FedEx (FDX) Stock Declines as High Costs Hurt Q3 Earnings

FedEx Corporation’s FDX third-quarter fiscal 2022 (ended Feb 28, 2022) earnings (excluding 39 cents from non-recurring items) of $4.59 per share fell short of the Zacks Consensus Estimate of $4.69. Results were hurt by high transportation and labor costs. Adverse effects related to the omicron variant also dented results. The third-quarter earnings miss disappointed investors. As a result, the stock declined in after-market trading on Mar 17. The bottom line, however, increased 32.3% on a year-over-year basis.

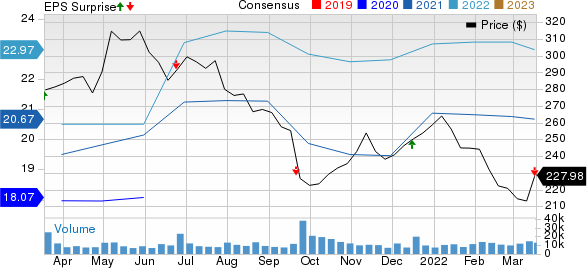

FedEx Corporation Price, Consensus and EPS Surprise

FedEx Corporation price-consensus-eps-surprise-chart | FedEx Corporation Quote

Quarterly revenues for the quarter came in at $23,641 million. The top line edged past the Zacks Consensus Estimate of $23,569.3 million and increased 9.91% year over year, with revenues increasing at all its key segments. Operating expenses (reported basis) increased 8.8% to $22.31 billion. Operating income (on a reported basis) increased 31.9% year over year to $1.33 billion.

Operating income (on an adjusted basis) increased 37% year over year to $1.46 billion for the reported quarter, driven by higher revenue per shipment and a net fuel benefit at all segments. Operating margin (adjusted) increased to 6.2% from 4.9% in the year-ago period.

Segmental Performance

Quarterly revenues at FedEx Express (including TNT Express) improved 5% from the prior-year quarter to $11,304 million. Within the segment, package revenues increased 6% while freight revenues were flat year over year. Segmental operating income increased 12% year over year to $520 million. Segmental operating results were driven by higher yields, a net fuel benefit and lower variable compensation expense.

FedEx Ground revenues increased 10% year over year to $8,800 million for the period under consideration, owing to favorable yield management actions, higher fuel surcharges and additional ground commercial operating weekdays. Revenue per package (yield) increased 9%. Operating income came in at $641 million, decreasing 9% year over year. Segmental operating results were hurt due to higher operating expenses pertaining to labor market woes and wage pressures, as well as increased costs related to network expansion.

Expenses pertaining to salaries and employee benefits increased 18% in the third quarter due to higher labor expenses and network inefficiencies. Purchased transportation expense increased 7% due to the challenging labor market conditions. Other operating expense increased 25% primarily due to higher self-insurance accruals, while rentals expense increased 22% due to network expansion.

FedEx Freight revenues climbed 23% year over year to $2,253 million, driven by higher revenue per shipment, increased average daily shipments and higher fuel surcharges. The segment’s operating income surged 183% to $337 million, courtesy of an intensified focus on revenue qualitative and profitable growth. Average daily shipments in the unit and revenue per shipment increased 2% and 19%, respectively.

Capital expenditures for the quarter decreased 10% from the prior-year period to $1.23 billion. The same increased 4% to $4.37 billion in the first nine months of fiscal 2022 primarily due to higher spending on package handling equipment at all segments, increased spending on vehicles and trailers at the Express and Ground units in addition to increased spending on facilities at the Ground unit.

Liquidity

FedEx, currently carrying a Zacks Rank #3 (Hold), exited third-quarter fiscal 2022 with a cash and cash equivalent balance of $6,065 million compared with $7,087 million recorded as of May 31, 2021. Long-term debt (less current portion) is pegged at $13,990 million compared with $13,660 million recorded at the end of fiscal 2021.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

View

Management expects earnings growth to be impressive in the fourth quarter of fiscal 2022. As in the fiscal third quarter, variable compensation expense should be low in the ongoing quarter, thereby aiding results.

For fiscal 2022, management still expects earnings per share (before the year-end MTM retirement plans accounting adjustment, and excluding estimated TNT Express integration expenses, estimated costs associated with business realignment activities, and the second quarter fiscal 2022 MTM retirement plans accounting adjustments) in the band of $20.50-$21.50. The mid-point ($21) of the guided range is above the Zacks Consensus Estimate of $20.67.

Moreover, FedEx anticipates earnings per share in the range of $18.60-$19.60 (earlier guidance: $18.25-$19.25) before the year-end MTM retirement plan accounting adjustments.

The effective tax rate, before the year-end MTM retirement plan accounting adjustment, is now expected in the 22-23% band in fiscal 2022 (earlier projection was 24%).

Capital expenditures are now predicted at $7 billion for fiscal 2022 compared with the earlier forecast of $7.2 billion. The forecast has been lowered due to extended time lines resulting from supply chain considerations. Cash flow (on an adjusted basis) is expected to be more than $3 billion.

Let’s recap briefly the latest earnings results of two companies also belonging to FedEx’s industry.

Akin to the last few quarters, upbeat demand for e-commerce-related package deliveries boosted United Parcel Service’s UPS fourth-quarter 2021 results. UPS reported fourth-quarter 2021 earnings (excluding 7 cents from non-recurring items) of $3.59 per share, beating the Zacks Consensus Estimate of $3.11. The bottom line jumped 35% year over year, with strong performances across all segments.

Quarterly revenues at UPS came in at $27,771 million, outperforming the Zacks Consensus Estimate of $27,179.6 million. The top line increased 11.5% year over year, driven by higher shipping rates and upbeat e-commerce demand.

Atlas Air Worldwide Holdings’ AAWW fourth-quarter earnings (excluding $1.50 from non-recurring items) of $7.05 per share outperformed the Zacks Consensus Estimate of $6.11. Driven by solid e-commerce demand, AAWW reported revenues of $1,163 million, outpacing the Zacks Consensus Estimate of $1,096.8 million.

Per AAWW’s president and CEO John W. Dietrich, “Our strategic focus on express, e-Commerce and fast-growing markets will continue to drive our business forward.”

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FedEx Corporation (FDX) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

Atlas Air Worldwide Holdings (AAWW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research