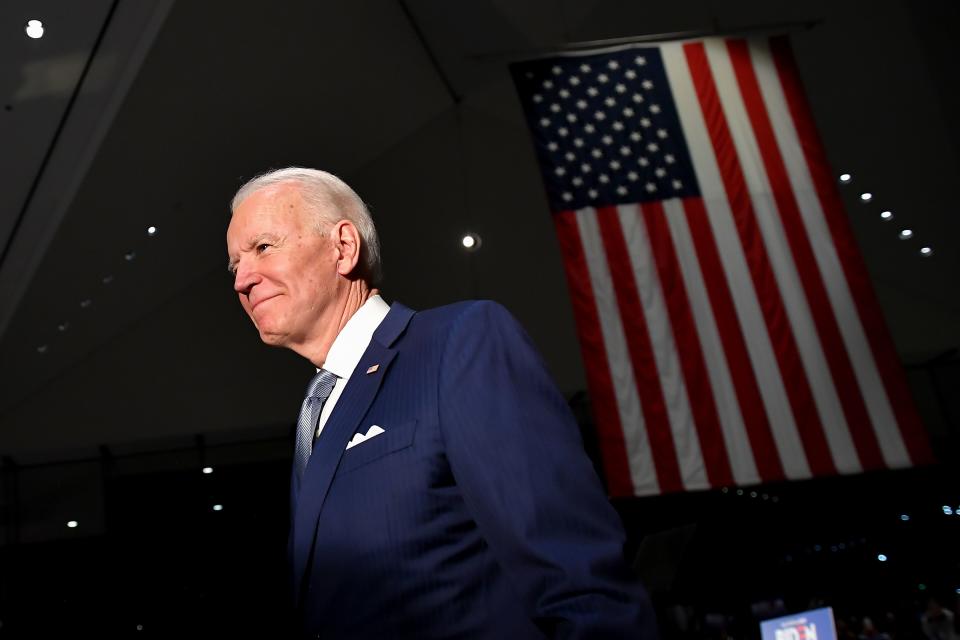

COVID-19 is a threat to Trump's presidency — here's why a Joe Biden win in November could drill stocks

Biden is better than Bernie, and for now that appears to be just good enough for jittery markets.

“I think it’s all about a comparison. Compared to Bernie Sanders, they [Biden’s policy proposals] are market friendly. Compared to some of the de-regulatory agenda and other proposals of the Trump administration maybe they are a little less market friendly,” explained Raymond James policy analyst Ed Mills on Yahoo Finance’s The First Trade.

It’s a debate for investors now worth having amid Biden’s surge in the polls to be the Democratic presidential nominee.

After shocking everyone with an impressive performance on Super Tuesday, former Vice President Joe Biden won most states’ primaries Tuesday evening. Importantly for Biden, he won the key battleground state of Michigan. Biden has now amassed 846 total delegates compared to former frontrunner Senator Bernie Sanders, who has 684.

Biden has scored big points — and high-profile endorsements of late — by adhering to a more moderate, level-headed message on the campaign trail. Whereas Biden is a calming presence in the eyes of many voters, Sanders is a revolutionary that could cause real-life chaos. While Biden is far from President Trump in terms of loose regulations and rock bottom taxes, to Mill’s point he is also no tax hike freak a la Sanders. That is theoretically good news for stocks, as is Biden not being in favor of a costly Medicare for All plan such as Sanders.

But investors that have been conditioned the past two weeks that Biden is positive for stocks (now known as the Biden Bounce on Wall Street) may want to slightly temper their enthusiasm.

“One thing the market is starting to look at is if the response to COVID-19 gets worse, that is one of the biggest threats to the Trump presidency. It increases the probability of an all Democratic government. In that scenario, you would probably see an increase in corporate tax rates not all the way back to 35% but perhaps it goes from 21% to 25%. You would see some changes to individual taxes and probably investment taxes,” says Mills.

The other wildcard, Mills adds, is who Biden would choose as Treasury Secretary. Speculation runs the spectrum — from a market friendly name in JPMorgan Chase CEO Jamie Dimon to a totally unfriendly name in policy hawk Senator Elizabeth Warren.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Read the latest financial and business news from Yahoo Finance

Beyond Meat founder: things are going very well with McDonald’s

Starbucks CEO on what China has in store for the coffee giant

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.