Is the stock market overreacting to coronavirus?

What’s happening

Global financial markets are reacting sharply to the coronavirus outbreaks.

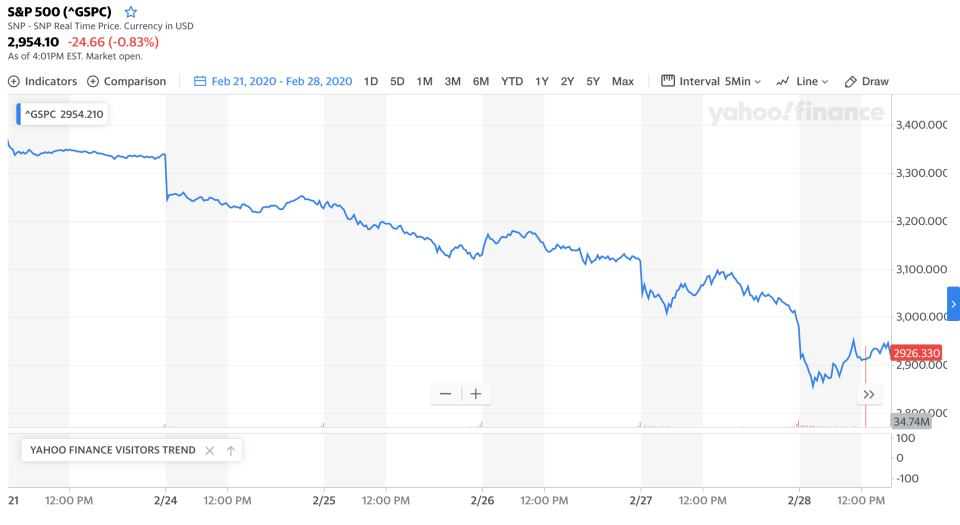

Trillions of dollars of value have been wiped out as the major stock market indices dropped amidst concern. Since fear took over the market on Feb. 20th, the S&P 500 (^GSPC) had dropped around 13% by market close on Friday, Feb. 28 going into the weekend.

The index had lost all its gains of 2020, bringing it back to where it was in October.

There are two prevailing points of view on what this means for the market — the market is overreacting, and this is a serious event that could have long-term economic ramifications.

Here we will present you with the most authoritative voices on both sides of the debate.

