YouTube TV Is Thriving in the Cable Replacement Space as a ‘One-Stop Shop’ for Consumers

As many entertainment industry experts declare the streaming wars over, one challenger is giving streaming king Netflix a run for its money in total viewers: YouTube.

The Alphabet-owned video platform has beaten out all the major streamers for the highest share of TV viewing over the past 12 months, according to Nielsen. Its YouTube TV subscription service is also gaining ground on the major cable giants in the U.S. as cord-cutting continues to weigh heavily on the traditional carriers.

As the networks bleed video customers, YouTube TV reported 8 million subscribers in 2023, nearly double its closest vMVPD (virtual Multichannel Video Programming Distributor) competitor, Hulu + Live TV, which most-recently reported 4.6 million subscribers.

With a quarter of pay TV subscriptions now coming from digital services — a shift that is altering the cable landscape — YouTube TV is positioned as a trailblazer.

“We believe this is the start of the new arms race on streaming, with YouTube in a position to gain more market share on cord-cutting customers,” Daniel Ives, managing director and senior equity research analyst for Wedbush Securities, told TheWrap.

YouTube disrupted the television industry by prioritizing overall viewership above all else — embracing both creator content from its main video platform and its live TV vertical, while also investing in live sports.

Rather than fighting over the same channels as its traditional and digital pay TV competitors, YouTube is melding the creator-generated content it’s known for with a cable alternative. And YouTube has already won over the coveted Millennial and Gen Z viewers other cable offerings are struggling to entice — and found a way to bring cable TV to them.

“Getting a scaled platform like YouTube in your ecosystem really allows you to integrate creators,” YouTube Global Head of Media and Sports Partnerships Lori Conkling told TheWrap.

The platform has become a “one-stop shop” for consumers: In addition to a channel business, YouTube offers pay-per-view, TVOD (transactional video on demand), AVOD (advertising-based video on demand) and pay TV. “You don’t need to leave YouTube,” Conkling said. “If you come here, we want to over-deliver for you.”

But as with other tech company video platforms, YouTube TV, which is part of the larger YouTube ecosystem owned by Alphabet, is not being altogether transparent about its performance. The pay TV division doesn’t have to report growth statistics as often as most of its competitors. So while the platform leads the vMVPD pack for now, Wall Street isn’t holding it to any specific growth targets.

The YouTube empire

When YouTube first launched in 2005, its aim was to give creators a platform to make their own content. Over the years, that service has grown across multiple verticals including movies and TV, sports and music.

The expansion started in 2014 with the launch of YouTube Premium (formerly YouTube Red), which offered an ad-free option for YouTube as well as the ability to play videos offline and access original content. The YouTube Originals program that produced the popular series “Cobra Kai” never quite took off and was shuttered in 2022, with “Cobra Kai” moving to Netflix. (It shut down after the departure of global head of originals Susanne Daniels and as the company opted to use the investment on other initiatives more relevant to the YouTube creator ecosystem.)

The curated YouTube Kids followed in 2015, with YouTube Music and the video-on-demand service YouTube Movies & TV launching in 2018. Those were followed by a specialized app for emerging markets (YouTube Go), a TikTok competitor (YouTube Shorts) and a short-lived Instagram Stories competitor (YouTube Stories).

Then in 2017 the company launched YouTube TV. A cable replacement of sorts, the platform offered subscribers access to the big five networks — ABC, NBC, CBS, Fox and the CW — and select cable networks like Food Network, HGTV and Disney Channel.

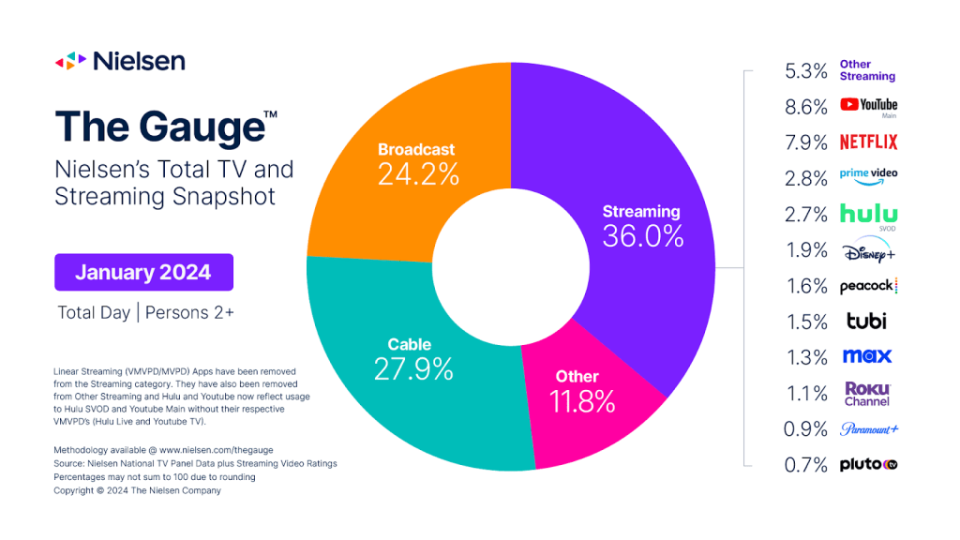

All of these investments have created a media powerhouse. In January, YouTube’s share of TV viewing stood at 8.6%, according to Nielsen’s The Gauge, with Netflix coming in second at 7.9% for the month. The rest of the pack (Prime Video, Hulu, Disney+, Peacock, Tubi, Max, Roku Channel, Paramount+ and Pluto TV) each held a less than 3% share.

