This is everything you can expect to see in the Budget

Chancellor Philip Hammond has said he will use the Budget to “invest to secure a bright future for Britain”, in a strong signal that he is ready to start bringing down the curtain on the age of austerity.

In his keynote statement on Wednesday, Mr Hammond is expected to respond to intense pressure for Government spending to boost industrial productivity and ease the housing crisis, as he promises to build “a Britain fit for the future”.

But his room for manoeuvre has been limited by surprise figures showing that state borrowing jumped to £8 billion last month, adding to pressure from the Office for Budget Responsibility’s expected downgrade of productivity projections.

The director of the Institute for Fiscal Studies, Paul Johnson, said Mr Hammond was caught “between a rock and a hard place” and may be forced to abandon his target of balancing the nation’s books by the middle of the next decade.

And as inflation at 3% hits prices in the shops, wages remain largely static and Brexit pressures weigh heavy on British business and commerce, “Spreadsheet Phil” is up against it.

Latest figures show public sector borrowing rose to £8bn in October, up £500m from a year earlier.

MORE: UK aerospace industry already being frozen out of big deals amid Brexit uncertainty

Fresh from a humbling at the general election ballot box, his Conservative Party colleagues will be yearning for even the slightest nugget of good cheer.

So what can we expect from the 2017 Budget…

Housing: Most commentators and pundits reckon this is where the major policy announcements will be made.

It’s already been trailed widely he will pledge to build 300,000 homes per year, with the Treasury reportedly ready to find £5bn for housing schemes, and tens of billions more could be earmarked for underwriting loans.

Housing associations will be reclassified as private bodies allowing their £70bn debt to be removed from the government’s balance sheet. The technical change would allow them to build more affordable ‘social housing’.

There has also been widespread speculation Hammond might even scrap or at least shake-up the stamp duty levy in England to ease the burden for first-time buyers.

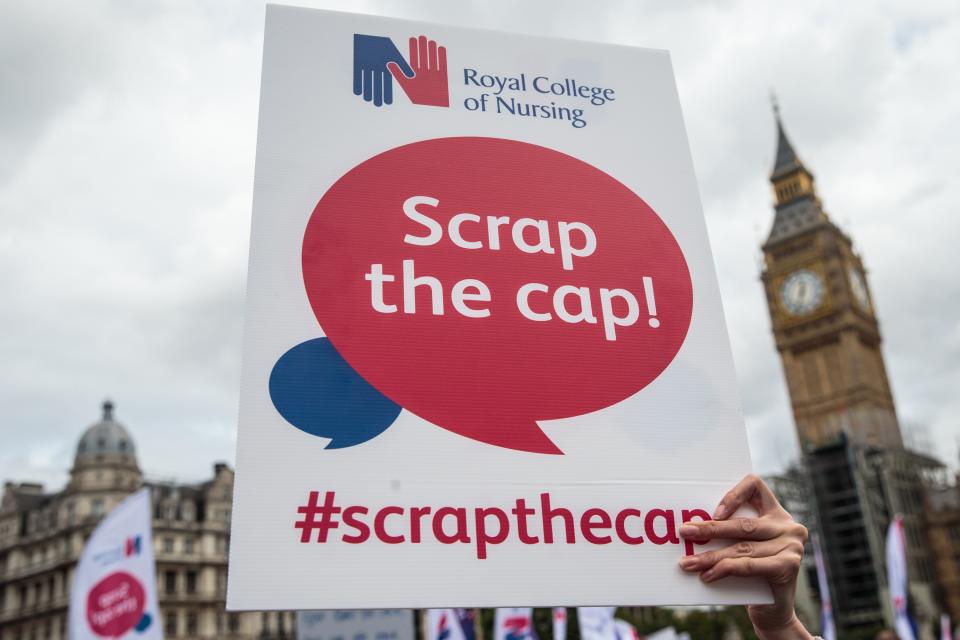

Pay: The public sector pay freeze, in place in some form since 2010, has hit teachers, nurses and other public workers up and down the country hard.

However, increasing public sector pay across the board for the nation’s 5m-plus workers would be very expensive.

Upping wages in line with either prices or private sector earnings would add £6bn a year by 2019-20 to the cost of employing them.

Having already committed to giving the police and prison officers a 1% rise plus a 1% bonus for 2017-18, few expect anything elsewhere.

Benefits: Theresa May and her ministers have been under pressure for months to curb the roll out of the Universal Credit system.

Critics say too many vulnerable people are finding themselves out of pocket – or even out of a home – by its delays in getting money to them.

It has been rumoured the chancellor will seek to address some of those concerns during his statement, possibly cutting the six-week wait for Universal Credit payments to five weeks.

Other benefits, such as Jobseeker’s Allowance, Employment and Support Allowance, some types of Housing Benefit, and Child Benefit, are halfway through a four-year freeze, so few think they will be changed.

MORE: What this week’s Budget could mean for your pension

NHS: Simon Stevens, head of NHS England, said recently £4bn extra was needed for hospitals next year, saying the £350m figure quoted during the EU referendum should be coughed up.

While Remainer Hammond might smile at that request, he is expected to find more money for the NHS. Nurses, too, could see a boost to their pay packets in some form.

Business: Much of the Budget gossip has centred on possible changes to the VAT threshold for smaller business.

Firms are currently liable to charge VAT once their annual turnover reaches £85,000, but the Office for Tax Simplification has recommended a review.

Lowering it to £20,000 would bring it in line with the EU average and raise extra funds for the Treasury, but could prove politically unpopular as it would affect self-employed builders, B&B owners and the like.

There has also been talk the gig economy could be in the spotlight, with many feeling those “going freelance” while foregoing holiday pay, for example, are making up for it through much lower tax bills.

MORE: Deficit widens in October ahead of Hammond’s Budget

Students & young people: Theresa May has already committed to raise the threshold at which students begin repaying their loan, from £21,000 to £25,000. Tuition fees would also be frozen at the current £9,250 until 2019, rather than increased with inflation by £250.

The young person’s railcard will be extended from 16-25 up to 30, helping millions of millennials with their off-peak travel.

Cars & tech: Hammond wants Britain to be in the driving seat on driverless car technology. Speaking at the weekend, he said he wanted to see self-driving cars on UK roads by 2021. Expect money to be made available in the form of tax breaks for R&D in this area.

It’s also believed £400m will be earmarked for electric car charge points, £75m on artificial intelligence, and £100m to boost purchases of clean fuel cars.

And all this will be offset by (paid for by) diesel drivers. Once the darling of central government, “dirty diesels” will see fuel duty rise by 1p a litre.

MORE: Your Uber car could be driverless within 2 years

Green tax: The fast food industry is braced for a plastic tax. Hammond is set to order a review on the use of plastic burger trays, plastic cutlery, drinks bottles with a possible levy to be imposed later down the line, similar to the 5p plastic supermarket bag charge.

Yahoo Finance

Yahoo Finance