Here's the most important number from Friday's big jobs report

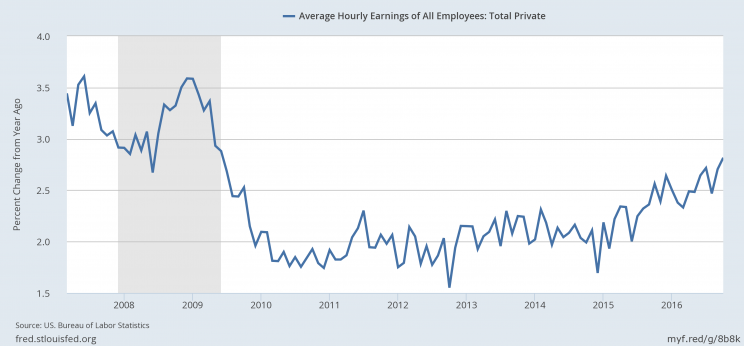

2.8%.

In Friday’s October jobs report, we learned US economy added 161,000 jobs in October, 12,000 less than expected. While this is the most widely watched number in the report, it wasn’t the most important one this time around.

The most important numbers inside the report were average hourly earnings, which are definitively moving up and to the right.

In October, average hourly earnings rose 2.8% over the prior year, the fastest pace since the recession (when wage growth was on the way down). Over the prior month, wages rose 0.4% in October.

As worker pay increases, so too do the prospects for a faster rise in consumer prices.

Inflation — which has been running below the Fed’s 2% target for some time — is the result of too much money chasing too few goods. More money in the pockets of consumers, then, paves the way for a faster rise in consumer prices.

In its latest policy statement out Wednesday, the Fed said it would wait, “for some further evidence of continued progress toward its objectives” before raising rates.

Friday’s report “likely fits the bill” for meeting this standard, according to UBS economist Drew Matus.

In other words, it is almost certain that for the second year in a row the Federal Reserve will raise rates in December.

The most recent data on inflation shows “core” PCE, the Fed’s preferred inflation measure, rose 1.7% year-on-year in October.

Fed policy statements, however, have made clear that the central bank intends on raising rates slowly, but it will not necessarily wait to fulfill its inflation target before further rate hikes.

And so December it is.

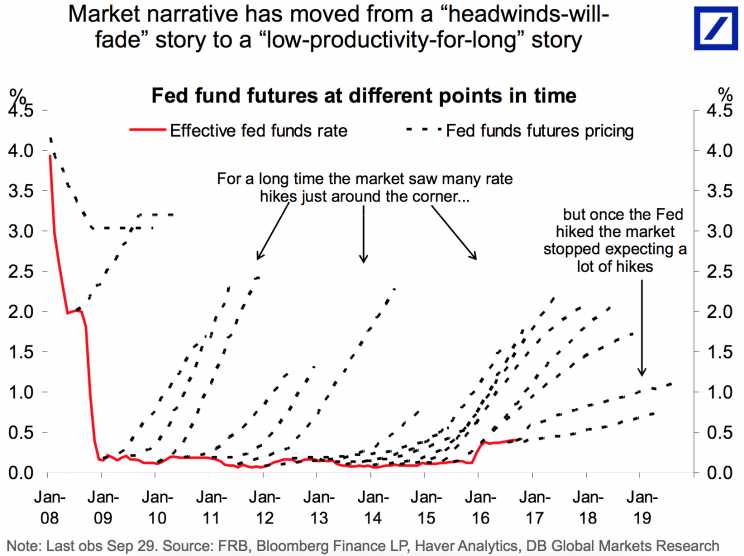

Looking out into 2017 and beyond, Friday’s wage data also suggests there is potential for markets to be somewhat underpricing future action out of the Fed.

This chart from Deutsche Bank shows how expectations for Fed rate hikes have come down considerably over the last few years as the market has become conditioned to bet on inaction from the Fed.

Quick-changing labor dynamics, however, could change this outlook, particularly given the Fed’s insistence that it remains “data dependent.”

Outside of the near-term implications for Fed policy, Friday’s jobs report also serves as a positive indicator for a hotly-contested economic idea that has been called into question in recent years: the Phillips Curve.

The Phillips Curve states that lower rates of unemployment will lead to higher rates of inflation. As the labor supply goes down, wages must go up. And as wages go up, so too do consumer prices.

But the decline in the unemployment rate over the last several years and a lack of corresponding inflation led some to ask if perhaps this relationship had broken down.

Friday, at least, is a win for Phillips Curve defenders.

—

Myles Udland is a writer at Yahoo Finance.

Read more from Myles here; follow him on Twitter @MylesUdland.