users topped that of its older users, stating that, “users 25 and older visited Snapchat approximately 12 times and spent approximately 20 minutes on Snapchat every day on average in the quarter ended December 31, 2016, while users younger than 25 visited Snapchat over 20 times and spent over 30 minutes on Snapchat every day on average during the same period.”

Snap also acknowledged that while daily active users rose 7% in the third quarter, user growth was “relatively flat” in the latter part of this quarter.

From the company’s filing, here’s a snapshot of its financial situation:

The underwriters for Snap’s deal include Morgan Stanley, Goldman Sachs, JP Morgan, Deutsche Bank, Barclays, Credit Suisse, and Allen & Co.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland