Here's one of the most bullish stock market charts you'll ever see

This is bullish.

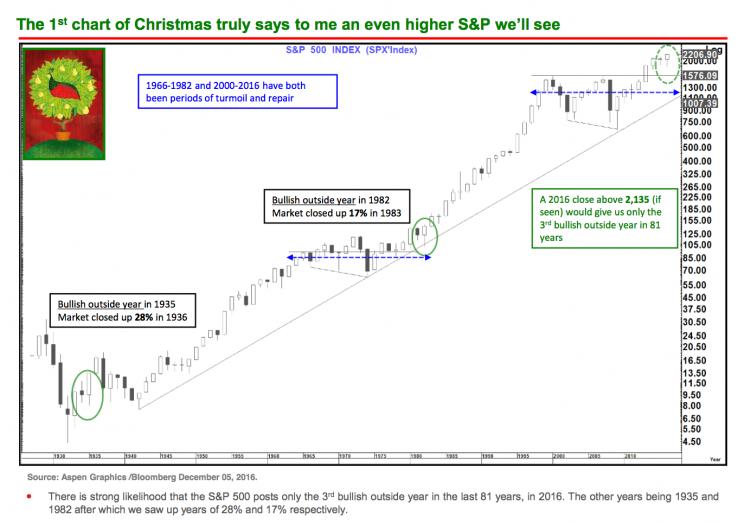

In a note to clients out Monday, the technicals team at Citi published its annual “12 Charts of Christmas” for 2016.

And its first chart out of the gate makes 2017 look like it could be a blowout year for the stock market.

Let’s quickly walk through what the chart is telling us.

Currently, 2016 is on track to be an “outside year” for the S&P 500. As Josh Brown over at The Reformed Broker outlined when breaking down an earlier version of this chart published back in July, an “outside year” is one in which the high and low range for the index are above and below the prior year’s range and the close comes above last year’s high.

What this means in something like plain English is that 2016 was a more volatile year in the stock market than 2015. And when it was all said and done, stocks ended on a positive note.

These occurrences, as Citi’s chart outlines, are big-time bullish for stocks into the next year. In the last 81 years, there have been only two “outside years” before 2016 (which will meet the standard if the S&P 500 closes above 2,135; it’s currently trading near 2,250): 1935 and 1982.

Both of these years were followed by the S&P enjoying double-digit gains — +28% in 1936, and +17% in 1983 — which potentially sets the table for a monster rally into 2017.

Binary outcomes

Since Donald Trump’s election win, stocks have rallied on the expectations for better US economic growth and better corporate earnings as a result of lower taxes. Most Wall Street strategists, as a result, see stocks climbing again next year.

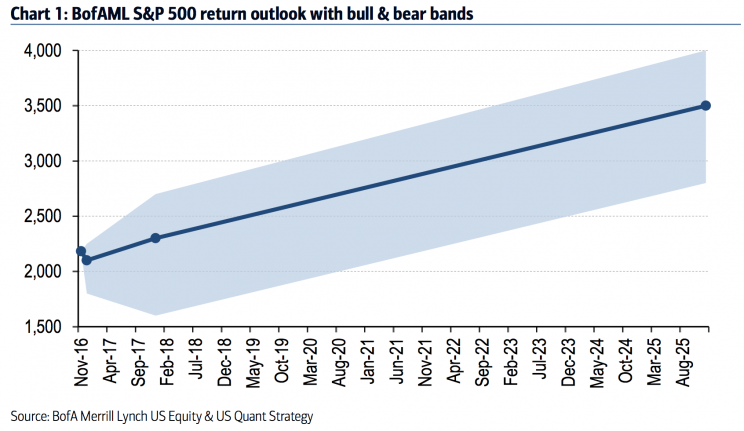

But history setting the market up for a big rally fits into a theme outlined by Bank of America Merrill Lynch strategist Savita Subramanian in her year-ahead outlook published last month.

“Our S&P 500 2017 year-end target of 2,300 assumes +5% from current levels,” Subramanian wrote in a note published November 22. “But 2017 could be anything but normal. We see fat tails and a binary set of outcomes.” (Emphasis added.)

And as Subramanian added at a panel attended by Yahoo Finance last week, “It’s a little misleading to say we think the market is going to close at 2,300 on December 31, 2017, at 4 o’clock.”

In other words, the firm’s 2,300 price target for the S&P 500 isn’t a target at all, it’s merely the midpoint of a year the firm doesn’t expect to be a middling year at all.

On the upside, Subramanian and her team see the potential for the S&P 500 rising to 2,700 next year. The firm’s sell-side indicator, a contrarian indicator that has been a reliable marker of where stocks go next based on how money managers are positioned, points towards the potential for a 19% rise over the next 12 months to around 2,750.

On the downside, Subramanian and her team are braced for a decline in the S&P to 1,600, which would be about a 20% drop.

Subramanian and her team see the potential for the S&P 500’s double-digit rise as one underpinned by better economic growth, lower taxes, and the addition of long-missing euphoria from investors about the stock market, something that has to this point been missing from the post-crisis bull market.

You could call this analysis a mix of fundamental and behavioral factors.

Citi’s outlook for a major market rally in 2017 is strictly based on technical factors and market history: the last two times we saw an “outside year” in stocks, a double-digit rally followed; 2016 is set up to be an “outside year”; therefore, a double-digit rally in 2017 is likely.

Of course, neither Citi’s technicals team nor Subramanian and the team at Bank of America would say they know what happens next year in the market.

And, as we know from studying market history, stocks usually go up. But looking at these two analyses, 2017 could be a bit better than a year when stocks merely “go up.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: