2 Names to Consider With Upcoming Ex-Dividend Dates

Investors interested in capturing a stocks next dividend should always be mindful of the upcoming ex-dividend date.

Other items to keep in mind is can the underlying companys business model support future dividend growth?

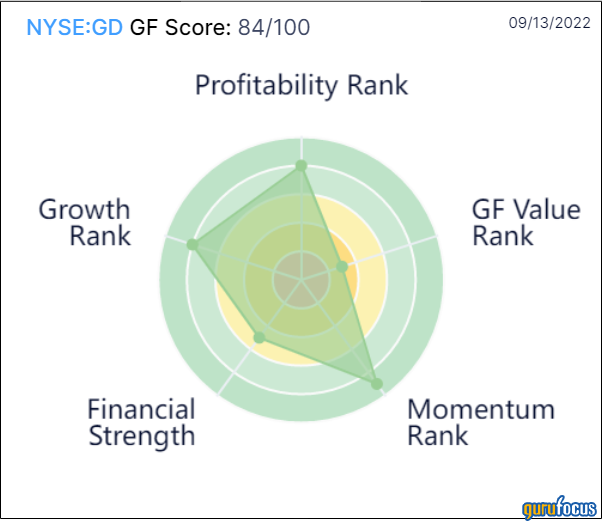

Finally, investors should not simply pick an investment because of the yield. Quality should always be a major factor in any decision-making. The GF Score, which takes into account growth, profitability, financial strength, value and momentum, is one way to compare stocks.

Warning! GuruFocus has detected 7 Warning Signs with CL. Click here to check it out.

NYSE:CL), a leading consumer staples company that can trace its roots back to the early 1800s. The $65 billion company generated revenue of $17.4 billion in 2021.

Colgate-Palmolive is blessed with a strong lineup of products that cover some of the most important consumer staple markets, including oral care, home care, personal care and pet care. The companys key brands include cleaners like Ajax and Palmolive, soaps such as Irish Spring, Mennen shave cream, Colgate toothpaste and Science Diet and Prescription Diet pet foods.

The company operates in nearly every country on the planet, giving it a reach that only the largest consumer staple companies can match. With the strength of its product lineup and its massive scale, Colgate-Palmolive has a leading position in many key markets. Pet food has also been a key tailwind for results as consumers continue to look for the best products.

These competitive advantages have allowed Colgate-Palmolive to raise its dividend for 60 consecutive years. The last decade has seen the dividend have a compound annual growth rate of 4.4%. Shares have a dividend yield of 2.4%, which is above the average yield of 1.6% for the S&P 500 and looks safe based on a projected payout ratio of 63% for 2022. Investors wishing to capture the next dividend payment from this Dividend King will need to purchase shares prior to the ex-dividend date of Oct. 20.

Colgate-Palmolive has a solid GF Score of 82 out of 100. This score is driven by a momentum rank of 9 out of 10, where the company has better scores than the majority of peers on all metrics, including relative strength indexs for the past 5, 9 and 14 days. Profitability rank is an 8 out of 10. Here, gross margin and operating margin scores are above 90% of the industry group. Colgate-Palmolive has also produced 10 years of profitability for the last decade, topping 99.94% of the competition.

On the other hand, Colgate-Palmolive receives just a 5 out of 10 on both financial strength and growth rank. The debt-to-equity and equity-to-asset ratios are below 99.7% and 94.6%, respectively, of the peer group. Interest coverage is above the majority of peers, while the companys return on invested capital of 24.9% is well ahead of its weighted average cost of capital of 4.8%.

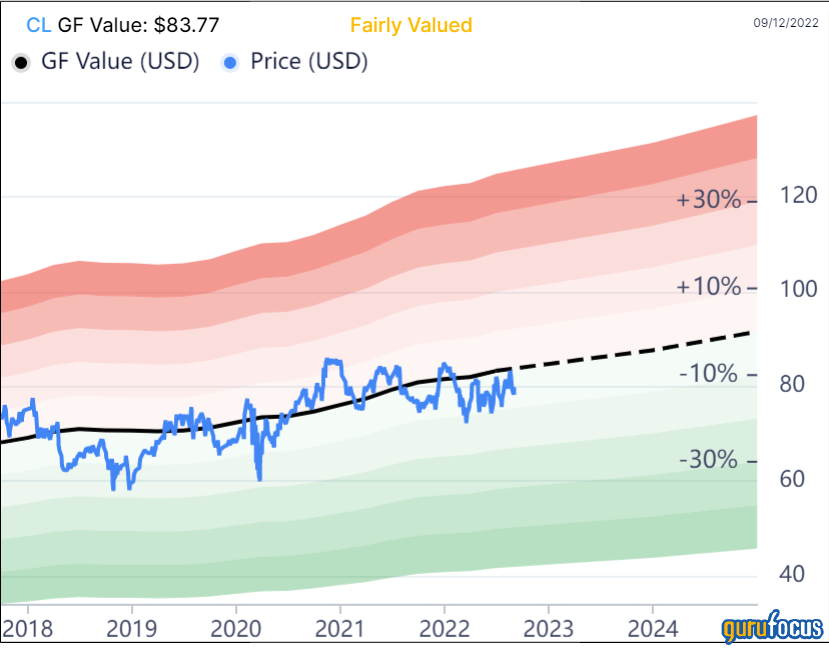

2 Names to Consider With Upcoming Ex-Dividend Dates Based on the recent price, Colgate-Palmolive is trading below its GF Value and has a price-to-GF Value ratio of 0.93.

2 Names to Consider With Upcoming Ex-Dividend Dates General Dynamics

The second name to consider is General Dynamics Corp. (NYSE:GD), one of the largest aerospace and defense contractors in the world. The company has a market capitalization of nearly $66 billion and generated revenue of $38.5 billion last year.

General Dynamics is comprised of four business segments, including Technologies, Marine Systems, Aerospace and Combat systems. The company is fairly diverse in that no business accounts for more than a third of sales. The U.S. government is responsible for slightly more than two-thirds of annual revenue, but this is not as high of a percentage as many of General Dynamics peers.

The company also has diversity in the products that it produces. For example, General Dynamics portfolio includes the Columbia- and Virginia-class submarines, the M1 Abrams tank and the Stryker vehicle, amongst others. The companys aerospace segment manufactures the Gulfstream line of business jets, providing it a market outside of its defense business.

Many of the companys products, especially the submarines, take multiple years to complete, often guaranteeing that they will be funded. General Dynamics had nearly $88 billion in its backlog as of the end of the most recent quarter. Of this, $68 billion is already funded, giving the company almost two years of guaranteed work based on last years revenue total.

General Dynamics business model has been successful for a long period of time, allowing the company to grow its dividend for 31 consecutive years. As a result, General Dynamics is a Dividend Aristocrat. The dividend has a CAGR of close to 10% since 2012. The projected payout ratio is 41% for this year, so shareholders can likely rest easy that the company will continue to grow its dividend. Shares yield 2.2% and the next ex-dividend date is Oct. 6.

The company has a GF Score of 84 out of 100.

2 Names to Consider With Upcoming Ex-Dividend Dates The profitability and growth ranks are both an 8 out of 10. The company has shown the ability to achieve a strong rate of return on assets and equity, with both recent results topping more than 80% of the companys industry group. General Dynamics has been profitable in nine out of the last 10 years, which is better than three-quarters of peers.

On growth, General Dynamics has performed near the middle of the pack on both revenue and earnings growth over the last three years. Free cash flow is a similar story, but the recent results have been near the higher end of the companys long-term performance. Future growth on the top and bottom lines is below 60% of peers. Three-year book growth has been solid, however, and above the majority of the competition.

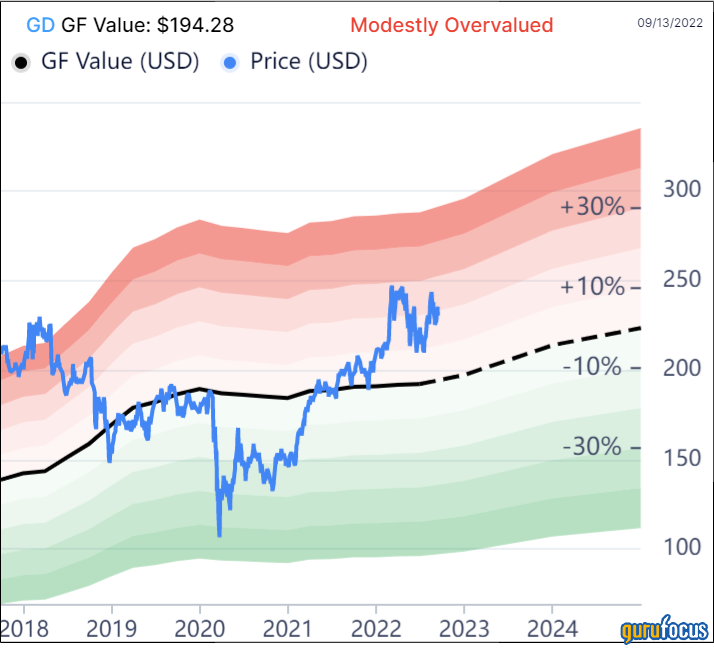

Shares of General Dynamics are not cheap as they currently trade with a price-to-GF Value ratio of 1.19. Investors interested in the name may wish for a lower entry point.

2 Names to Consider With Upcoming Ex-Dividend Dates Final thoughts

Both Colgate-Palmolive and General Dynamics have dividend growth streaks numbering in the decades, meaning each company has perserved through multiple recessions and still increasd their payouts. This was accomplished because of their business models. Each stock offers a market-beating dividend yield, but only Colgate-Palmolive is trading below its instrinic value. Investors interested in either company for income should considering purchasing the stock prior to the next ex-dividend date.

This article first appeared on GuruFocus.