The American shopper wants fewer options

Purchase paralysis and genius of Costco

Barry Schwartz’s 2004 bestseller “The Paradox of Choice” taught a generation of readers that less was actually more.

And the American retail business continues to find new ways to learn this lesson.

In a recent interview with the Wall Street Journal, Bed Bath & Beyond’s (BBBY) new CEO Mark Tritton offered a fascinating anecdote on, of all things, can openers. (Economists will get the reference.)

“The former Target Corp. executive has spent the first 100 days on the job thinking about how many different types of can openers the retailer should stock. After the chain cut the number of options from more than a dozen to about three, sales rose,” the WSJ reported.

“The big takeaway: Selling too many items in stores that are overcrowded leads to ‘purchase paralysis,’“ Mr. Tritton said.

Get Yahoo Finance’s Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

In retail, avoiding what Tritton calls “purchase paralysis” revolves around managing one key metric: the stock-keeping unit, or SKU. In Tritton’s example above, Bed Bath & Beyond went from “more than a dozen” can-opener SKUs to “about three” SKUs.

Tritton’s discovery is far from novel, and companies are increasingly talking up their embrace of this practice. According to research published by Credit Suisse last week, consumer goods companies have discussed SKU rationalization on earnings calls 144, 135 and 127 times in 2017, 2018 and 2019, respectively. This compares to 56, 37 and 63 times in 2011, 2012 and 2013.

For many retail experts, no category employs this strategy better than warehouse clubs. And in this category, no company has been more aggressive and has executed this better than Costco (COST). And Costco’s SKU rationalization is not a particularly new or novel approach for the retailer.

“Customers think they want more variety, but too many choices actually makes shopping more difficult,” a Kantar Retail analyst said to RetailWire in a 2012 article titled “Costco Makes SKU Rationalization a Fine Art.”

Costco takes pride in its limited options. And the company explains it by essentially saying that they are taking care of all the product scrutinizing. “Costco warehouses carry about 4,000 SKUs (stock keeping units) compared to the 30,000 found at most supermarkets,” the company boasts on its website. “By carefully choosing products based on quality, price, brand, and features, the company can offer the best value to members.”

Get Yahoo Finance’s Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

By comparison, competitors Sam’s Club and BJ’s Wholesale Club carry around 5,000 SKUs and 7,200 SKUs, respectively.

“Deep customer pockets coupled with unwavering execution on limited SKU merchandising have yielded some of the most impressive store productivity metrics we have seen,” Credit Suisse said of Costco.

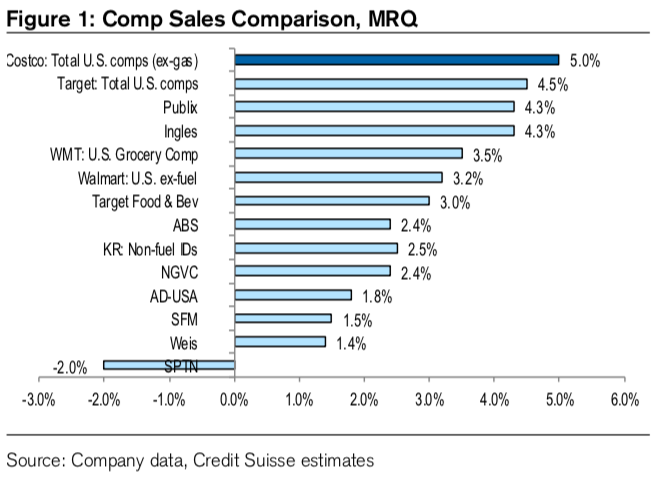

As you can see in the chart below, Costco is leading the way in comparable store sales growth among the big box retailers.

This thinking, of course, doesn’t apply to all categories. According to data provided to Yahoo Finance, SKUs for things like alcoholic beverages and skincare products are very much on the rise.

But overall, the trend seems to favor fewer choices.

“It’s no secret that the warehouse club model thrives on a limited SKU offering; a consumer trend we see increasing in popularity,” Credit Suisse said.

Sam Ro is Yahoo Finance’s managing editor. Follow him at @SamRo

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.