Here's How to Find the Best Dividend Stocks

Dividends are a tangible return on your capital. They can help provide income for your daily needs or they can be reinvested and allowed to compound over time. They can also help steer your investment process -- if you use them the right way. Here's a three-step process that will help you find the best dividend stocks for your portfolio. And it doesn't matter if you are into growth or income; this dividend approach can work for everyone.

1. Limit your list

There are a lot of companies that pay dividends. However, there's a select group that increase their dividends every year -- those are the types of stocks on which you'll want to focus. Regular dividend increases are proof of management's commitment to returning value to shareholders over time. It shows the business is strong and that the people running the show have a positive outlook for the future. And it helps to quickly cut your list of options down to a manageable number.

Image source: Getty Images.

How do you find all of these longtime dividend-paying companies? Luckily, the DRIP Investing Resource Center provides a free spreadsheet that has all of the stocks that have increased their dividends so you don't have to do the legwork. There are three lists: companies that have increased dividends for 25 or more years, those that have between 10 and 24 years under the belt, and one with stocks that have between five and nine years of hikes.

Although you can limit yourself up front to a particular list, you might want to just go with the "fourth" list, and include all the companies. You can always go back and pick the names with longer dividend histories later.

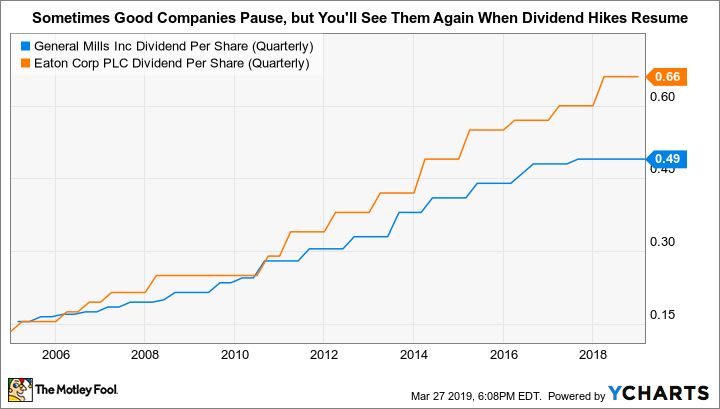

GIS Dividend Per Share (Quarterly) data by YCharts

The one caveat here is that you may miss great companies that have paused their dividend streaks for some reason. For example, General Mills (NYSE: GIS) recently made a big acquisition and is focused on paying down debt. It is holding its dividend steady while it does that. It has a long history of steadily increasing dividends over time, but sometimes pauses like this. Eaton is another company that fell into this category a few years ago, but it has once again made its way onto these lists after it resumed annual dividend hikes. In the end, don't worry too much about this, but know it's an issue.

2. Income or income growth?

This is a big step and one that you need to think about very carefully. If you are looking to maximize income, then sort the spreadsheet using dividend yield. If you want to focus on growth, then sort by annualized dividend growth rate (there's data on the trailing one-, three-, five-, and 10-year periods). Pick one of these approaches and, very quickly, you've taken the list and highlighted what's most important to you.

Note that picking one approach doesn't mean you have to ignore the other. You are simply pulling to the fore the names that will be most interesting to you. That's the first step. Once you've done that, you can look through the list and consider other factors. For example, you can find a stock with a high dividend growth rate, low debt (another data point in the sheet), and a relatively high yield. Or you can find a stock with a high yield, a dividend growth rate that beats inflation, and a history of annual increases that spans at least two decades. All that you have to do is sort the list and look at the statistics that resonate with you.

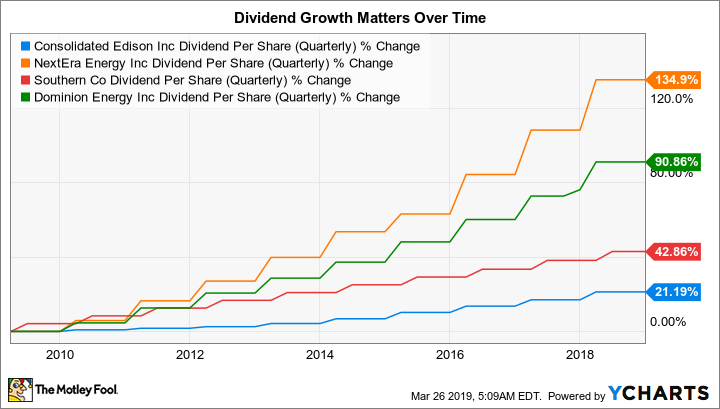

ED Dividend Per Share (Quarterly) data by YCharts.

One warning here for income-focused investors: Don't ignore dividend growth. You'll want to see annual dividend increases of at least 3% or so over time to ensure that you maintain the buying power of your dividends. Anything less than that and you could wind up short of spending money as inflation goes up but your dividends don't keep pace.

3. Valuation is important

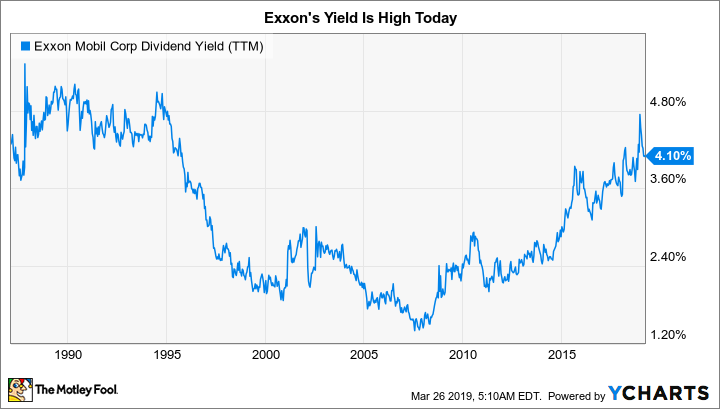

At this point, you should have a solid list of stocks that interest you. The next step is to take that list and only focus on the stocks that are presenting the best investment opportunities. To do this, you'll need to use a graphing tool to examine a company's dividend yield history. Focus on companies where the current dividend yield is toward the high end of the company's historical dividend yield range. It's a valuation shortcut that helps you focus on only those stocks that appear to be relatively cheap. It isn't a perfect method, but it will steer you in the right direction as you dig in to really do your homework. Most important, it will lead you away from overpaying, since even a great company can be a bad investment if you pay too much.

XOM Dividend Yield (TTM) data by YCharts.

A good current example of a stock with a relatively high yield is ExxonMobil (NYSE: XOM). The stock has increased its dividend for over 30 years, passing screen one above. The dividend growth rate over time has handily bested inflation, passing screen two. It also has low debt levels on both an absolute basis and relative to peers, for those with a safety-first mind-set. All of those facts can be gleaned from the dividend spreadsheet. And the yield today is toward the high end of its historical range, as shown in the graph above. Now there are reasons for this, but at this point, you are just looking to shorten the list to potential options.

Once you have those options lined up, you can do the digging to figure out the story behind each company. That will allow you to make an educated assessment about each stock and whether or not it belongs in your portfolio. This is the meat of the work, but can only happen once you cull the list down to a manageable size using the three simple steps above.

Go to work!

Now that you have this simple three-step process for finding good dividend stocks, you can go to work creating your own dividend portfolio. Remember, these simple rules are just the starting point. But they move you quickly to the real work, which is digging into each company and figuring out whether it is a good fit for you. Don't expect to find investment opportunities every time you look. But if you stick with these rules, over time, you can build a great dividend portfolio.

More From The Motley Fool

Reuben Gregg Brewer owns shares of ETN, ExxonMobil, and General Mills. The Motley Fool owns shares of ExxonMobil. The Motley Fool has a disclosure policy.