Biden's tax hikes could flip even a moderate

If there's one thing Americans can agree on, it's that we want to keep as much of our money as we can. The economy has been rough for the last few years, and Americans are feeling the squeeze.

If President Joe Biden wins in 2024, how will he continue to handle the economy? On Friday, Biden’s top economic advisor gave us a window into that by explaining the administration's plans for Donald Trump's expiring tax breaks so many Americans enjoyed. So, without any changes from Congress, several portions of Trump's tax cuts will sunset after 2025.

“It’s clear we need to end the 2017 tax breaks for the ultra-wealthy and scale back costly permanent corporate tax breaks,” White House National Economic Advisor Lael Brainard said Friday during a speech to The Hamilton Project at the Brookings Institution. “As we approach the tax debate next year, the stakes could not be higher for the fairness of our tax system and our nation’s fiscal future. Achieving a fairer tax system also means we can’t extend expiring Trump tax cuts for those with incomes above $400,000."

Lower federal income tax brackets, a higher standard deduction and doubled estate and gift tax exemption are just some of the provisions from the Tax Cuts and Jobs Act Trump instituted in 2017 that will expire after 2025 if Congress fails to act.

Biden's promise to tax the rich is a standard progressive narrative

It's not surprising to see Brainard proudly say Biden's tax plan would include hikes on the ultra-wealthy and for corporations to pay for expiring middle-class tax breaks. The administration also wants to increase the tax on stock buybacks and add a 25% minimum income tax for billionaires.

This is a typical strategy of Democrat politicians who harbor disdain for capitalism and scorn for the ultra-rich, even though this is often based on false information. The rich do pay their fair share, and then some. The average tax rate for the top 0.1% of income earners is 33.5%, meaning just over one-third of their income is confiscated in taxes.

Biden's vowed to increase the top tax rate on the wealthiest Americans to almost 40%. I'm not sure what Biden thinks rich Americans do, but they don't just make money. They also buy goods and services. If they're taxed even more, they purchase less, hire less and spend less. This will end up hurting middle-class Americans. If he's elected and implements his tax plan, Biden will be throttling the rich with taxes.

Who will fix inflation? Inflation is still bad. It's both Trump and Biden's fault

Moderates who aren't committed to either party yet but earn above $400,000 or own a business could be persuaded to vote for Trump if it boosts their bottom line or they can't stomach paying even more taxes.

It's estimated that about 50% of Americans are in the middle class. More than 50% of Americans in a 2023 Monmouth survey said the middle class has not benefited at all from Biden's policies. I wouldn't be surprised if people are so frustrated with inflation and concerned about Biden's worrisome future tax plans. This subject alone could flip even moderates into Republicans (if they can stomach Trump).

Americans prioritize the economy in 2024

Some analysts, like those at Brookings, suggested that the Trump tax cuts would boost the economy, fizzle out quickly and add nearly $2 trillion to the deficit by 2028. Others, like the right-leaning Heritage Foundation, think the tax cuts helped the government generate more tax revenue because the corporate tax reform "propelled higher income growth and therefore higher income taxes and payroll taxes."

According to the most recent report by the nonpartisan Congressional Budget Office, extending the Trump tax cuts for the next 10 years would add $4.6 trillion to the deficit, although their press releases smearing Republicans don't sound non-partisan.

