Don't Count Out This Mining Stock Yet

Freeport-McMoRan Inc (NYSE:FCX) is down 0.3% to trade at $38.36 this afternoon, amid a myriad of bear and bull notes from analysts. So far today, at least three firms have slashed their price targets, with Deutsche moving to lowest to $40. Meanwhile, Jefferies hiked its price objective to $55 from $50. This comes a day after the copper miner announced fourth-quarter revenue that was lower than what analysts anticipated, resulting in a 3% bear gap.

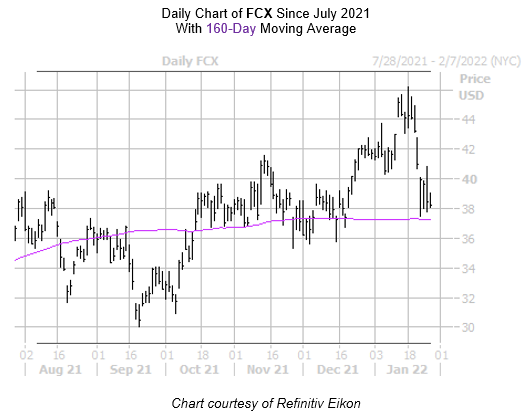

Freeport-McMoRan stock had started 2022 off strong, rising to a 10-year high of $46.20 on Jan. 18. Lately though, FCX is pacing for a sixth-straight loss and sports an 8% deficit year-to-date. The one silver lining is this pullback has put the shares near a trendline that if past is precedent, has historically bullish implications.

Freeport-McMoRan stock just came within one standard deviation of its 160-day moving average, after some time spent above this trendline. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, at least three similar signals were observed in the past three years. FCX enjoyed a positive return one month later in 67% of cases, averaging an 6.1% gain. From its current perch, a move of comparable magnitude would place the security near $41, filling that post-earnings bear gap from this week.

There's another contrarian factor to consider. FCX's 14-Day Relative Strength Index (RSI) has breached the 40 level and is nearing five-month lows. If this oversold reading continues to flash, it could signal a short-term bounce for the copper stock.