Analyzing Citigroup's Prospects

Much has been made of Warren Buffett (Trades, Portfolio)'s first-quarter investment in Citigroup Inc. (NYSE:C), and investors are probably wondering whether the stock is a lucrative opportunity given his interest. The answer is not straightforward. First of all, it depends on how it spans with the rest of your portfolio and your investment horizon. Additionally, we are in a market that does not provide clarity on whether cyclical stocks will under or outperform.

Nonetheless, I discovered a few helpful pointers. Let's get into it.

Operating results

Citigroup's latest operating results have improved after a period of restructuring that saw the company garner high costs.

The company beat its first-quarter earnings target by 56 cents per share amid rising services activity. During its first quarter, Citigroup accumulated gains from its security services and trade loans segments as they grew by 18% and 6%.

Although the bank's previous financial results showed promise, I see the company struggling for the rest of 2022. I suspect that Citigroup's non-interest-bearing activities have slowed considerably amid a stock market downturn. Additionally, interest rates have not risen as rapidly as initially anticipated. Thus, wages have remained resilient and the debt market has not recovered as well as forecasted.

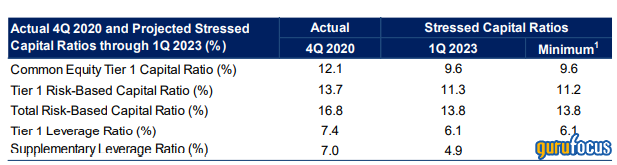

Stress test

Stress tests are carried out annually in the United States. Citigroup is due for another stress test this year, and it is projected that the bank's ratios will remain borderline the minimum requirements.

Source: Citigroup

The stress test ratios are metrics that weigh a bank's equity and debt assets relative to risk. They are essential to look at as they determine solvency and liquidity risk, which are areas of interest for most investors that have exposure to banking stocks.

Valuation and dividends

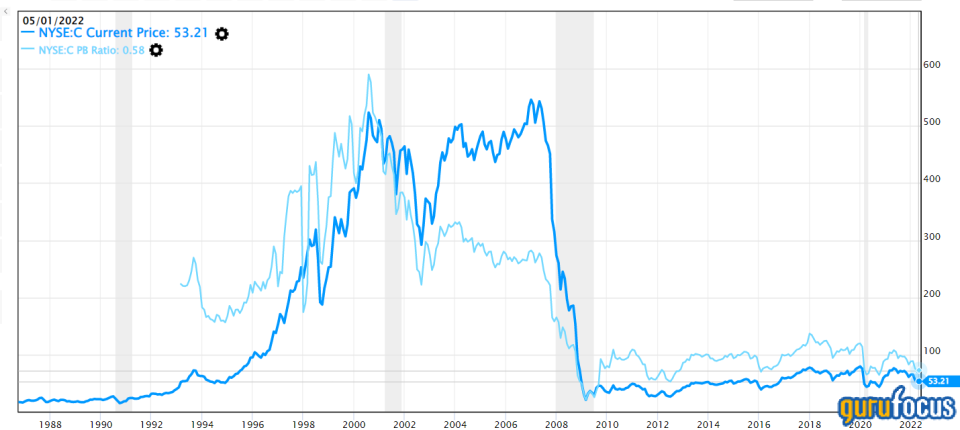

The best way to value a banking stock is by analyzing its price-book value. The reason for this is that banks make a living out of trading assets that are, in most cases, marked and liquid.

Citigroup's price-book value of 0.54 suggests its stock is severely undervalued. A price-book value of between 1 and 3 is usually considered acceptable for a stock; however, an asset needs to ideally have a book value of lower than 1 to be fully undervalued.

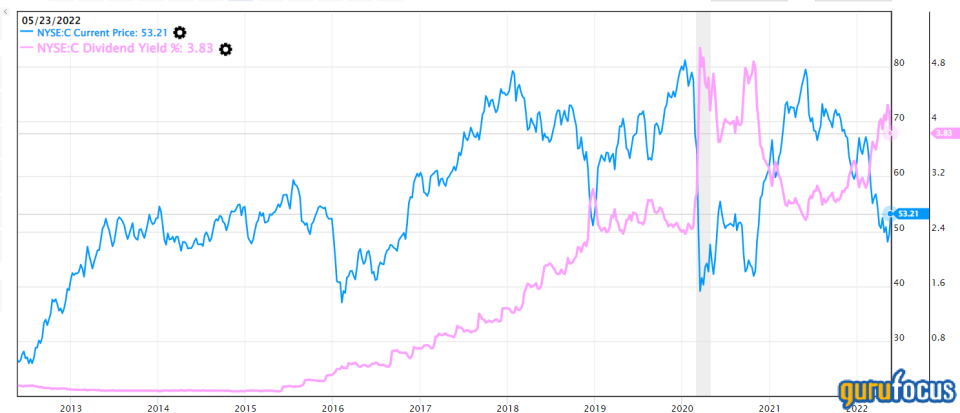

Lastly, Citigroup distributes a dividend with a yield of 3.83%. This could be lucrative to some investors; however, the stock's price has an inverse relationship with its dividend yield, suggesting that the post-distribution erosion of residual value has a bearing on the market price.

Pricing

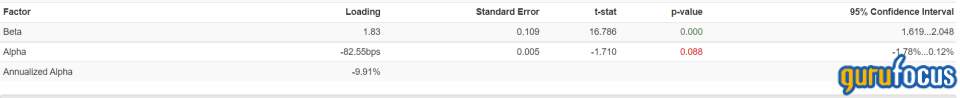

The capital asset pricing model implies that Citigroup generally underperforms the market in the long run. Readers should note the regression is ex-post. Thus, any results are only part of the analysis rather than a predictive metric.

Nonetheless, the one-factor market model has proven predictive ability, and cyclicality and high-dividend payments will likely cause Citigroup's stock to underperform the market in the long run.

Source: Portfolio Visualizer.

The bottom line

Citigroup's stock is undervalued and pays a lucrative dividend. However, investors should be careful as it tends to underperform the market due to cyclical behavior and the inverse relationship between its investor dividend payouts and market value. Lastly, Citigroup's forecasted stress test does not convey much confidence, which is something investors should keep an eye on.

This article first appeared on GuruFocus.