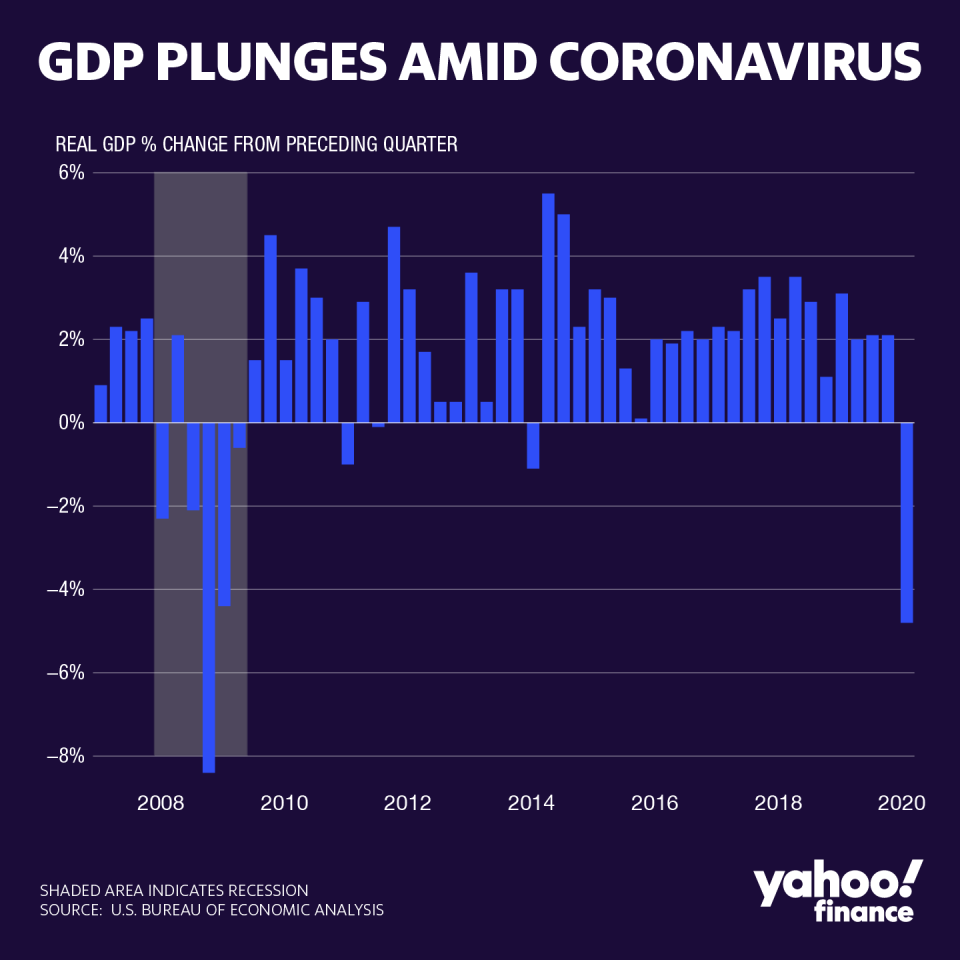

First quarter 2020 GDP: U.S. economy contracted for the first time in six years

U.S. gross domestic product turned negative for the first time since 2014 in the first three months of the year as the coronavirus pandemic broadened out across the globe and country in March, dragging output to a near standstill and driving a deep contraction in consumer spending.

The U.S. Bureau of Economic Analysis (BEA) released its advance estimate of first-quarter 2020 GDP Wednesday morning. Here were the main metrics from the report, compared to consensus expectations compiled by Bloomberg:

1Q GDP annualized, QoQ: -4.8% vs. -4.0% expected, +2.1% in 4Q 2019

1Q Personal consumption: -7.6% vs. -3.6% expected, +1.8% in 4Q 2019

1Q Core PCE QoQ: +1.8% vs. +1.7% expected, +1.3% in 4Q 2019

Estimates for the size of the first-quarter contraction spanned a wide range, as economists grappled to assess the extent of the damage caused by an unprecedented set of business operational halts and widespread stay-in-place orders.

The reported 4.8% contraction in GDP was the largest drop since late 2008.

“The decline in first quarter GDP was, in part, due to the response to the spread of COVID-19, as governments issued ‘stay-at-home’ orders in March,” the BEA said in a statement. “This led to rapid changes in demand, as businesses and schools switched to remote work or canceled operations, and consumers canceled, restricted, or redirected their spending.”

The first-quarter gross domestic product report underscored the economic devastation the coronavirus has induced even at its earliest stages on the U.S. economy. At -7.6%, the drop in personal consumption was the fastest since the second quarter of 1980, and double the rate at the worst point during the global financial crisis. Consumer spending comprises about two-thirds of U.S. economic activity.

Services consumption shrank 10.2% in the first quarter over the prior period, the deepest contraction on record. Household consumption for services deducted 5.61 percentage points to headline GDP.

Other areas of the economy also weakened sharply in the first quarter. Business fixed investment dropped by 8.6% in the first quarter, or the most since 2009, as companies pared back spending plans while the pandemic forced business closures and dented demand.

The declines in first-quarter GDP were somewhat blunted by residential investment, net exports and government spending, each of which added modest gains to the headline print. But these were not, however, enough to counterbalance the sharp declines elsewhere in the economy.

Ahead of the report, a number of government data releases already underscored the economic damage invoked by the coronavirus pandemic and widespread business closures.

A historic 26 million individuals filed for new unemployment insurance claims over the past five weeks, with new claims appearing to have peaked in late March. Retail sales plunged by a record 8.7% in March, suggesting a sharp drop-off in discretionary spending as social distancing measures overtook the country. Consumer spending comprises about 70% of U.S. economic activity.

The manufacturing sector showed similar signs of distress, with output falling by the most since 1946 in March. Durable goods orders sank by the most since August 2014 as commercial aircraft orders sank, reflecting shriveled demand for air travel and, more broadly, supply chain disruptions for the manufacturing sector as a whole.

Many expect the economic damage will only deepen in the second quarter, affirming that the U.S. is in the midst of a downturn. A recession is defined as two consecutive quarters of negative GDP growth.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

What we can learn from the 17 stock market crashes since 1870

Nike 3Q revenue tops expectations as surge in China digital sales helps offset store closures

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news