YouTube is thriving with Gen Z. A Piper Sandler survey of over 9,000 Gen Z teens released in the fall found that the age group spends 29.1% of daily video consumption on YouTube, compared to Netflix’s 28.7% and Hulu’s 7.7%.

Netflix co-founder Reed Hastings has acknowledged the threat YouTube posed to viewership.“Our largest competitor for TV viewing time is linear TV,” he said in 2021. “Our second largest is YouTube, which is considerably larger than Netflix in viewing time.”

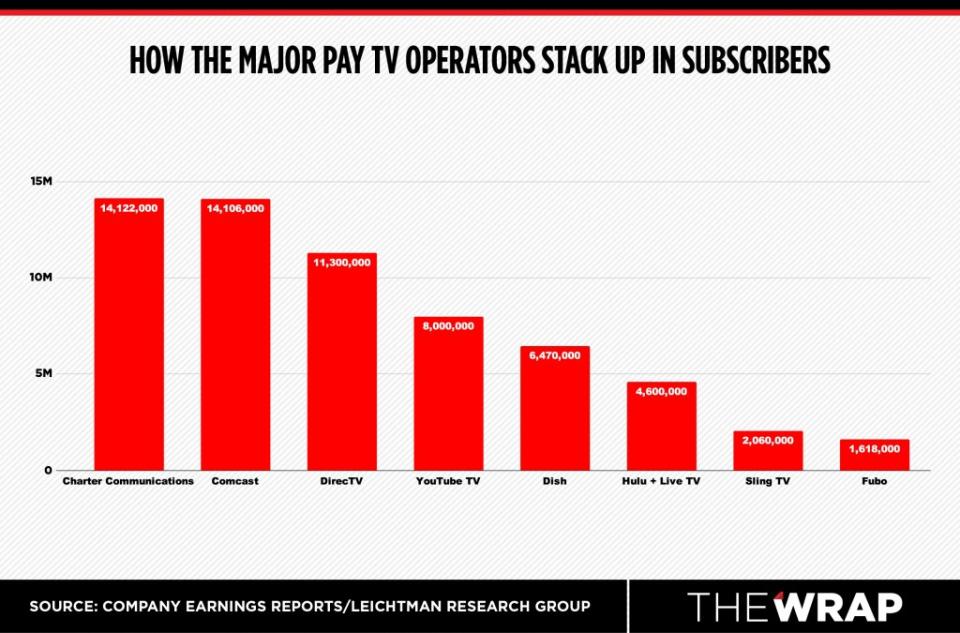

And thanks to YouTube TV, the company’s dominance in the attention economy has a direct link to TV. The service has cemented its position as the fourth-largest pay TV operator in the U.S. with 8 million subscribers, up from its last disclosure of 5 million in July 2022.

While Hulu + Live TV ended the first quarter of 2024 with 4.6 million subscribers, other vMVPD offerings fell even further behind YouTube TV, with Sling TV reporting 2.06 million subscribers and Fubo reporting 1.62 million subscribers in North America for their fourth quarters of 2023.

But YouTube TV’s true competitors are the cable giants themselves. Currently, the offering has more subscribers than Dish TV’s 6.47 million subscribers. Spectrum owner Charter Communications is the pay TV leader with 14.12 million video customers, followed by Comcast with 14.11 million subscribers.

DirecTV does not publicly disclose its figures. However, Leichtman Research estimated it ended 2023 with about 11.3 million subscribers, down from an estimated 11.85 million for the third quarter of 2023.

Charter, Comcast, Dish and DirecTV shed 5.81 million subscribers in 2023, while YouTube TV added 1.9 million subscribers. Hulu + Live TV gained 100,000, Sling lost 297,000 and Fubo added 173,000 during the year, according to Leichtman Research Group founder Bruce Leichtman.

The pay TV ecosystem is declining largely because many of the companies are “not aggressively pursuing new customers,” Leichtman told TheWrap. As a result, YouTube TV has become the default video service for many rural cable companies that have “essentially completely given up on video,” he said.

“It’s not necessarily because [YouTube is] doing it better. While everybody is taking a step back, they’re taking a step forward,” Leichtman said. “They don’t care about the low margin on the business.”

