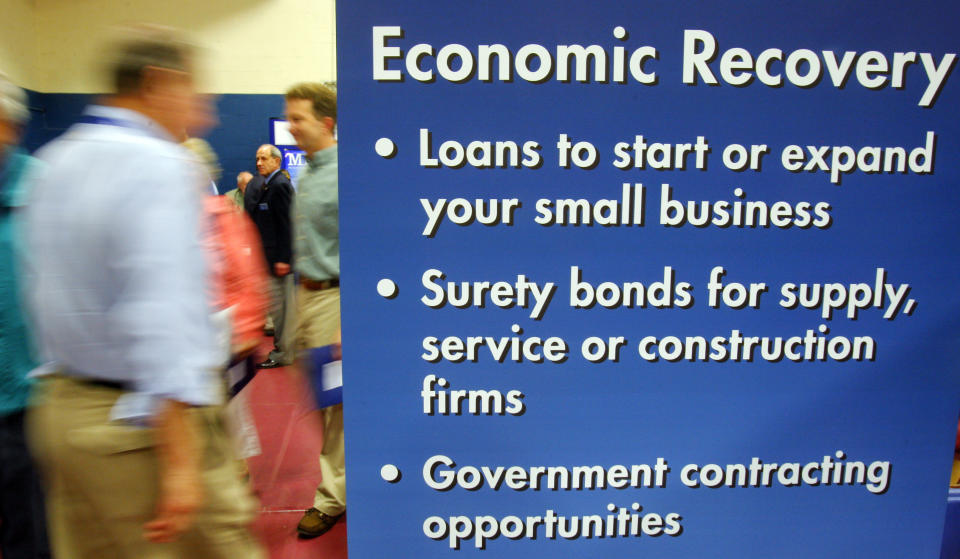

Small Business Administration: $50B coronavirus lifeline 'already starting to be approved'

President Donald Trump’s plan to utilize the Small Business Administration in the U.S. government’s coronavirus response is moving quickly, a top official told Yahoo Finance, with billions set to be allocated to cash-strapped establishments around the country.

The U.S. virtual shutdown amid the pandemic is set to spark mass layoffs. It’s galvanized Washington to hash out a massive stimulus package to backstop an economy that analysts believe has already fallen into recession.

Trump recently stated that the SBA would serve as a clearing house for “up to $50 billion” in available loans to help struggling small businesses weather the coming storm. The stimulus deal being negotiated on Capitol Hill will likely give the agency even more lending power — with the president vowing “aggressive action” as the crisis escalates.

Today I spoke with our Nation’s Small Businesses, which employ nearly half of America’s workforce. We are taking the MOST aggressive action in history to deliver fast relief to your businesses and workers. We will always protect our Small Businesses! @SBAgov https://t.co/lf3y5iJ4hd

— Donald J. Trump (@realDonaldTrump) March 20, 2020

“The money's already starting to be approved,” Alejandro Contreras, director of the SBA's Office of Disaster Assistance told Yahoo Finance on Friday. The official added that the agency was cutting red tape and many applications are already being processed.

The money will “start to roll out to the states as quickly as possible,” Contreras added.

‘The difference between surviving and failing’

The SBA has long had an important role in helping small businesses after a disaster like a hurricane or a flood. The Administration’s new leader, Jovita Carranza, was confirmed by the Senate in January.

The question is whether all that cash will get to business owners in time, as social distancing in multiple states to slow the virus forces one business after the other to shut their doors.

“We've had a lot of experience with large scale disasters over the past years but this is something that we haven't really seen before” Contreras said. For crisis-hit businesses, disbursing the money quickly “can mean the difference between them surviving and failing.”

The SBA’s disaster relief page lists current states and territories that have declared a disaster. This is a required step for businesses within those areas to begin to apply for the aid, but the agency recently relaxed those standards.

The page includes a link to apply for an Economic Injury Disaster Loan that can provide up to $2 million.

“On average, it takes between two and three weeks to process a decision on an application,” said Contreras — stating that many clear-cut applications get approved much faster.

The administration has also approved a one-year deferment on the payments, so business owners have a full year before repayments begin. The interest rate is 3.75% for small businesses, 2.75% for non-profits.

What else need to be done

The SBA’s work is just one part of what’s needed to help the small business community. “It's not going to be the one size fits all solution,” Contreras acknowledged.

Another proposed lifeline from Sen. Mark Warner (D-Va.) has called for a joint U.S. Treasury-Fed facility that would provide a trillion dollars in federally-guaranteed loans to small businesses during the crisis.

“If we do not take action immediately, thousands of American businesses and millions of their employees are at enormous risk,” Warner said in a recent Yahoo Finance interview.

More assistance for small business is also expected to be a key part of the next economic stimulus bill that lawmakers are negotiating this weekend, and hope to pass within days.

Senator Marco Rubio, Chairman of the Senate Committee on Small Business and Entrepreneurship, has spearheaded a $300 billion relief proposal that would give the SBA even more lending power and staff to administer all these loans.

Rubio’s plan would relax some of the restrictions on SBA loans. However, some have argued for grants — or money that doesn’t have to be paid back.

“We don't have the authority within our program to convert these to zero interest [loans] or to forgive them, effectively making them grants,” Contreras said. However, he noted that there are a variety of assistance programs available elsewhere in the government or from the private sector that could accomplish that task.

Ben Werschkul is a producer for Yahoo Finance in Washington, DC.

Read more:

Why businesses might ‘walk away’ from Trump’s coronavirus aid if there are strings attached

Meet the former UPS box handler now in charge of the Small Business Administration

Why hurricane season is a big deal at the SBA

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.