The Fed may wait too long to cut interest rates and spark a recession, economists say

As inflation gathered force in 2021 and 2022, the Federal Reserve notoriously waited too long to raise interest rates, allowing consumer prices to continue to climb sharply, Fed officials now acknowledge.

Now that inflation is easing, the Fed may be poised to make another blunder by moving too slowly to cut rates and triggering a recession, some economists argue.

“The longer they wait, the greater the risk that something goes off the rails,” says Mark Zandi, chief economist of Moody’s Analytics.

With annual inflation drawing closer to the Fed’s 2% goal and some risks to the economy growing, Zandi says the Fed should start lowering rates in March, or May at the latest. Inflation is running around 3% or slightly below, based on the two most popular measures, down from a 40-year high of up to 9.1% in June 2022.

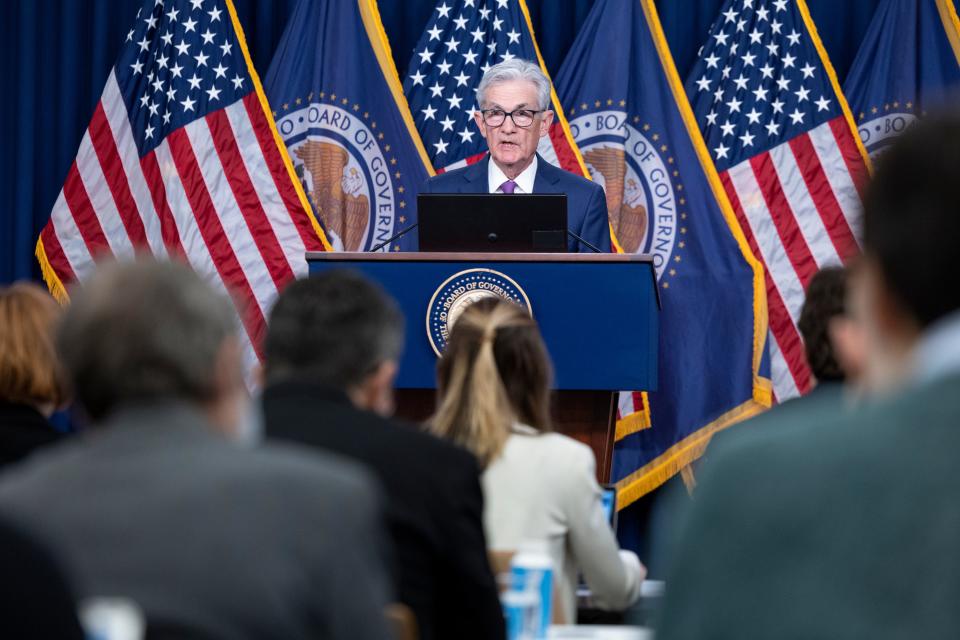

But Fed Chair Jerome Powell said last month that a March cut is highly unlikely. And minutes of the Fed’s late January meeting, released last week, has led some economists to push their predictions for the first rate decrease to June or later.

Many of them say inflation still poses the bigger threat and the Fed is on the right track.

“I think they’re right to be patient,” says Barclays economist Marc Giannoni.

What is the current Fed interest rate?

From March 2022 to July 2023, the Fed lifted its key short-term interest rate from near zero to a 22-year high of 5.25% to 5.5% to help wrestle down inflation, which already was slowing as pandemic-related supply chain snarls resolved. Since then, the central bank has held the rate steady.

A drop in the benchmark rate would lower borrowing costs for mortgages, credit cards, cars and other consumer and business loans, stimulating the economy. The prospect of lower rates already has propelled the stock market to record highs.

But after its two-day meeting last month, Powell told reporters that, before lowering the rate, officials want to gain more confidence that inflation “is on a sustainable path down to 2%.” According to the minutes, most policymakers worried about the risk of acting too quickly to chop rates and reigniting inflation. Only “a couple” of officials pointed to the hazards of keeping rates high for too long and causing the economy to weaken significantly or slip into recession.

