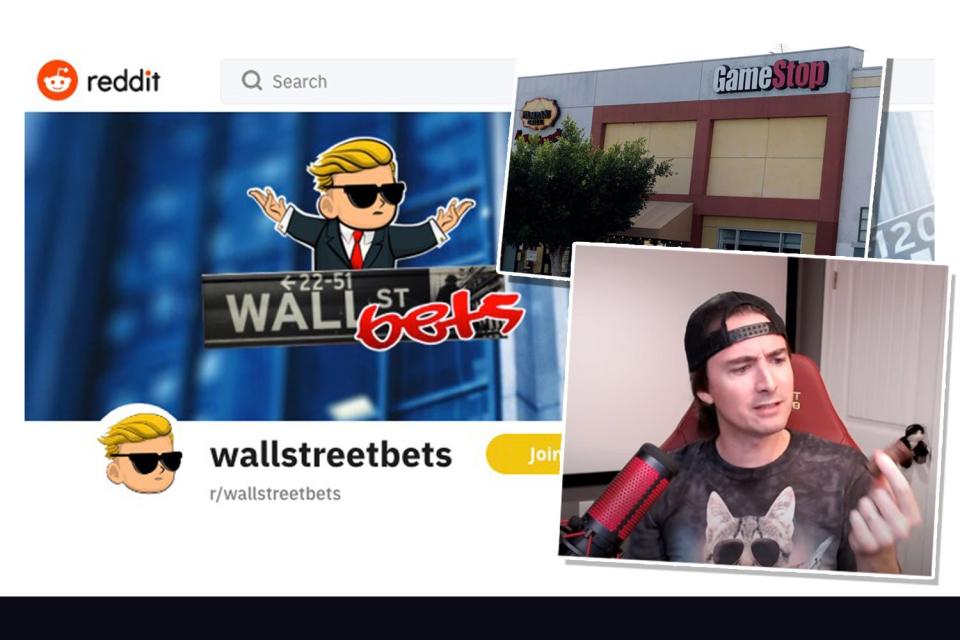

GameStop shares up 60% as Reddit army returns to rock Wall Street 🚀🚀🚀

THE Reddit investor army was back on the march today sending shares in US ‘meme stocks’ such as GameStop rocketing to month-high levels.

GameStop, the bricks-and-mortar video games seller at the centre of an armchair trader frenzy in January, roared 70% higher at $160 as Wall Street opened this afternoon.

That came after a gathering rally exploded to lift its share price from $49 to $91.71 in the final hour of trade in the previous session amid mounting speculation online that a major equity investor may have taken a stake.

A stop-start afternoon of volatility suspensions left the stock hovering at around $143, still up almost 60%.

Just over 100 million shares had changed hands by mid-morning, almost double its 30-day average volume of 62 million, but still around half the more than 190 million daily trades in late January.

Other companies caught up in the original outbreak of meme buying mania - coordinated on the WallStreetBets forum on Reddit - also surged on the second wave.

McDonald’s ice cream may seem an unlikely trigger for a fresh bout of frenzied retail trading

Koss, a maker of headphones based in Milwaukee, was up 55% to $9.85.

Cinema chain AMC was up by more than 10% to $10.04. Nokia climbed 7.7% in Europe, and BlackBerry added 5.3% in early trading.

— Ryan Cohen (@ryancohen) February 24, 2021

The fresh outbreak of volatility, fuelled by retail traders using free investment apps like RobinHood, provoked fresh warnings for small-time investors.

Back to the MOON!!!

Stockwatchers were casting around to identify a reason behind the second wave.

Some cited a report on Bloomberg News saying GameStop’s CFO Jim Bell was pushed out in a disagreement over strategy to make way for an executive more in line with the vision of activist investor and board member Ryan Cohen.

Cohen, is the co-founder of online pet-food retailer Chewy.com, and his addition to the board early in the year - and calls for the company to shift focus from shopping malls to the lucrative download market - underpinned the first flurry of moves in the stock.

According to Neil Wilson, chief market analyst for Markets.com, the sudden surge in GameStop may have been triggered by a cryptic tweet from Cohen, who posted a frog emoji and picture of a McDonald’s ice cream cone.

“Does it signal Cohen will fix the company the way McDonald’s finally fixed its ice cream machines?” Wilson wrote in a note. “Who knows, stranger things have happened. It looks like the Reddit crowd are at it again.”

Further speculation followed that equity investor Volition Capital, a major backer of Cohen’s chewy.com may have stepped aboard.

A post on chewy.com’s website reads: “FUN FACTS ABOUT CHEWY & VOLITION: Chewy’s first official board meeting included two slides, a lot of laughter and a trip to McDonalds for soft serve.”

One Reddit detective wrote: “You guys! ð Ryan Cohen has the reigns as CEO and they just had their first board meeting ð¦. Same as he did at Chewy! The frog ð¸ is the long-used symbol of transition and change, from tadpole to frog.”

Analysts ruled out a short squeeze like the one in January that battered hedge funds, indeed some said the rally may have been partially fuelled by a fear of betting against GameStop.

Dennis Dick, a trader at Bright Trading, told Benzinga podcast: “There are not a lot of people who are just sitting there, ‘oh yeah, let’s for fun, let’s just short GameStop and get my head ripped off.’

I like the stock

RoaringKitty to US Congress

Whatever the explanation, the sequel to last month’s retail boom led to concerns that amateur investors would pile into the stock at an inflated price, only to lose hundreds of thousands when the bubble burst.

Confirmation of that fear runs through a string of fresh posts on the r/WallStreetBets forum.

“Why is GME going up?” one user asked. “Because we like the stock”, another replied - the phrase used by GameStop backer Keith Gill, aka RoaringKitty, when he was hauled before Congress eariler this month.

Another posted: “I missed out on GME the first time, I’m not making that mistake again. TO THE MOON”

Charlie Munger, longtime business partner of Warren Buffett, said: “It’s really stupid to have a culture which encourages as much gambling in stocks by people who have the mindset of racetrack betters.”

Read More

IG Index blocks investors from more than 1000 smallcap stocks as RobinHood GameStop saga ripples

Short-seller Marc Cohodes strikes back on Reddit saga as GameStop shares tumble again

Reddit retail investors declare they will “hold the line” on GameStop shares even as they plunge

Investors hunt for the next GameStop as ‘meme’ shares crash 30% in sell-off