'Houses before spouses': This Austin woman went viral on TikTok for buying 6 properties with friends. Does her hustle explain why single women now own more homes than single men?

Kristina Modares bought her first house at age 25.

The Austin, Texas, resident is no Rockefeller, but she and a friend pooled their money together and realized they could afford to buy property, she revealed in one of her TikToks.

According to a LendingTree study released earlier this year, single women own 2.7 million more houses than their male counterparts in 47 of the 50 U.S. states — this, despite the fact that women’s median weekly earnings are only 83% of men’s.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Inflation is still white-hot — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

Anything can happen in 2024. Try these 5 easy money hacks to help you make and save thousands of dollars in the new year (they will only take seconds)

In total, Modares now owns six properties — all of which she purchased with friends, she explained in another viral video.

She currently runs a real estate business, famous for its slogan, ‘Houses Before Spouses.’ Modares said that she and her business partner coined this term as a way to encourage young, single people to consider home ownership as a viable financial option, even if they’re not partnered.

“People buy with their spouses all the time, why is this any different?” she added.

Modares isn’t alone either. According to a survey from U.S. surety bond provider, JW Surety Bonds, 13% of Americans had purchased a home in recent years with a non-romantic partner, such as a sibling, friend or parent.

Why is this happening?

Nearly 25% of those who have bought homes with non-romantic partners revealed they couldn’t have afforded a home on their own, according to the JW Surety Bonds survey.

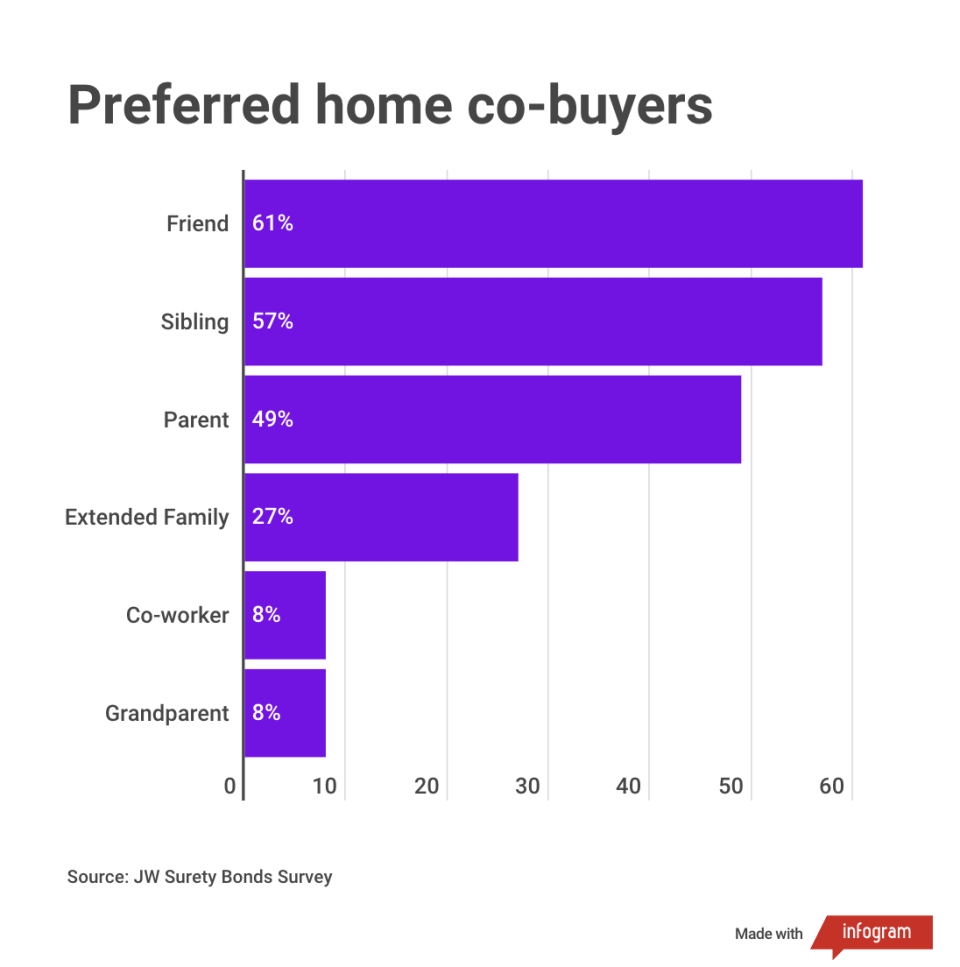

The study further breaks down whom the respondants would prefer to co-own property with — with friends and siblings coming in at almost equal levels.

The company also discovered that more than half of platonic co-homebuyers are millennials, just like Modares. Millennials, the oldest of whom are now in their early 40s, have lived through two recessions and skyrocketing housing prices.

In fact, mortgage rates and soaring housing costs have become so high that even wealthy young Americans are turning their backs on the dream of home ownership.

Waiting until marriage to buy property has also become increasingly more difficult, given skyrocketing housing prices and the fact that people are marrying later (if at all).

In 1980, the average age for grooms was 25 years old, while the average age for brides was 22, according to Census data. In 2023, the data shows that those ages have increased to 30 and 28, respectively.

Read more: Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Why this may become a trend for boomers

Though millennials are the driving force behind this co-buying trend, it’s something that 9% of boomers have done too, according to the JW Surety Bonds survey.

The trend may even become more popular for older adults, as many are starting to live with roommates. Around 913,000 Americans aged 65 and older live with roommates who aren’t relatives or spouses — nearly double the amount since 2006, according to a study from Harvard University’s Joint Center for Housing Studies (JCHS).

Not only does this save seniors on rent, but on the overall cost of aging. Only 13% of 75+-year-olds living alone could afford assisted living without dipping into assets in 97 U.S. metros, according to the JCHS report.

The benefits of owning a home together in old age go far beyond just the financial ones. It can also help you mitigate health care costs. Your roommate can help you with day-to-day tasks, as well as split caregiving costs.

Alternative real estate investments

However, if you’re not interested in recreating a real-life episode of The Golden Girls, there’s another possible option.

You can take advantage of unique real estate arrangements such as real estate investment trusts (REITs). These trusts own real estate investments, like apartment buildings and shopping centers, that make profit.

The way you get money is by receiving dividends from the rent that these properties collect. You reap the rewards without any of the landlord hassle.

What to read next

Here's how you can invest in rental properties without the responsibility of being a landlord

'The biggest crash in history': Robert Kiyosaki warns that millions of 401(k)s and IRAs will be 'toast' — here's what he likes for protection

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling inflation

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.