Helicopter Money: The emergency economic plan President Trump and Fed Chair Powell might agree on

It will be months before we understand the economic damage caused by COVID-19. But experts are already considering the worst and pondering the kind of policy responses that may be needed to help turn things around.

Veteran Wall Street strategist Ed Yardeni of Yardeni Research raises a very controversial option: “helicopter money.”

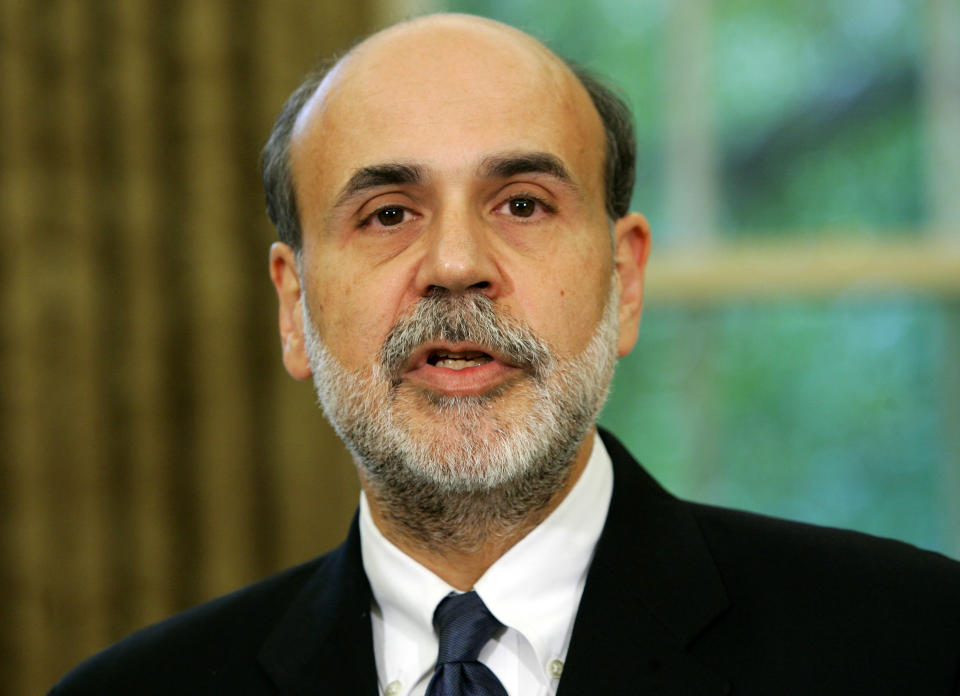

“Former Fed chair Ben Bernanke many years ago suggested that if things really get bad, there's always helicopter money,” Yardeni said on Thursday on Yahoo Finance’s The Final Round on Thursday. “Helicopter money would be actually something that both [president] Trump and [Fed chairman] Powell... could agree on. Because the president wants tax cuts. And if the tax cuts are paid for with ultra easy monetary policy, guess what? That's helicopter money.”

“Helicopter money” was first coined by economist Milton Friedman in 1969 as a thought experiment where a helicopter drops cash over a community. In theory, people may assume it’s just a one-off event, and they may find themselves just spending it. Economic activity would spike suddenly.

Former Fed chair Bernanke later referenced this concept in a 2002 speech. Then a Fed governor, Bernanke discussed using loose monetary policy (via money printing) to finance stimulative fiscal policy, which could come in the forms of tax cuts or government spending. From his speech:

A broad-based tax cut, for example, accommodated by a program of open-market purchases to alleviate any tendency for interest rates to increase, would almost certainly be an effective stimulant to consumption and hence to prices. Even if households decided not to increase consumption but instead re-balanced their portfolios by using their extra cash to acquire real and financial assets, the resulting increase in asset values would lower the cost of capital and improve the balance sheet positions of potential borrowers. A money-financed tax cut is essentially equivalent to Milton Friedman's famous "helicopter drop" of money.

Now, it’s not hard to imagine the backlash one would get for floating such an idea today. And that, in turn, is why it could be incredibly difficult to execute.

“In order to get a helicopter-drop style policy, you would first need to coordinate the responses of a government and the independent central bank,” Tomas Hirst wrote for the World Economic Forum. “While this doesn’t present much of a barrier in theory, in practice the two seldom operate seamlessly with one another and indeed frequently operate at cross-purposes.”

It’s challenging to imagine a scenario where the Federal Reserve and the Treasury are able to sync up while securing the support from the U.S.’s divided government.

Perhaps, an all-out crisis would put everyone on the same page.

For Yardeni, who has held positions at the Fed and the Treasury, COVID-19 ranks among history’s panics.

“I've been keeping a diary of the selloffs in this bull market, and there've been seven corrections, including this one,” he said to Yahoo Finance. “Altogether, I've counted what I called 66 panic attacks. This one really is the worst of them, because in the past, we can always count on monetary policy to save the day.”

“This one, it's very obvious that there's nothing central bankers can do about the global health care crisis,” he added.

On Tuesday, the Fed announced an emergency 50 basis point rate cut. It was the first time it made such a cut since 2008 during the depths of the financial crisis. The news didn’t exactly induce confidence, which is why experts continue to stress the need for a coordinated response across policymakers around the world.

For now, it’ll likely be wait-and-see until the data tells us how much of a problem we actually have in front of us.

[See also: Coronovirus and travel: What you need to know]

—

Sam Ro is managing editor at Yahoo Finance. Follow him on Twitter: @SamRo

Read more:

Why the stock market could continue to swing wildly for months

Why a big market rally right now would be no reason to get excited

The incredibly bullish force investors can't afford to ignore

Warren Buffett warns coronavirus will affect business, but he 'certainly won’t be selling' stocks

Forecasting one-year stock market returns is basically impossible

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay