How much the Obamacare repeal might cost

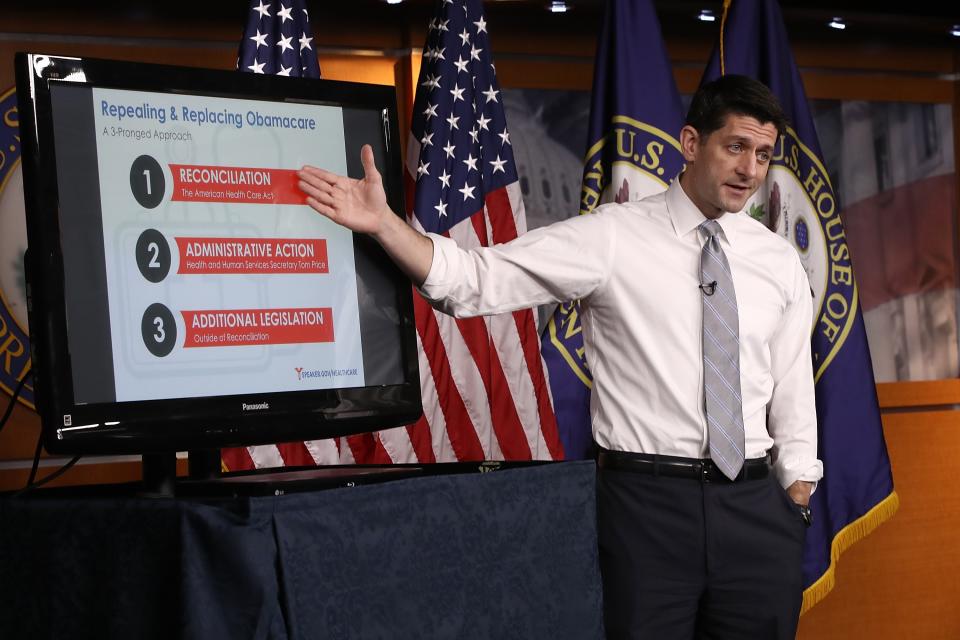

The Obamacare repeal bill, called American Health Care Act, is rolling through Congress, passing the first committee. However, there is still no analysis from the Congressional Budget Office as to how much the bill will cost American taxpayers and how many more (or fewer) people would be insured under the plan. Many members of Congress, so far, have voted for a new plan without an assessment of whether it’s better than the existing plan.

The CBO, the nonpartisan agency Congress relies on for estimating the impact of legislation, is working on scoring the bill, but the analysis isn’t yet out. In its absence, Brookings, Standard & Poor’s, and a few other outfits have provided an idea of what to expect. The results will likely anger budget hawks and small-government Republicans and severely aggravate Democrats. So far, the AHCA has been a bill only a parent would love, and few people other than its parents, Speaker Paul Ryan and the White House, have expressed support.

Here’s what certain institutions have put out.

Brookings

Brookings has arguably the most comprehensive analysis on what to expect from the CBO, and it paints a bleak picture. “We conclude that CBO’s analysis will likely estimate that at least 15 million people will lose coverage under the American Health Care Act (AHCA) by the end of the ten-year scoring window,” the report says. “Estimates could be higher, but it’s unlikely they will be significantly lower.” The 15 million number comes from the population that is affected by the repeal of the mandate for coverage and Medicaid losses. As for the changes in subsidies, the Brookings analysis noted that they are “unlikely to substantially mitigate coverage loss.”

Brookings gives a ballpark estimate for how much this will cost. Adding up $600 billion in tax cuts, $100 billion in new state grants for high risk pools, “additional revenue losses” from removing the employer mandate, comes to at least $700 billion. “Increasing total spending on tax credits while avoiding an increase in the deficit is likely impossible, even taking into account the bill’s Medicaid cuts.”

Coverage estimate: 15 million people would lose insurance, and maybe millions more.

Cost estimate: No cost savings over the current system.

S&P Global

S&P found that the switch from the ACA to the AHCA would shake up the markets in a massive way, given how fragile and complex health care in the US currently is. “If signed into law, [the AHCA] will fundamentally change federal financing of healthcare, especially for the Medicaid and individual insurance segments,” S&P analysts note.

Coverage estimate: 6 million to 10 million would lose insurance.

Cost estimate: Not given.

Commonwealth Fund

The Commonwealth Fund specifically looked at Medicaid expansion changes, which would phase out expanded coverage by 2020. Medicaid is characterized by people going in and out of the program as those who earn more than about $14,600 a year are not eligible.

Commonwealth says 30 million Americans would see 30% premium increases under the new plan – a bigger penalty for a lapse in coverage than Obamacare’s penalty for going without. A 50-year-old making $50,000 would see a $2,161 premium surcharge with the repeal bill for a four-month insurance gap. Under Obamacare, it would be $232.

Coverage estimate: Millions would lose insurance.

Cost estimate: Not given.

Committee for a Responsible Federal Budget

The CRFB’s focus is on the deficit, so its report simply points to the Joint Committee on Taxation’s figures of the immense cost of the tax cut—$595 billion through 2026. The cuts include killing a 3.8% investment income tax, 2.3% medical device tax, 0.9% high income tax, and delaying the Cadillac tax on luxury health plans.

Coverage estimate: Not given

Cost estimate: $600 billion or more.

Center on Budget and Policy Priorities

Putting great detail to the numbers of the Medicaid budget cuts, the CBPP, a nonpartisan think tank, calculates $370 billion to shift from federal to state budgets—if the states decide to keep the current levels. While Brookings doesn’t think this will offset the $600 billion in tax cuts, the CBPP does. “The Medicaid cuts in the House plan would largely or entirely pay for high-income tax cuts.” However, the CBPP says the GOP’s cost-shifting would “jeopardize coverage and access to care for tens of millions of low-income people.

Coverage estimate: Tens of millions would lose insurance.

Cost: Potentially neutral.

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, tech, and personal finance. Follow him on Twitter @ewolffmann. Got a tip? Send it to tips@yahoo-inc.com.

Read more:

Multibillion-dollar Chinese play for American insurer likely doomed

We still don’t know how much Trumpcare will cost