The Fed may be suffering from a 'credibility' issue with its inflation target

Last week’s round of Fedspeak amplified a critical question for the central bank: is the Federal Reserve suffering from a “credibility” issue with inflation?

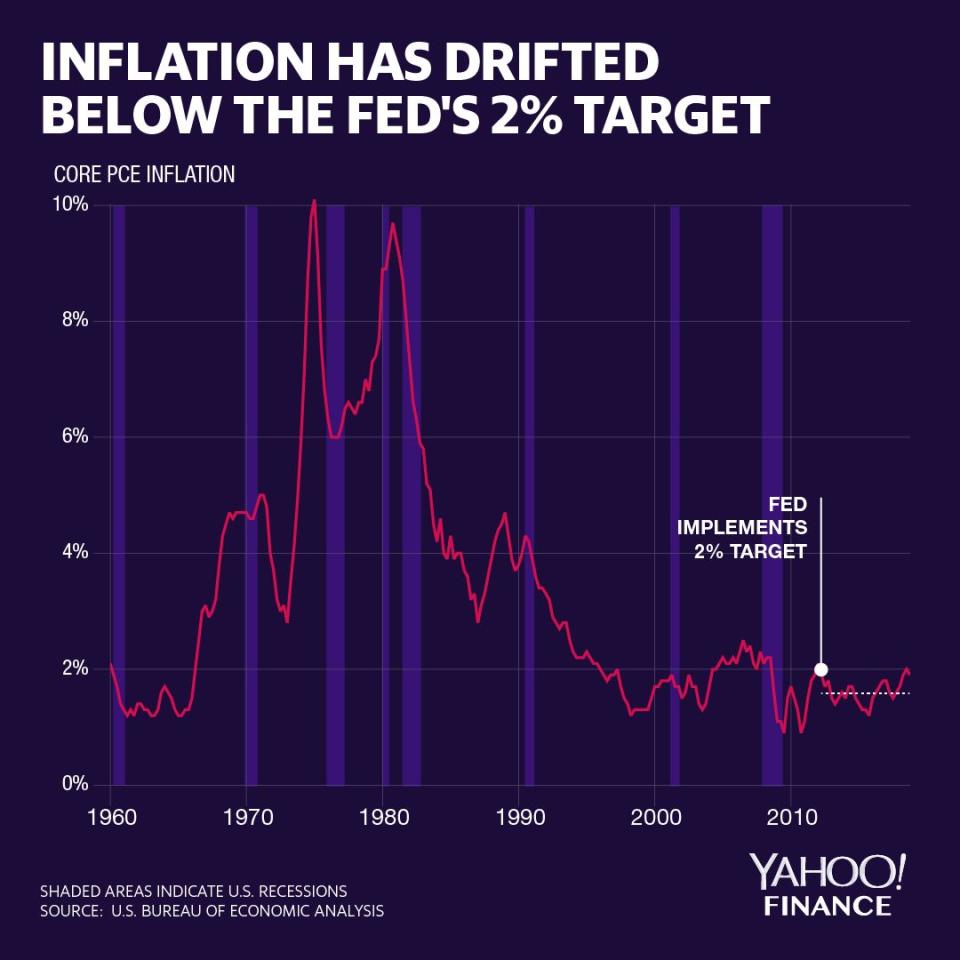

As part of its Congressionally-mandated mission of achieving price stability, the Fed has defined a 2% target for inflation. But measures of core personal consumption expenditures (PCE) have persistently drifted below the central bank’s 2% target level, raising questions over whether or not it can credibly get inflation to its target.

The existential crisis on the Fed’s inflation targeting strategy comes as the Fed wrangles with “muted” inflationary pressures, which Chairman Jerome Powell frequently cites as a reason for needing “patient” monetary policy and a pause on rate hikes.

This year, the Fed will review its “strategies, tools, and communication practices” which could cover the way it pursues its price stability mandate. Current and former Fed officials are taking advantage of the open forum to suggest policy alternatives like price-level targeting.

Powell told Congress last week that this will be a huge effort.

“[Economists have been] thinking of ways to make that inflation 2% target credible — highly credible — so that inflation kind of averages around 2% rather than only averaging 2% in good times and then averaging way less than that in bad times, which would drag expectations down,” Powell said.

