Higher-rate taxpayers £85,000 worse off if Rishi Sunak cuts pensions tax relief

Millions of higher earners could be hundreds of thousands of pounds worse off in retirement if the Government targets pension tax relief to plug the growing hole in Treasury coffers.

The Chancellor Rishi Sunak is reportedly reconsidering proposals to limit tax relief on pension contributions to 25pc for all workers as part of a desperate attempt to reduce the deficit which is forecast to hit almost £400bn this year.

An announcement is not expected as part of today's Spending Review, which does not cover changes to tax policy, but could feature in a future Budget.

The move would put those on middle and higher incomes in the crosshairs for cuts while boosting the amount received by basic-rate taxpayers, all those earning less than £50,000 in the current tax year.

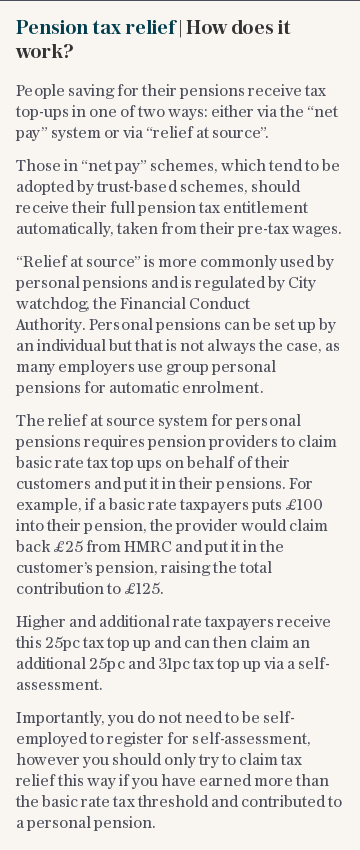

At the moment tax relief is based on your marginal rate of income tax – the higher the tax bracket, the greater the incentive to save into a pension.

Those earning £50,000 or less would receive a 5 percentage point boost in the amount they receive but those who earn between £50,000 and £150,000 would lose the additional 15 percentage point top-up from the Treasury. Those with annual income above £150,000 would lose an additional 20 percentage points relief on all pensions savings.

This is more generous than the 20pc flat rate the Chancellor was said to be considering earlier this year and could incentivise greater saving among lower earners.

A reform of pension tax relief could allow the Government to make billions in savings each year. Earlier this year, the Pensions Policy Institute, a think tank, reported the cost of income tax relief on pension contributions had increased to £9.3bn in 2018 for the Treasury. It estimated that a flat rate of 25pc would reduce that total to £7.3bn.

At that rate, a 22-year-old earning £27,000 paying 4pc in pension contributions would be £21,000 better off by the time they reach state pension age, according to Aegon, a pension provider.

However, a 35-year-old earning £60,000 paying the same 4pc could be £85,000 out of pocket by retirement age. To make up for lost tax relief, they would have to contribute an extra £50 per month.

Steven Cameron, of Aegon, said the reform could make a big dent in the future pension pots of higher and additional rate taxpayers unless they increased their contributions. But a higher, flat rate of relief would be in line with the Government’s levelling up rhetoric and be widely seen as a fairer system, Mr Cameron suggested.

Others say higher earners might abandon pension savings if the incentives were scaled back.

A basic-rate taxpayer contributing £100 a month to their workplace pension would see this topped up to £133.33 by the Government rather than the current £125. While higher rate taxpayers would see their topped up total fall from £166.66 to £133.33

Zena Hanks of Saffery Champness, an accountancy firm, said there has been an annual speculation of reform but a move from the Chancellor would be less of a surprise in 2020 given the fact that the public purse has been squeezed more than ever.

The Treasury declined to comment.