Which housing market do you live in? Michigan housing agency has defined eight in Greater Lansing

LANSING — More housing is needed across the entire Greater Lansing area, according to state officials.

The state is divided up into housing regions and within each region, specific types of housing markets are identified.

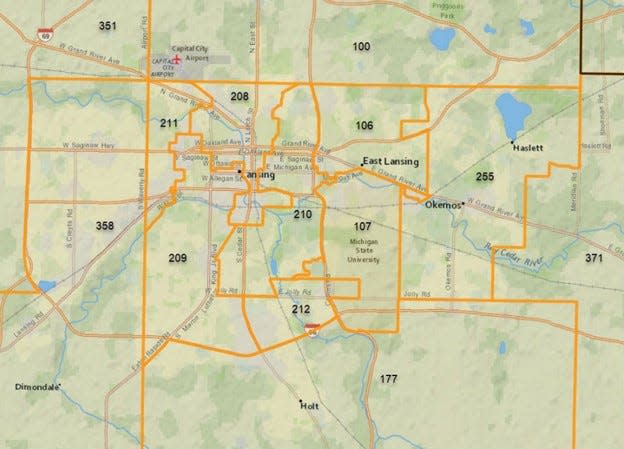

Here is how the Michigan State Housing Development Authority sorted the Greater Lansing housing markets into eight broad types of markets within the region.

Northern Clinton, central Clinton, and northwestern Ingham counties. These are comparable to state averages, largely single-family homes that are larger than the rest of the market. Housing costs and home values have decreased or remained steady since 2016. The area tends to have low housing costs and housing values.

Western and southwestern Eaton County and southeastern Ingham County. Housing demand is strong, higher than the state average. Incomes tend to be slightly higher than the state average, and unemployment lower. Older single-family homes dominate the supply, with larger-than-average homes and higher home ownership rates. It's a stable market, few people coming or going. Housing costs are mostly stable.

Central and southwestern Lansing. Housing costs are very low, but so are incomes and many families are still stretched thin here. Single family homes are common and there are many multi-family homes as well. The housing stock is exceptionally old, a quarter of these homes were built by 1939 and few homes are newer than 2010. The five-year trends show prices are falling, even as there are fewer available options in the neighborhoods.

Eastern Lansing and its near southern and western suburbs. These tend to be younger people, with college degrees. There are newer homes and the homes are not overcrowded, with low vacancy rates that help to drive increasing costs and property values, especially in rental units.

Southeastern Clinton County and northwestern Ingham County. Strong demand for housing but options are primarily large single-family homes. Residents tend to be older, with more education. Housing values and costs are high, with higher incomes. Housing costs are expected to continue to increase for both owners and renters.

Southeastern Clinton County. Demand is strong and growing, part of the "push to the exurban fringe" with larger and more expensive houses. The five-year outlook could continue the same patterns as the past five years as fewer vacancies and higher homebuilding costs push construction into areas like this.

Okemos-Haslett. Incomes are significantly above the state average, as are housing costs and valuations. It's a diverse area for housing, only a slight majority of options are single family detached homes with plenty of new construction, too. It has more newcomers than the state average, and less homeownership. Housing costs have risen dramatically here in the last five years and will likely continue to rise.

East Lansing and southeastern Lansing. The numbers show it as a 'soft' market due to low average incomes but being the home for Michigan State University students explains much of this area. It has more new construction than the state average and higher mortgage costs for owners as well as higher rental costs. The number of homes for sale or lease increased in the last five years.

This article originally appeared on Lansing State Journal: Greater Lansing has 8 housing markets, say Michigan housing agency