Dow 19,999.63

The Dow Jones Industrial Average (^DJI) has never been so close to hitting 20,000.

“Believe it or not, at exactly 12:43 pm ET, the Dow hit a new all-time intraday high of 19,999.63(!!?) before pulling back slightly,” NYSE floor governor Rich Barry said in an email. “[It spurred] floor traders to collectively ask the question: ‘What the heck is going on here?!'”

In recent weeks, the stock market index come close but failed to breach 20,000.

Nevertheless, it’s yet another all-time high for this bull market, which started back in March 2009.

Friday’s stock market rally comes on the tails of a healthy US jobs report. US companies added 156,000 jobs in December, marking the 75th straight month of jobs gains. The unemployment rate ticked up to 4.7% from 4.6% in November. However this is way down from its June 2009 high of 10.0%.

Despite the impressive improvement in the US labor market over these years, the market has been anything but smooth sailing.

“[I]nvestors have been climbing the wall of worry for eight years and counting,” BMO Capital’s Brian Belski said in a note to clients on Friday. “Doubt, fear, and rushes to judgement have been trying to diagnose the end of the bull market since it began.”

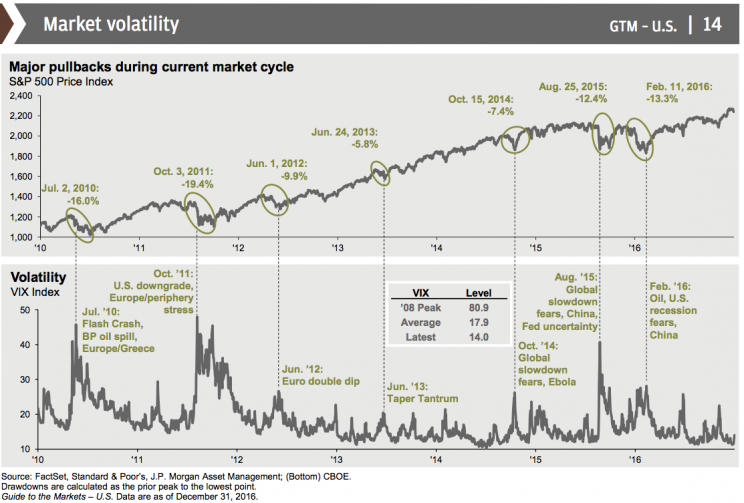

The graphic below comes from JP Morgan Asset Management’s brand new Guide To Markets. The chart above is of the S&P 500 (^GSPC) with annotations noting the major pull backs. Below is the CBOE Volatility Index (^VIX) highlighting the major risk events that have occurred during this bull market.

“There’ve been recoveries, rebounds, reversals and turnarounds─and all with the participation (willing or otherwise) of a cast of billions of people around the world affected in one way or another by the vacillations and inter-market relationships among asset classes and their valuations,” Oppenheimer’s John Stoltzfus said.

Indeed, there has been no shortage of risk events that have led to pundits predicting doom for this bull market time and time again.

“Bears and skeptics to this market have sought out black swans, bolts from the blue, and even Armageddon itself only to come up short and be proven wrong repeatedly since March 9, 2009, as the bull has climbed a wall of worry,” Stoltzfus said.

“It’s the most unloved and denied bull market we have ever experienced in an investment career that spans over three decades,” he said. “It’s not just the existence of this bull that’s regularly denied by its detractors, but its very purposefulness via the further denial of the importance and usefulness of the efforts of the Federal Reserve to save our society financially from itself that initially propelled this bull market into existence.”

During the more recent part of this bull market, stock prices have gone up as earnings growth has gone sideways, which has stretched valuations. And at current levels, most strategists on Wall Street are telling clients to prepare for years of lackluster returns.

However, most of these strategists aren’t yet ready to call the end of this bull market for at least two major reasons: 1) there’s little evidence to suggest a recession, aka the “slayer of bull markets,” is imminent, and 2) earnings, which are the mother’s milk of stocks, are expected to accelerate.

“[W]e have crossed into the 10th decile of valuations: US equities have been more expensive than current levels only 10% of the time in the post-WWII period,” Goldman Sachs’ Sharmin Mossavar-Rahmani and Brett Nelson told clients on Thursday. “Yet we continue to recommend staying the course. We are duly aware that this recommendation is long in the tooth, particularly given such high valuations and the unusually high level of policy uncertainty.”

Buyer beware.

–

Sam Ro is managing editor at Yahoo Finance.

Read more: