Citi (C) to Incur $170M Charges on Exit From Russian Operations

Citigroup C will exit its consumer banking and commercial banking operations in Russia, while seeking to sell some of the consumer loan portfolios. The winding down process will commence this quarter and will likely take 18 months to complete.

C expects to incur $170 million in charges over the period of winding down. These are mainly related to “restructuring, vendor termination fees and other related charges.” The exit will likely affect nearly 2,300 employees and 15 branches. Consumer products and channels impacted by the move comprise deposits, investments, loans and cards.

Following this development, shares of Citigroup rallied 2.1% in yesterday’s trading.

The company will continue to help “its multinational institutional clients, particularly those which are undergoing the complex task of winding down their operations in Russia.” Also, C is not closing its investment banking and transaction services operations in Russia but is steadily lowering its exposure and not taking new clients.

As of Jun 30, 2022, Citigroup’s exposure to Russia was $8.4 billion, down from $9.8 billion at 2021-end. Of the total exposure, roughly $1 billion relates to the consumer and local commercial banking businesses.

Citigroup had first announced its plans to exit the Russian consumer banking business in April 2021 as part of its broader strategic efforts to wind down operations in 14 markets across Asia, Europe, the Middle East and Africa, and Mexico. Later this March, the company included Russia’s commercial banking operation in the scope of its planned exit.

The company had been trying to sell these operations since then and was even in talks with a few banks. But it seemed impossible to complete the divestiture under the several sanctions imposed by both the United States and Russia, following the latter’s conflict with Ukraine.

Titi Cole, Citigroup's CEO of Legacy Franchises, said, “We have explored multiple strategic options to sell these businesses over the past several months. It’s clear that the wind-down path makes the most sense given the many complicating factors in the environment.”

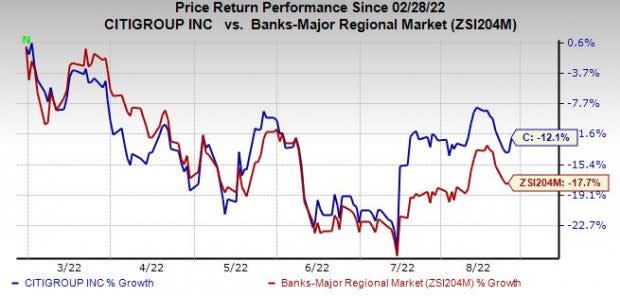

Shares of this Zacks Rank #3 (Hold) company have lost 12.1% over the past six months compared with a decline of 17.7% for the industry it belongs to. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

With this move, Citigroup joins other Wall Street giants like JPMorgan JPM and Goldman Sachs GS in winding up their businesses in Russia.

In March, Goldman Sachs stated, “Goldman Sachs is winding down its business in Russia in compliance with regulatory and licensing requirements. We are focused on supporting our clients across the globe in managing or closing out pre-existing obligations in the market and ensuring the wellbeing of our people.”

Echoing similar sentiments, JPMorgan noted, “In compliance with directives by governments around the world, we have been actively unwinding Russian business and have not been pursuing any new business in Russia.”

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research