The US economy has become disappointing

Since Donald Trump was elected president, economic news about the U.S. has done one thing: get better.

But for the first time, recent rounds of economic data have begun to disappoint.

The March jobs report saw the economy add 98,000 jobs, well below economists’ expectations for gains of closer to 180,000 ahead of the data. And last Friday, we saw retail sales numbers come up shy of expectations, while on Tuesday both housing starts data and industrial production missed estimates.

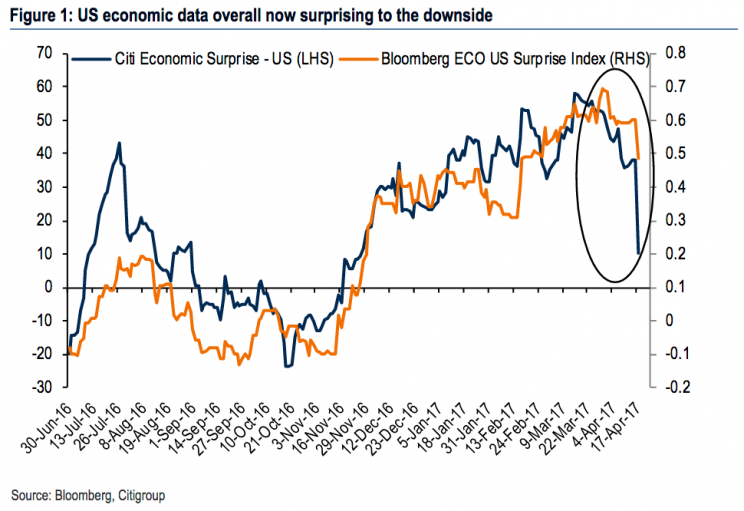

And according to data from Bank of America Merrill Lynch, the U.S. economic surprise index is starting to roll over. Which means that economic news — while not necessarily bad — is no longer better-than-expected.

“For the first time since the US elections economic data overall have begun to surprise to the downside,” writes Hans Mikkelsen, a credit strategist at BAML.

While the magnitude of these disappointments depends on perspective — i.e. how the individual data releases are weighted and more — this trend is noteworthy.”

Actual economic growth, of course, is a combination of activity and confidence and plans long since committed to. But part of what makes confidence such a pivotal measure for markets and economists to track is that upticks in confidence can lead to either new plans or change the trajectory for existing investments.

So while the ups and downs of economic confidence are far more volatile than economic growth itself, confidence is the thing with the most potential to change what actually happens.

Mikkelsen adds that this drop in expectations, “comes after an extended period of time where, as we have addressed frequently, loan data has been weak.” This decline in bank loans, which we saw again in last week’s H.8 data on bank balance sheets from the Federal Reserve, has been much discussed in markets, though dismissed as not a concern by Fed officials, among others.

And whether the decline in credit growth and the drop in economic surprises are the beginning of a downturn or the right-sizing of trends that broke out after the election, it’s clear we are entering a new phase for the U.S. economy.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: