Should Groupe Partouche (EPA:PARP) Be Disappointed With Their 34% Profit?

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. To wit, the Groupe Partouche SA (EPA:PARP) share price is 34% higher than it was a year ago, much better than the market return of around 20% (not including dividends) in the same period. That's a solid performance by our standards! Unfortunately the longer term returns are not so good, with the stock falling 34% in the last three years.

See our latest analysis for Groupe Partouche

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last twelve months, Groupe Partouche actually shrank its EPS by 68%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

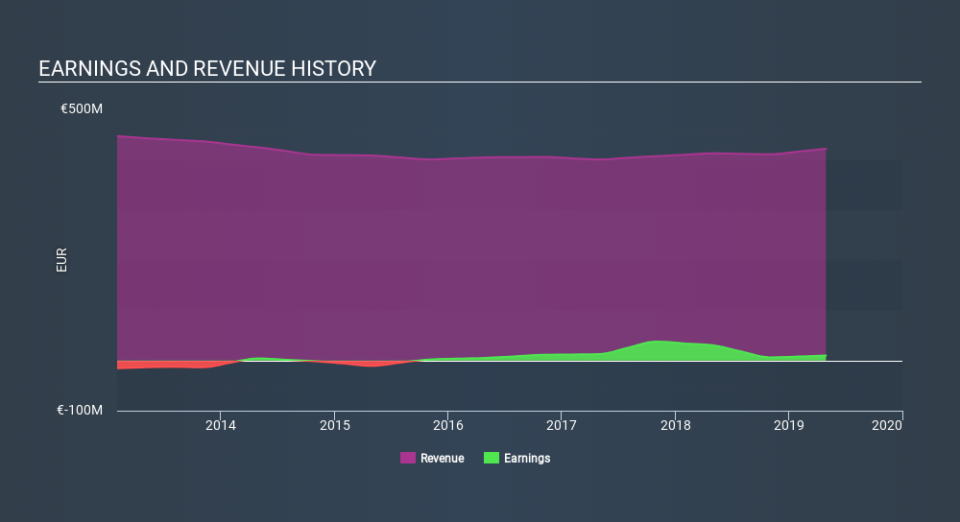

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Pleasingly, Groupe Partouche's total shareholder return last year was 34%. That certainly beats the loss of about 12% per year over three years. It could well be that the business has turned around -- or else regained the confidence of investors. Is Groupe Partouche cheap compared to other companies? These 3 valuation measures might help you decide.

Of course Groupe Partouche may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.