Background

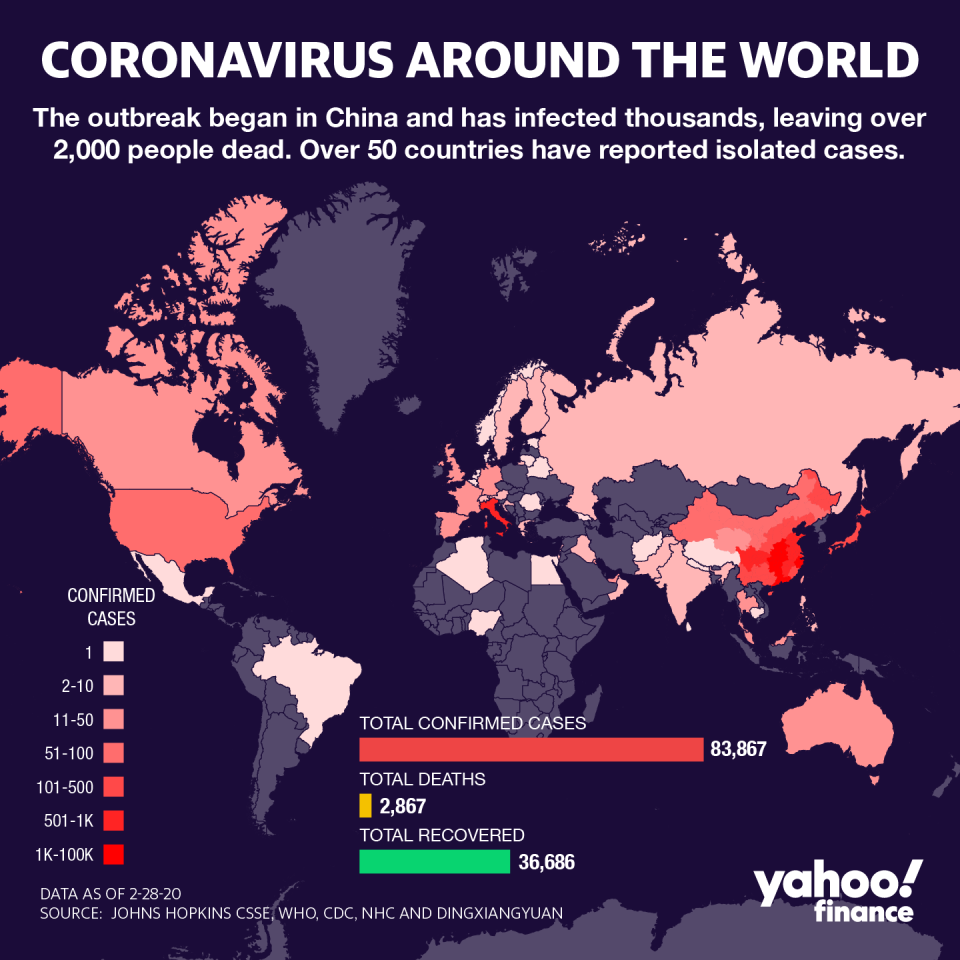

The coronavirus (called COVID-19 by the authorities) is a new type of respiratory illness similar to the flu, with a fatality rate of around 2%. So far over 82,000 cases have been confirmed.

The spread of the virus, which was first identified in Wuhan, China, was limited by quarantine, but has nevertheless spread over China’s borders with outbreaks in South Korea, Japan, Italy, and Iran. Due to a controversial quarantine, the disease has spread in isolated incidents in the U.S. The disease has also reached South America. It’s a global situation.

The Centers for Disease Control (CDC) has said that the disease has a rising risk of becoming a big problem, and has told the public to expect the possibility that it could be “bad.”

Markets hadn’t reacted much until Feb. 21 when reports emerged that the virus was not going to be easily contained. Now, this is shaping the narrative around markets in a big way, and two sides have emerged, a side that’s very concerned and another side that sees this as something that will be a speed bump to the global economy — and potentially an opportunity to buy stocks at a discount.

Why there’s debate

A new disease that is in the beginning stages of spreading around the world isn’t a little thing. It has the potential to disrupt supply chains, freeze consumer spending, shut down factories, and damage sentiment. And without an end in sight, there are plenty of reasons to be defensive.

On the other hand, the market has shrugged off a lot of things in the past. Despite bouts of volatility, stocks generally go up over time. That’s why people often say “buy the dip” when things get tough as these fleeting moments often prove to be opportunities to accumulate stocks cheaply. Early on, some investment professionals drew comparisons to other outbreaks of respiratory viruses like SARS and MERS and expected a similar market response: brief volatility followed by a long recovery.

Of course, every instance is different and past results are no guarantee of the future.

What’s next

Everyone, ranging from Wall Street strategists to Fed officials to business executives have uttered a version of “we’ll have to see how it plays out” or “that is the question” because no one knows with any amount of certainty what is next.

So far, the disease has proved to be much more like the flu than SARS in its deadliness, but that’s one of the reasons why it’s been able to travel the world so quickly.

Perspectives

YES, the market is overreacting

President Donald Trump is reportedly very angry that the market has plunged, according to the Washington Post, and is angry at his staff.

“The Coronavirus is very much under control in the USA. We are in contact with everyone and all relevant countries. CDC & World Health have been working hard and very smart. Stock Market starting to look very good to me!” — Donald Trump 2/24

The market is probably cheap to long-term investors.

“The virus story is not going to last forever. To me, if you are an investor out there and you have a long-term point of view I would suggest very seriously taking a look at the market, the stock market, that is a lot cheaper than it was a week or two ago.” — Larry Kudlow, National Economic Council Director 2/25

Things will be fine later, so long-term investors are more stocks for their money.

“With this dip if it continues to go down, [long-term investors with 10+ years to retirement] should just stay the course and actually be quite happy because the market is still incredibly high.” — Suze Orman 2/26

A plunge like this almost always leads to positive gains six months later.

“We see this 3% drop as buyable.” — Tom Lee, Fundstrat 2/25

A V-bounce, where the market jumps back up after it falls down, is likely because people sold too much.

“S&P 500 has fallen 6 consecutive days with >8% fall. This happened 10 times since 1948. 10 of 10 times stocks higher 12 months later.” — Tom Lee, Fundstrat 2/28

Markets are overreacting — if we’re talking about long-term.

“There’s a lot of panic at the moment that’s not warranted. Short-term economic activity will contract and it will have an impact on global GDP, but it’s not like the world will end tomorrow.” — Allianz CEO Oliver Baete 2/26

Coronavirus is scary, but not a reason to sell for Warren Buffett.

“It is scary stuff. I don’t think it should affect what you do in stocks. If you look at the present situation, you get more for your money in stocks than bonds” — Warren Buffett 2/24

In the long run, things usually work out.

"While we are not trying to call the bottom of the market, past experience suggests this is a good time to invest in US stocks for investors with a time horizon of several months or more." — UBS Global Wealth Management CIO Mark Haefele 2/27

“Panic is not a winning investment strategy”

“Technological advances have led to 24/7 access to information, and one of the byproducts of this has been increased ‘short-termism’ among investors. This mindset is dangerous because it lacks discipline, in our view, something we have found typically beats those trying to time the market.” — BMO Capital Markets 2/27

If you're in it for the long-term, remember that.

"Most of us fall into that category, if we are saving for retirement. We invest in stocks because doing so has consistently proved to be a good way to buy a little piece of capitalism. Hold on long enough to a diverse collection of stocks, and the system has tended to generously repay patient people over six or seven decades of working, saving and drawing down a portfolio." — Ron Lieber, New York Times

NO, this is really serious

Goldman Sachs warns that it’ll get worse before it gets better.

“A more severe pandemic could lead to a more prolonged disruption and a US recession.” — Goldman Sachs strategist David Kostin 2/27

There’s a lot we don’t know, it could affect many short and long-term issues, and result in a cascade of effects.

“The longer-term issues are even more complex. Will the shock to China derail what has been an unprecedented development process? What will happen to the China brand that was underpinning much of the country’s regional and international expansion and integration? Will the immediate disruption to travel and supply chains fuel a multiyear deglobalization?” — Allianz chief economist Mohamed El-Erian 2/25

The death rate is higher than 2%, because most counts use deaths/cases and not deaths/(cures + deaths) — which is around 4%

“This is not a buy-the-dip market. It is a don’t-catch-a-falling-knife market. “ — Guggenheim Investments’ CIO Scott Minerd 2/13

The virus is ‘underrated.’

“What I think is a little too premature is they all presume that it is going to be solved within a foreseeable time frame. At what point do we say that many, many companies are going to be hurt by the virus [and] we’re paying too much for stocks?” — Jim Cramer, CNBC 2/24

Coronavirus is a material disruption to Q1 global and regional growth.

“We have slashed our global GDP growth projection for 1Q20 in half to a 1.3% annualized rate, which is the weakest outcome since the global financial crisis, but the trajectory regionally and globally still indicates nearly all the hit being recaptured by 3Q20,” said Bruce Kasman, Chief Economist, J.P. Morgan. 2/20

There could be escalation and disruption in the second quarter.

“The economic impact of Covid-19 depends on the extent of the sperad of the virus and the magnitude and duration of the disruptions to economic activity. We lay out three possible scenarios for global growth and recent developments mean that we are heading towards [escalation and disruption in Q2].” Morgan Stanley analysts 2/28

—

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

The US-China trade war unintentionally prepared companies for coronavirus

19 companies where the CEO makes 1,000x the median employee’s salary

The government is finally cracking down on companies that enable robocalls

How an insured pro athlete ended up with $250,000 in medical debt

The first thing to do after you're involved in a hack, according to experts

'Snake oil salesmen': Two neurologists respond to the CBD craze

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.