Bond expert: Trump's Puerto Rico debt comments have 'little merit'

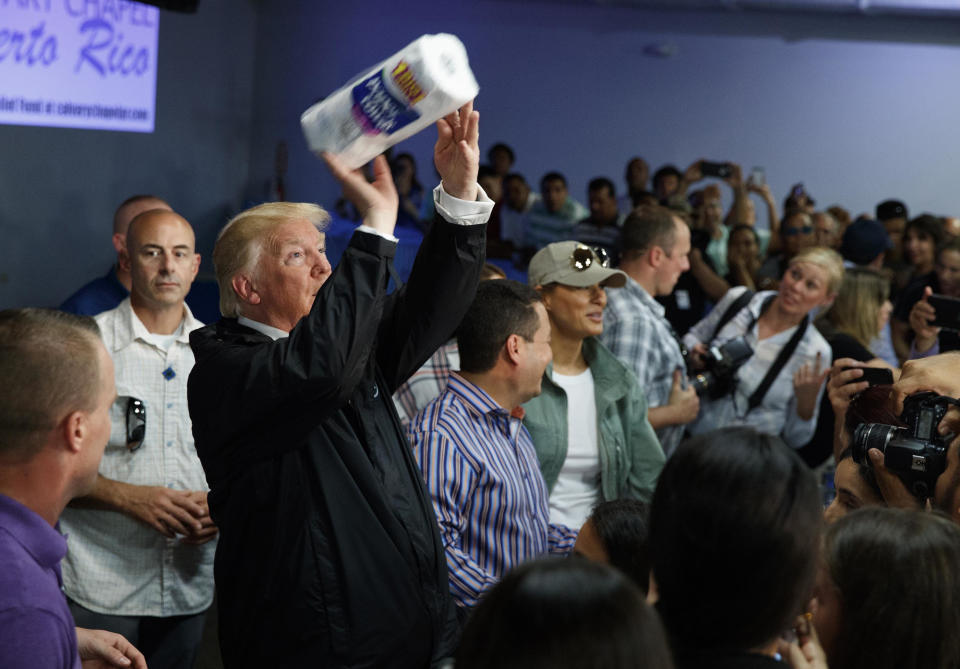

In a bizarre moment on Tuesday, President Donald Trump told Fox News that he was “gonna have to wipe out” Puerto Rico’s debt.

“We are going to work something out. We have to look at their whole debt structure,” Trump said. “You know they owe a lot of money to your friends on Wall Street. We’re gonna have to wipe that out. That’s gonna have to be — you know, you can say goodbye to that. I don’t know if it’s Goldman Sachs but whoever it is, you can wave goodbye to that.”

The exchange sent Puerto Rico general obligation bonds into a tailspin, with bonds maturing in 2035 dropping over 13% to $0.38 on the dollar, according to Bloomberg data.

Evidently, the market interpreted this to mean that the president might somehow erase the debt the territory is obligated to pay its creditors, not a federal government sponsored bailout package to square all the outstanding debts.

But not everyone is rushing to apply meaning to the president’s remarks.

“I wouldn’t start to guess with Trump,” John Mousseau, director of fixed income at Cumberland Advisors told Yahoo Finance. “The pace of rebuilding efforts will tell a lot.”

With an impetuous president often hazy on policy and details, many professionals like Mousseau have hesitated and remained calm in the face of wild, head-scratching statements.

“We take these comments as an unclear off-the-cuff response with little merit,” wrote Shaun Burgess, a fixed-income analyst for Cumberland in a note.

Indeed, soon after, Trump’s budget head Mick Mulvaney told CNN not to take the president “word for word,” an echo of the classic debate whether to take Trump “literally” or “seriously” or both.

Ethan Wolff-Mann is a writer at Yahoo Finance. Follow him on Twitter @ewolffmann. Confidential tip line: emann[at]oath[.com].

Read More:

ATM fees have shot up 55% in the past decade

Big bitcoin-friendly companies like Microsoft and Expedia hedge their bet

The real reason Mexico will never pay for the Trump’s wall: It’d be ‘treason’

How Waffle House’s hurricane response team prepares for disaster

Trump weighs slashing one of the most popular tax deductions

A robot lawyer can fight your parking tickets and much more

Consumer watchdog is making it easier for consumers to sue banks