Better Stock: Verizon Communications Inc. (VZ) vs. Johnson & Johnson (JNJ)

Johnson & Johnson (NYSE: JNJ) and Verizon (NYSE: VZ) have long been bastions of bountiful dividend income for investors. With the stocks of the healthcare colossus and telecom titan currently yielding 2.7% and 4.9%, respectively, that remains the case today.

But which of these dividend dynamos is the better buy? Let's find out.

Image source: Getty Images.

Moat

Verizon's economic moat is built upon advantages of scale. With more than 150 million subscribers, Verizon is the largest U.S. wireless carrier. This subscriber base helps it generate strong, recurring cash flows, which Verizon can then use to reinvest in its wireless network while also rewarding shareholders with a steadily rising dividend.

Yet competitors are chipping away at Verizon's lead. T-Mobile (NASDAQ: TMUS) is gaining subscribers at a rapid clip with its aggressive promotional campaigns. And recent studies now have T-Mobile's wireless network quality pretty much on par with Verizon, thereby eliminating what was once a powerful point of differentiation for the telecom king. As such, Verizon's competitive moat appears to be shrinking.

Like Verizon, Johnson & Johnson's benefits from scale advantages. But unlike Verizon, J&J enjoys diverse revenue streams and a broad geographic footprint. With leading positions in consumer healthcare, medical devices, pharmaceuticals, and biotechnology, J&J is able to profit from a wide variety of global growth opportunities.

Moreover, J&J's massive cash flows and fortress-like balance sheet allow it to acquire smaller competitors, while also investing heavily in its own research and development program. In this way, J&J is continuously strengthening its competitive position.

For these reasons, J&J has the wider moat.

Advantage: Johnson & Johnson

Financial fortitude

Let's now take a look at some key metrics to see how Verizon and Johnson & Johnson stack up regarding financial strength.

Revenue | $126.03 billion | $76.45 billion |

Operating income | $27.41 billion | $18.71 billion |

Operating cash flow | $25.31 billion | $21.06 billion |

Free cash flow | $7.48 billion | $17.78 billion |

Cash & investments | $2.08 billion | $18.30 billion |

Debt | $117.51 billion | $34.59 billion |

Data source: Morningstar, Yahoo! Finance.

Verizon generates more revenue, operating income, and operating cash flow than Johnson & Johnson. But because of the massive capital expenditures required to maintain and improve its wireless network, its free cash flow is less than half that of J&J. Verizon also has more than three times as much debt, but only about one-tenth as much cash. Thus, J&J has the edge in terms of financial fortitude.

Advantage: Johnson & Johnson

Growth

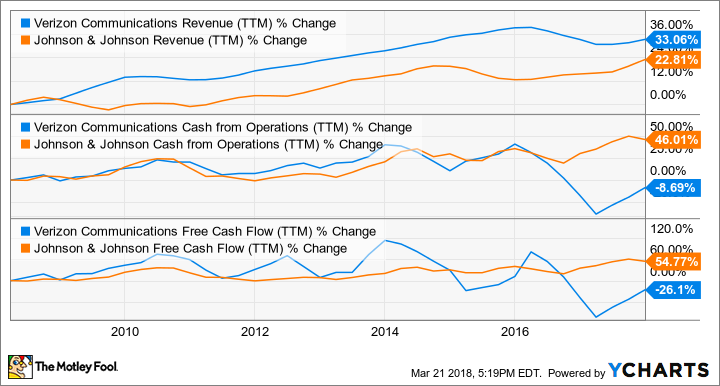

Over the past decade, Verizon's revenue growth has outpaced that of Johnson & Johnson. Yet during this same time, J&J's cash flow production has increased by about 50%, while Verizon's has fallen significantly.

VZ Revenue (TTM) data by YCharts.

Over the next five years, Wall Street expects Johnson & Johnson to grow its earnings per share by nearly 8% annually, fueled by the continued expansion of its pharmaceutical business. Verizon, meanwhile, is projected to increase its EPS by less than 6% annually during this same time, as it fights to fend off competition from T-Mobile. So in terms of expected future profit growth, J&J comes out ahead.

Advantage: Johnson & Johnson

Valuation

No better-buy discussion should take place without a look at valuation. Let's check out some key value metrics for these dividend giants, including price to free-cash-flow, price-to-earnings, and price to earnings-to-growth ratios.

P/FCF | 25.94 | 19.15 |

Forward P/E | 10.09 | 14.85 |

PEG | 1.78 | 2.08 |

Data sources: Yahoo! Finance, Morningstar.

J&J is the better bargain on a trailing price to free-cash-flow basis, while Verizon is the better deal on a forward P/E basis. That's true even if we adjust for J&J's higher expected EPS growth rates, as can be seen by their PEG ratios. We care more about what lies ahead then what's already occurred, so I'll give a slight edge to Verizon here.

Advantage: Verizon

The better buy is...

Although Verizon's stock may be cheaper, Johnson & Johnson's wider competitive moat, greater financial fortitude, and superior growth prospects make it the better long-term investment.

More From The Motley Fool

Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Johnson & Johnson and Verizon Communications. The Motley Fool recommends T-Mobile US. The Motley Fool has a disclosure policy.