Hard to Believe, but Tesla's (NASDAQ:TSLA) High Growth may be Just Beginning

This article was originally published on Simply Wall St News

Today, Tesla (NASDAQ:TSLA) released the Q3 vehicle production and distribution numbers, which is a great time to re-evaluate the fundamentals and see where the company is heading.

As long-term investors know, share price is up a whopping 1,871% in the last half decade, giving most investors a handsome return for holding the stock even a few years. It's also good to see the share price up 14% over the last quarter, which means that the stock has a powerful force behind it which has not interest in selling anytime soon.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long-term performance, or if there are some discrepancies.

Check out our latest analysis for Tesla

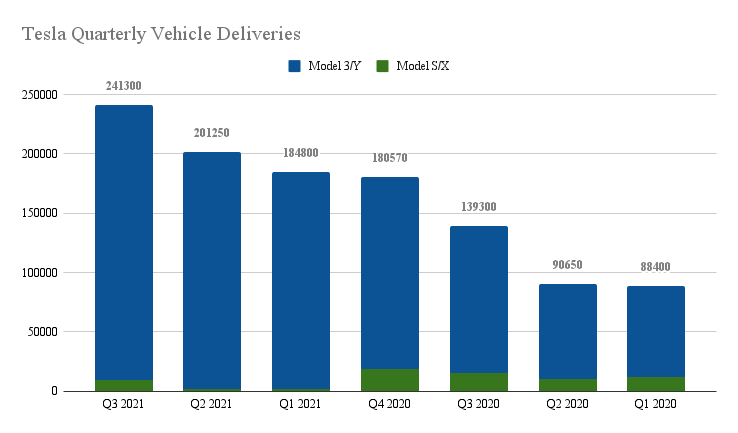

We start with today's new vehicle deliveries report, which shows the company making record-breaking deliveries of 241,300 vehicles in total.

We aggregated the numbers by quarter in order to get a better sense of the trend in deliveries. As it many not surprise many investors, the model 3/Y currently dominates demand.

Fundamentals

Given that Tesla only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, Tesla is currently in a high-growth & high-reinvestment phase.

The vehicles are in demand and the company must consistently re-invest in production and supply chain capacity in order to reach a mature phase and become a general vehicle (not just EV) market leader. This will take a few years as the autopilot systems are being worked on, and the factories are being expanded.

Growth is looking good and for the last half decade, Tesla can boast revenue growth at a rate of 34% per year.

Fortunately, the market has not missed this, and has pushed the share price up by 82% per year in that time. Despite the strong run, top performers like Tesla have been known to go on winning longer than skeptics can stay solvent.

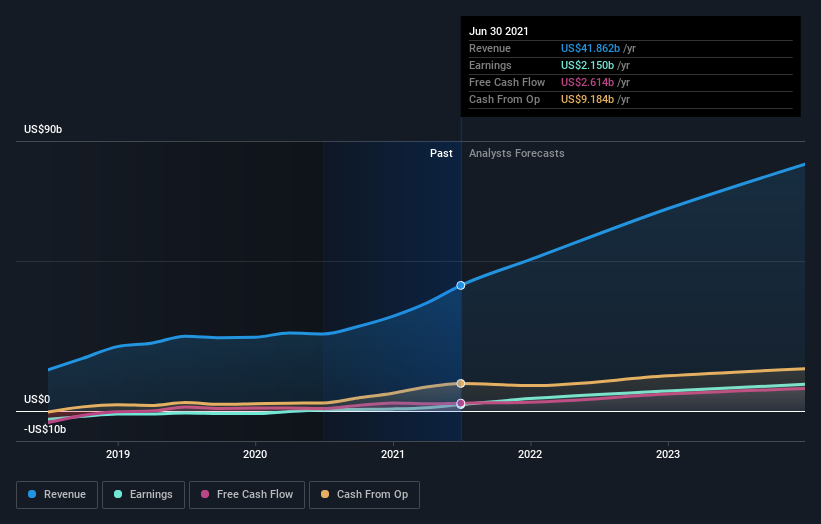

By looking at what analysts estimate for the future, we come up with a picture that shows a growing company, and perhaps even a few positive surprises in the years to come.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is great to see that in just two years, analysts are expecting revenues to be close to double their value from today. This picture outlines that Tesla's future is in front of the company.

Tesla is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

Key Takeaways

It's good to see that Tesla has rewarded shareholders with a total return of 87% in the last twelve months. Therefore, it seems like sentiment around the company is still positive, despite all the fluctuations.

The company is making good on its promises and delivering an increasing number of vehicles, further bolstering confidence in the product demand and the production capacity of Tesla. Analysts are forecasting constant growth, as the company keeps expanding and re-investing resources.

It's always interesting to track share price performance over the longer term. But to understand Tesla better, we need to consider many other factors. For instance, we've identified 1 warning sign for Tesla that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com