The Apple Card isn't your typical credit card — Here are its best features

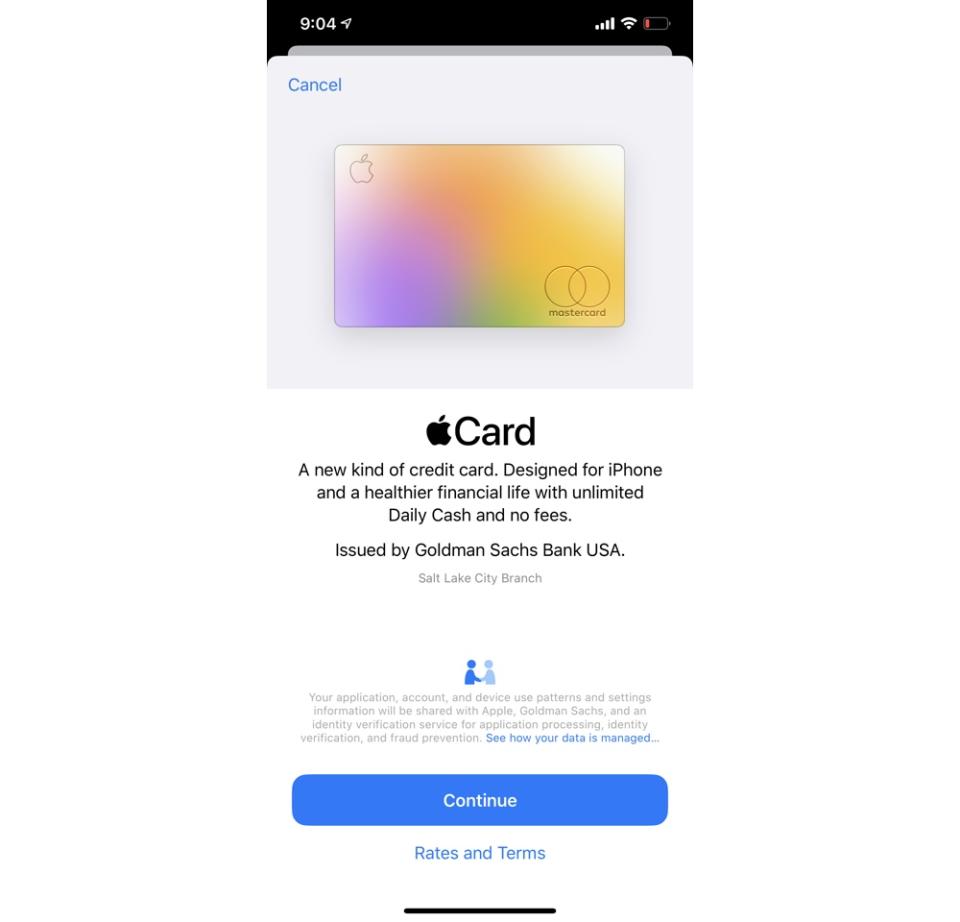

Apple (AAPL) is reinventing itself so it no longer depends solely on the iPhone, and the latest example of this change comes via the tech giant's new Apple Card credit card. Available to select customers starting Tuesday, Aug. 6, and rolling out to consumers nationwide later this month, the Goldman Sachs-backed Apple Card is the company's first foray into the credit card industry.

It's an interesting move on Apple's part, and it's bringing its consumer tech knowledge to bear in crafting the card from sign-up to payment. These are the best features of the Apple Card.

1. Sign up is incredibly easy

Apple has made signing up for the Apple Card as painless as possible. To get a card, you open the Apple Wallet app on your iPhone, tap on the Apple Card sign-up tab, enter your information and you're set. The process takes about a minute, and Apple doesn't collect the information you provide. Instead, Goldman Sachs uses the information to perform a real-time credit check to ensure you qualify for the card.

Once you're approved, you can start using the card for online and contactless purchases instantly. You don't have to wait for a physical card to come in the mail.

2. The card looks, well, pretty cool

Apple Pay is accepted at about 70% of retailers in the U.S., but there are times when you'll inevitably need a physical card. To that end, Apple has crafted a laser-etched titanium card that looks as sleek as anything the company has ever made.

Though the card is made of metal, it's incredibly lightweight. Apple says it purposely decided against using steel like other credit cards, because doing so would make the company's card heavier.

There are no numbers on the front or back of the card, either. In fact, outside of your name and some branding, the card is completely blank. Apple says this serves as a security feature to help prevent duplication of your card number.

Apple stores the card's number and security digits in the Apple Card section of your Apple Wallet app, which you can use to make purchases online at sites that don't support Apple Pay.

3. Security is a priority

Apple says it’s taking a privacy-focused approach to its card that should help protect users from hacks and stolen cards. The digital card itself is given a unique number that is created and stored on your iPhone in what Apple calls its Secure Element.

Each purchase you make then gets a dynamic code created by your phone when you authorize your transaction. You authorize your transaction using either Face ID or Touch ID, which ensures that you're the person making the purchase.

Had your card stolen? You can report it missing via the Apple Card tab in the Apple Wallet app, and get a new one sent to your right away. What's more, you can request a new virtual Apple Card number in the app and get it immediately.

As far as your private information, Apple says that Goldman Sachs has agreed to keep user data private, which means the bank won't provide your information to any third parties for advertising.

4. You can see where you made your purchases

We all put charges on our cards at bars, restaurants, bars...more bars, and then forget that we even made the purchases when the time comes to pay our monthly bill. Running through your list of transactions can be confusing thanks to the opaque way in which many card makers provide you with your charge details.

To make it easier, Apple Card pinpoints your transactions to the location in which you made your purchase using Apple Maps. To view this, open the transactions tab, then tap on the transaction to see where you were charged. Apple, however, never sees where you spent money. In fact, the company doesn’t get any of your transaction information.

Charges are broken down into different categories and assigned specific colors so you can better see where you're spending most often, and cut down where you want.

5. It helps you visualize your interest and payments

The Apple Card app provides you with a large wheel at the top of the screen that serves as a visual representation of your monthly bill. At the center of the wheel is your full balance, and around it is a slider that you can adjust to set your payment amount.

Setting your payment amount also provides you with the interest fees you'll incur if you don't pay off your entire balance. Along the wheels are what Apple refers to as nudges that help give you a visual identifier to push you to pay slightly more toward your balance each month.

6. Cash back is available the next day

The Apple Card offers 3% cash back on purchases through the Apple Store or App Store, 2% cash back when using Apple Pay either online or through contactless payments, and 1% cash back when using the physical Apple Card.

Apple says that your cash back will be available the day after you make a purchase, and can be loaded onto your Apple Cash card within Apple Wallet to use as regular cash. You can also have the amount moved over to a bank account, or send it to friends via Apple Messages.

The company also shows you how much cash back you get with each purchase you make by listing the percentage you earn through every transaction.

More from Dan:

There’s no evidence to back up Trump’s claim that video games cause mass shootings

Trump’s China tariffs couldn’t come at a worse time for Apple

What is Project JEDI? The $10 billion program Trump is holding up

Email Daniel Howley at dhowley@yahoofinance.com; follow him on Twitter at @DanielHowley.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.