Is inflation really high right now?

Several reports since the Fed meeting seemingly have vindicated the Fed’s cautious approach. A "core" inflation measure that strips out volatile food and energy items increased a hefty 0.4% in January, keeping the annual rise at 3.9%, according to the consumer price index.

Is the US economy strong right now?

Last month, meanwhile, U.S. employers added a booming 353,000 jobs and average annual wage growth – which feeds into inflation – jumped to 4.5% from 4.3%.

The economy also grew at a sturdy 3.3% annual rate in the past three months of 2023 and a solid 2.5% for the entire year.

The takeaway: The economy is not only on solid footing but could drive inflation higher again as consumers continue to spend their rapidly rising paychecks.

Some forecasters have a different view.

Is rent going down?

Granted, inflation flared in January but that’s just one month and it was mostly due to persistent increases in rent and other housing costs, Zandi says. Rent hikes are expected to ease in the coming months as falling rates for new leases ripple to existing leases.

Also, a different inflation measure that the Fed watches more closely – called the personal consumption expenditures price index – was at 2.6% in December and the Fed’s preferred core reading was at 2.9%, not far from the 2% target.

And if increases in core personal consumption expenditures price index prices over the past six months are annualized, inflation is already at 1.9%, Zandi notes.

By that gauge, “You’ve achieved your objective,” he says.

Are layoffs on the rise?

Meanwhile, he says, the economy isn’t as robust as it appears. Although job gains have been vigorous, the rate of hiring by employers in November hit the lowest level since 2014, excluding the pandemic recession. In other words, net job gains have been strong because employers have been loath to lay off workers following severe pandemic-related labor shortages (aside from high-profile layoffs by companies such as Amazon, Google and Microsoft).

And although the nation’s gross domestic product grew smartly last year, an alternative measure of economic output that some analysts say is more accurate – gross domestic income – has increased feebly.

Zandi, in turn, argues the risk of tipping the economy into recession is now greater than the chances of nudging inflation higher.

“You need to be careful that you’re not going to keep your foot on (the economy’s) brake too long,” he says.

Ryan Sweet, chief U.S. economist at Oxford Economics, agrees.

“If the central bank waits for clear signs that the labor market, or the broader economy, is deteriorating, it will be behind the curve,” he wrote in a note to clients.

Zandi especially frets about an unforeseen banking crisis like the one that felled Silicon Valley Bank and other regional banks, a year ago. High interest rates mean narrower profit margins that discourage banks from lending.

And while businesses so far have been reluctant to lay off workers, “That can change quickly,” he says, as high rates boost business costs while damping sales. Narrowing profit margins could prod more companies to cut employees to maintain earnings, he says.

Economists project economic growth will slow to a still decent 2.1% this year but see a 36% chance of recession, according to the average estimate of forecasters surveyed by Wolters Kluwer Blue Chip Economic Indicators. That's down from 61% odds in May but still historically high.

According to a model that accounts for a variety of economic indicators – including GDP, jobs and inflation – the Fed’s key rate should already be at 4% rather than 5.25% to 5.5%, Zandi says. That would still be well above the Fed's estimate of the long-run rate, 2.5%.

Will inflation rise again?

Giannoni, the Barclays economist, agrees the risks of another price surge versus a recession are becoming more balanced. But he thinks inflation is still the bigger worry.

“We’ve been consistently surprised by the strength and resilience of the economy,” he says. “There is a risk that’s going to continue and it means the path to 2% inflation is not guaranteed.”

Bye, bye landline? Phone companies want to eliminate traditional landlines. What's at stake and who loses?

While personal consumption expenditures price index inflation has come down, Giannoni says it could heat up again. Prices of services such as health care, auto insurance and dining out have continued to increase sharply, in part because of labor shortages that have kept average employee pay increases elevated, he says.

But what about the risk that high interest rates could topple the economy into a downturn?

“I don’t see the probability of that being high,” Giannoni says.

This article originally appeared on USA TODAY: Fed interest rate cut may be delayed long enough to set off recession