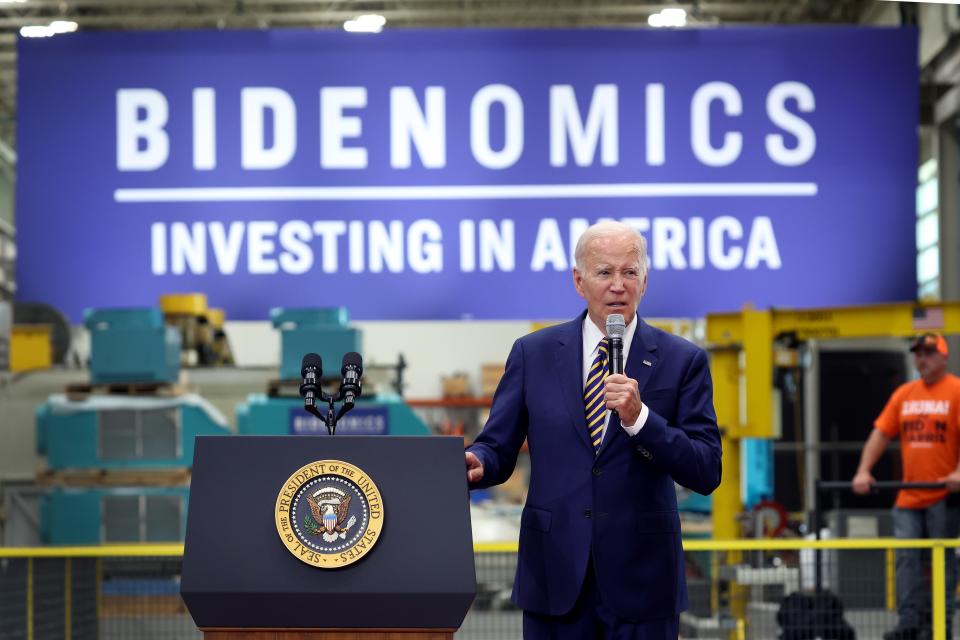

Inflation and the economy are consistently two top issues voters care about this election. While both presidents increased the national deficit, Biden's"Bidenomics" plan has failed miserably. The $2 trillion American Rescue Plan helped catapult inflation to its highest in 40 years.

Republicans and Democrats extremists: Biden and Trump need party extremists to win the election. It's pushing average voters away.

Sure, it's come down some, but nowhere near to pre-pandemic levels. Anyone who is buying groceries, used cars, eating out, or just trying to make ends meet can attest to the fact that inflation is real. Inflation peaked at 3.5 percent in March, the highest in the past six months. Since 2021, it has increased nearly 20%.

Trump's tax cuts could flip moderate voters already struggling with inflation

Because of the drastic inflation, it's easy for Americans to feel like the economy performed better when Trump was president, even if he partially inherited—and created—it. Inflation was at 2.1%, $1.9 trillion in tax cuts took place in 2018, unemployment had dropped to 4.1 percent, and 2.3 million new jobs had been created. Under Biden, unemployment is even lower. While wages are improving, in one survey, only one-third of workers said their increased wages can't keep up with inflation. Cynics who suggest the economy is drastically better under Biden fail to account for inflation's significant role in perspective. If everything costs more than it used to, the economy still feels difficult.

Combine this with Biden's brutal Bidenomics and his forthcoming plans to hike up taxes for really wealthy people and corporations, it's hard to see how this is appealing to the middle class he claims to represent.

If Biden is elected and prolongs Trump's middle-class tax cuts, passing them onto corporations as he promised, even this hike will be passed onto the consumer in the form of higher prices. This is just basic economics. Money has to come from somewhere, and if businesses are forced to pay higher taxes, that cost trickles down to the middle-class consumer.

It's even hard to believe Biden will actually continue the middle-class tax breaks the way they are now. In 2022, Biden said, "No one earning less than $400,000 will pay an additional penny in federal taxes—not one penny,” a refrain the White House repeated Friday.

Yet Biden hired 30,000 IRS employees (over two years, starting in 2023), spending $80 billion in new funds. Does anyone else wonder where this money to audit people actually comes from? Yet 63% of new audits last year were aimed at middle-class taxpayers with an income below $200,000. Sounds promising, doesn't it?

Biden's tax policies could be progressive enough to flip moderate voters to a Republican candidate in the name of an old political philosophy: taxation is theft.

Nicole Russell is an opinion columnist with USA TODAY. She lives in Texas with her four kids.

You can read diverse opinions from our Board of Contributors and other writers on the Opinion front page, on Twitter @usatodayopinion and in our daily Opinion newsletter.

This article originally appeared on USA TODAY: Biden's promise to undo Trump's tax cuts for the wealthy is misguided