'Has not lifted a finger': Education Secretary Betsy DeVos blasted for increasingly rocky tenure

Education Secretary Betsy DeVos has had a rough year — even relative to other remaining members of the Trump administration.

DeVos is facing troubles ranging from being fined $100,000 for contempt of court to dealing with lawsuits stemming from an ineffective Public Service Loan Forgiveness Program (PSLF).

Massachusetts Senator and presidential candidate Elizabeth Warren called DeVos “the worst Secretary of Education” ever. A U.S. Magistrate in San Francisco slammed DeVos over “gross negligence” over the collection of debt payments from students of a defunct for-profit college. And a top student loan official chosen by DeVos recently quit over how “broken” the student loan system has become.

According to experts, the tenure of Secretary DeVos has a poor record so far — particularly when it comes to student loans.

“We've now had years of failed efforts to try and block accountability over student loan companies who have ripped off borrowers at every turn,” former Consumer Financial Protection Bureau (CFPB) Ombudsman and current Executive Director of D.C.-based nonprofit Student Borrower Protection Center Seth Frotman, who resigned from the CFPB in August 2018, told Yahoo Finance. “It's time to quit the political games and allow law enforcement officials at the federal level and the state level to demand justice for student loan borrowers. And the Department of Education, which clearly has no desire to do so, should get out of the way.”

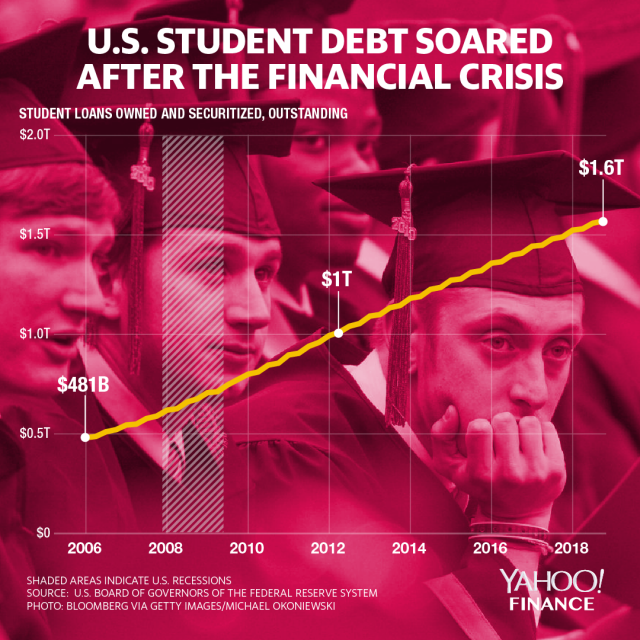

D.C.-based consumer advocacy group Allied Progress Spokesman Jeremy Funk told Yahoo Finance that DeVos “has not lifted a finger to fix the $1.6 trillion student debt crisis. [She has] only helped her friends in the student loan servicer and for-profit college industries make it worse for their own benefit.”

Funk added: “She’s expedited this harmful agenda by hiring a slew of industry lobbyists to run her Department … But don’t expect DeVos to change her behavior because President Trump either doesn’t care or is pleased she is doing the bidding of industries that have pumped millions of dollars into Republican campaigns like his.”

The failed PSLF program

One of the major issues that emerged this year was the ineffectiveness of the PSLF program.

Congress designed the program to reduce the student debt burden for thousands of borrowers who performed a decade of service in government or nonprofit jobs.

But the PSLF program has had a dismal track record with acceptance rates at a mere 1%. When Congress tried to fix it by funding a temporary expansion of the PSLF program, that too had a 1% approval rate, according to the Government Accountability Office.

Frustrated by the lack of progress, one group has decided to sue the DOE.

DOE Press Secretary Angela Morabito told Yahoo Finance that agency was working hard to improve the program, but the design of the program itself was flawed: “When PSLF was written more than a decade ago, the Department made Congress aware that only a tiny fraction of borrowers would qualify. It is important to note that the high denial rates in PSLF are by Congressional design, not by accident or failed implementation by the Department.”

Making life easier for for-profit schools

The other big issue has involved accreditation — a process where colleges, universities, and higher learning institutions get evaluated.

In October, DeVos loosened accreditation standards.

Experts said this opened up the possibility for subpar colleges — particularly for-profits — to secure federal funding for their students.

“Among other measures, this proposal would further open the spigot of taxpayer money going to failed and closing schools, conceal information from the public about the accreditation oversight process, and diminish the value of accreditor standards,” Antoinette Flores, associate director for postsecondary education at D.C.-based think tank Center for American Progress, said in a statement. “The simple question to ask is: Whose interest is Education Secretary Betsy DeVos truly serving?”

In an Oct 31 statement, DeVos maintained that this move was necessary: “[W]e ended the stranglehold that a system designed when people traveled by horse and buggy continued to have on institutions. …. it is time to right size bureaucracy and allow institutions to redirect their resources to students and teaching.”

Revoking Obama-era rules protecting defrauded borrowers

This year also marked the instance when a federal judge fined DeVos $100,000.

After the largest for-profit college, Corinthian, had closed in 2015, the federal government had declared that former students were eligible for loan forgiveness. In 2017, a group of former students said that the DOE stopped discharging those loans and filed a lawsuit.

Yet the agency didn’t stop collecting the loans. More than 3,000 made payments that they didn’t have to make, and 1,800 had their taxes seized or wages garnished.

U.S. Magistrate Judge Sallie Kim in San Francisco chastised DeVos during a hearing in early October, saying: "I am not sending anyone to jail yet, but it’s good to know that I have that ability.” Kim later doled out the $100,000 fine after finding that she had been in contempt of court. (But the DOE has said it has submitted a proposed motion for reconsideration for the fine.)

Meanwhile, the DeVos administration has rolled back Obama-era rules that allowed borrowers who were defrauded by their college to seek loan cancellation, called the “borrower defense.” Currently over 210,000 borrower defense claims are pending.

She also rolled back another Obama-era rule called gainful employment.

Under the 2014 rule, schools would not receive federal funding if their students consistently left with high student debt. Under the regulation, a graduate’s estimated annual loan payment should not exceed 20% of their discretionary income, or 8% of their total earnings.

In June, DeVos rescinded the gainful employment rule — because it “unfairly targeted for-profit colleges” — as of July 1, 2020.

Yet in October, the DOE had given a whopping $10.7 million in loans and grants to students at for-profit schools, even though the schools weren’t yet accredited hence ineligible to receive the aid.

“How do we know Secretary DeVos is a lost cause? Not even a court order was enough to convince her to work on behalf of all student borrowers,” said Funk. “She’d apparently rather be held in contempt of court than doing something as fundamental to the Department’s mission as forgiving debt for defrauded students.”

Consolidating power over student loans

Finally, some experts argue that DeVos has also consolidated oversight over student loans, demanding that only the federal government can hold servicers accountable over federal student loans.

Her office disagrees with that assessment.

“Secretary DeVos has lamented the government takeover of the student loan industry, and we are working within our authority and responsibilities set forth by Congress to oversee the Federal Student Aid portfolio,” DOE’s Morabito told Yahoo Finance.

The states seem to agree with the criticism: Citing federal inaction, many states are taking matters into their own hands — such as by enacting a student loan bill of rights.

DeVos had previously asked states to back off, arguing that companies hired by the DOE should only be under federal oversight.

This year, the DOE went one step further, with the case of the CFPB.

In April, CFPB Director Kathy Kraninger said that she had tried to fix the system by attempting to monitor the servicers to make sure they’re complying with the law.

The DOE had declined to produce the information.

“[I]t’s up to Congress to ensure DeVos’ Department is accountable to student borrowers, not industries that exploit them,” Funk stated. “The more Members of Congress hear that message from their constituents, the more likely we will see legislation that forces DeVos do her job protecting student borrowers.”

—

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

‘Stop the insanity’: Top education official resigns and endorses loan forgiveness

'Horrendous situation': America's teachers are suing the federal government over student loans

'Severely derogatory': U.S. student debt defaults have 'grown stunningly'

Elizabeth Warren: 'Betsy DeVos is the worst Secretary of Education' ever

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.