Annuity rates on the rise but experts urge caution

Annuities are on the verge of a comeback as rates have risen from all-time lows but some experts still question whether they offer value for money.

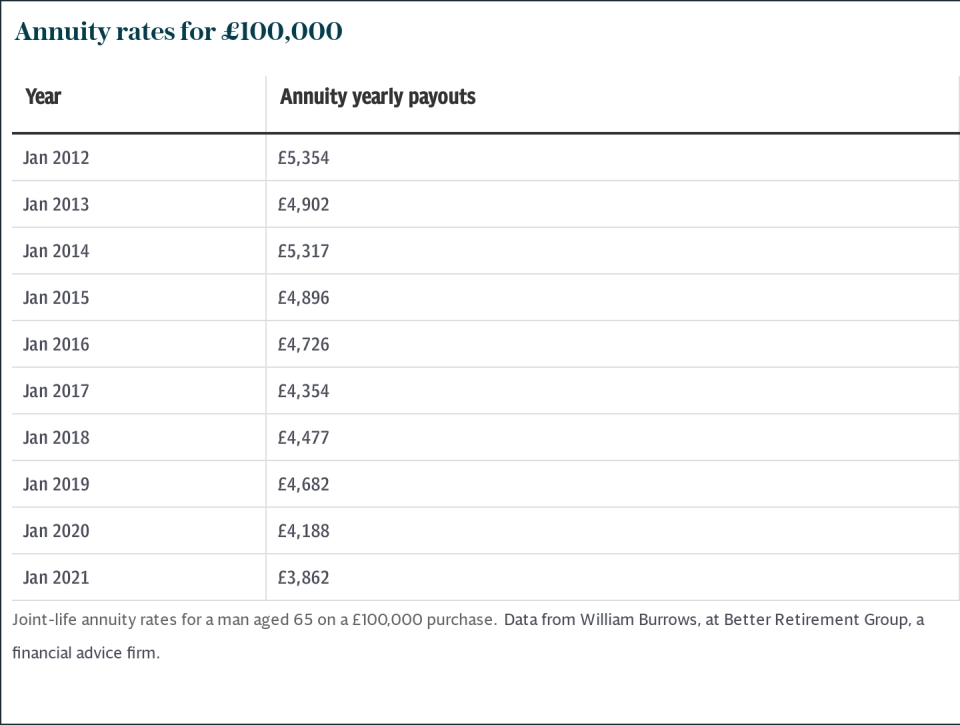

Rates have dropped by 6pc in each of the past two years but are on track to climb, according to analysis from Better Retirement Group, a financial advice firm.

The income paid on annuities depends largely on interest rates and the yield on British government bonds. Both have dropped in recent years forcing annuity rates down to a point most buyers were unlikely to get their initial investment back.

However, the yield on 15-year government bonds, known as gilts, has risen to 1.01pc, breaching an important milestone. Generally speaking, annuity rates increase by 10pc for every percentage point rise in gilt yields.

Billy Burrows, of Better Retirement Group, said this marked a turning point as it allowed providers to increase their rates. The rise in gilt yields has triggered a 4pc increase in payouts. Savers can now get £3,972 per year for every £100,000 used to buy an annuity.

He said: “The increase from February to March has translated into about another £200 per year.”

Rates fell to their lowest point in August 2020 when yearly payouts sat at £3,842 for a 65-year-old purchasing an annuity for £100,000. That represented nearly £2,000 less than a decade earlier.

Mr Burrows said annuity buyers would get their money’s worth when yields reached 2.5pc, which would pay out about £4,900 per year for a £100,000 lump sum at age 65.

David Stevens of LV, an annuity provider, warned that timing the market and delaying buying an annuity in the hope that rates rise can be risky. He said: “You might benefit from a higher rate because you are older, but it also means you forgo any income that the annuity would have generated.”

One option for those who are unsure whether now is the right time to lock in is to buy a fixed-term annuity, which can provide income for a chosen period, a guaranteed lump sum at the end or a combination of both. Mr Stevens said that rates on these types of annuities tend to be better than those paid on standard cash accounts.

Another option for those concerned about an imminent change in rates is to combine an annuity with drawdown. This gives the security of some guaranteed income while keeping options open. It means that if annuity rates rise in future a saver could buy another policy offering a better deal.