Low expectations

During its review, the Fed will host a number of public events around the country to hear from stakeholders. The Fed has explicitly said that the inflation target of 2% will not change, but it is open to tweaks in the way it gets to that target.

Under the Fed’s current strategy of inflation targeting, the Fed relies heavily on inflation expectations to drive inflation itself. In theory, telling the public that there will be inflation is a self-fulling prophecy; if households and businesses expect higher prices in the future, they will spend more money now which in turn raises prices in future periods.

“In our thinking, inflation expectations are now the most important driver of actual inflation,” Powell said February 26.

But in practice, the Fed has suffered from tepid inflation growth. Core PCE, which excludes food and energy prices, is currently near-target, at an estimate of 1.9%. But since the Fed adopted its 2% target in early 2012, core PCE has clocked in at an average of only 1.6%.

During that same period, core PCE readings also never broke higher than 2%, despite the Fed’s insistence that the target is “symmetric” and not a ceiling.

“I am worried that the market may not take us seriously that the 2 percent target has symmetry to it,” Atlanta Fed President Raphael Bostic said at the National Association of Business Economics conference March 1.

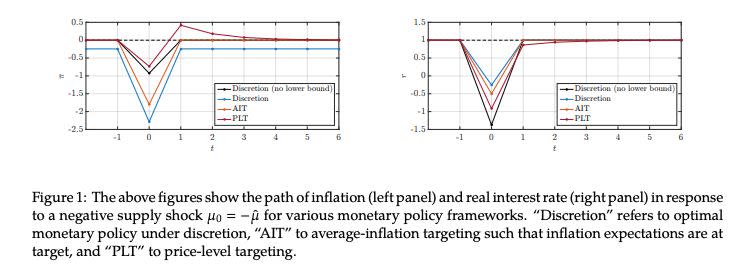

New York Fed President John Williams proposes an alternative framework and has advocated for price-level targeting, in which the Fed allows inflation to fluctuate as long as price levels themselves remain stable. Williams argues that in low-interest rate environments, the 2% stated target has a “downward bias” to stay below the 2% level, and suggests that price-level targeting would allow for more dynamism in inflation expectations.

Former Fed Chairman Ben Bernanke expanded on this theory, proposing a “temporary price-level targeting” framework that would use price levels when the Fed is near the zero-bound on rates but stick with its existing inflation-targeting strategy at other times.

Other alternatives include nominal GDP targeting and setting an inflation range with an adjustable inflation target (such as a 1.5% to 3% range, for example).

Time to overshoot?

In the meantime, inflation-targeting remains the strategy and market watchers are wondering if the Fed does indeed have its hands tied with regard to stimulating otherwise “muted” inflation.

With inflation measurements consistently coming in below 2%, Bank of America Merrill Lynch’s Ethan Harris argues that the Fed should message that it wants to modestly overshoot its target. Harris adds that the Fed needs to do so now.

“[I]f the Fed wants to average 2% inflation on a forward basis, they may need to push inflation above 2% during the ‘hot’ phase of the business cycle,” Harris writes. “Otherwise, the next recession will push them back down below 2% and they will average less than 2%.”

The Fed has been reluctant to message that it wants to deliberately overshoot its target, worrying that doing so could uncork inflation expectations and lead to overheating. Members of Congress have even expressed concern about overshooting; Pennsylvania Senator Pat Toomey told Powell last week that in his judgment, “higher inflation has been a bigger problem than lower inflation” to the U.S. economy.

As the Fed continues to pause on its rate hike path, the central bank’s approach to inflation could prove more important than the measures of inflation themselves.

“These are questions that are going to be the subject of careful consideration over the course of this year and beyond in our thinking,” Powell told Congress last week.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Read more:

Will we get to 3% GDP growth this year? Economists say no.

Warren accuses Fed of approving bank mergers with 'rubber stamp'

Powell signals that balance sheet rolloff could end as early as October

Fed Chair Powell: We're seeing 'crosscurrents and conflicting signals'

Congress may have accidentally freed nearly all banks from the Volcker Rule