Charter and Comcast have pivoted their efforts to a joint streaming venture called Xumo, which has launched more than 1 million of its boxes nationwide since launching in October. Comcast and DirecTV have also launched live TV streaming services Now TV and DirecTV Stream, respectively, while Charter’s recent carriage agreement with Disney has allowed it to bundle Disney+ and ESPN+ with its Select TV video packages.

YouTube TV’s flexible model involves allowing customers to sign up for one of its plans while also offering the option to add on select channels. Add ons can be priced as low as $1.99 a month.

YouTube TV’s lofty bet on sports pays off

One thing customers clearly want is live sports. Conkling credited YouTube TV’s partnership with the NFL as a key driver of its recent subscriber growth, though she declined to reveal how many people signed up for the Sunday Ticket. YouTube’s Sunday Ticket deal, which kicked off in the 2023 season, is valued at around $2 billion per year for seven years.

“Sunday Ticket was a driver to get people to subscribe to YouTube TV,” she said. “Now we’re seeing that they’re staying, which to us reinforces the value of the product itself.”

YouTube leveraged its ecosystem to deliver a younger and more diverse audience to the NFL and other sports leagues. For the NFL Draft, the company made partnership deals with YouTube creators to make videos about a variety of topics, including tailgating recipes. Those recipes brought in younger, female viewers interested in cooking, thereby expanding the overall audience for both the NFL and the creators. YouTube also launched an NFL Creator of the Week program, which gave creators unprecedented access to NFL events and introduced their audiences to the football league.

“Other leagues saw what we were doing with the NFL and proactively came to us and said, ‘I’d like to do that too,’ ” Conkling added.

The next frontier: The living room

As YouTube looks to build on the momentum, the platform is eyeing a territory long-dominated by both the cable giants and streamers: the living room. Global viewers collectively watch an average of more than 1 billion hours of YouTube content on their TVs every day.

“What we’re finding is as people watch content in the living room on their television, they’re watching on all our platforms,” Conkling said. “But they’re doing it in a way that really seamlessly creates an experience where they might watch creator generated content, followed by a movie, followed by clips and highlights from a sports game.”

Conkling stopped short of calling Netflix, Disney+ and other streamers “competitors,” noting that YouTube is constantly in conversation with direct-to-consumer services about how distribution through its Primetime Channels business can be mutually beneficial.

The company sees streamers as partners. Netflix and Paramount+ are among those that use the YouTube video ecosystem to share trailers, clips and behind-the-scenes interviews from their originals.

Networks and streamers routinely upload full episodes or even movies on YouTube for free to promote their originals. PBS uploads documentaries from its “Independent Lens” brands, and in February Netflix put its Oscar-nominated movie “Nimona” on the platform for a limited time (although this was really a thinly veiled campaign move).

An advertising boon and transparency issue

There is an asterisk over YouTube’s recent success. By not reporting subscriber numbers on a quarterly basis, YouTube can choose to focus on total time spent watching across its platforms — a metric that helps boost its overall advertising business — rather than on meeting subscriber growth targets for Wall Street.

YouTube “can throw a number out there every two and a half years, and we can get excited about it,” Leichtman told TheWrap. “But by doing that, they can operate in a completely different fashion than any public company can.”

During Alphabet’s fourth quarter earnings call in January, CEO Sundar Pichai touted its subscriptions as a $15 billion business on an annual basis, calling YouTube a “key driver” of the segment’s revenues.

Google Subscriptions, Platforms and Devices revenue increased 19% year over year to $34.69 billion, accounting for 12.7% of the total $272.54 billion in Google Services revenue for 2023, the company recently reported. The segment includes fees from YouTube Music, Premium and YouTube TV subscriptions and NFL Sunday Ticket, as well as revenue from Google Play app sales and in-app purchases and sales of Pixel devices.

YouTube ad sales climbed 7% year-over-year to $31.5 billion in 2023, accounting for 13% of Google’s total $237.86 billion in advertising revenue for 2023. By comparison, Netflix’s ad business was not material to its earnings in 2023.

“I’d say we got years of work ahead of us to take the ads business to the point where it’s a material impact to our general business,” Netflix co-CEO Greg Peters told analysts in January, adding the ads business “won’t be a primary driver” in 2024.

YouTube has no plans to become more consistently transparent. “We will continue to celebrate the wins and the successes that we see here,” Conkling said.

Other tech giants, said Insider Intelligence analyst Ross Benes, likely will continue to employ the same strategy for their streaming platforms: stay quiet unless you have something good to say. “Amazon and Apple will not release figures until they feel they gain an advantage from doing so,” Benes told TheWrap.

Regardless, YouTube’s recent growth underscores that the likely future of the cable bundle is streaming. Already, digital services like YouTube TV and Sling control about one quarter of all pay TV subscriptions, Benes said.

“Fundamentally, what we heard loud and clear is people want a price point that they feel represents the value of the offering,” Conkling said. “They don’t want to be locked into contracts. They want to have the ability to watch their pay television offering on their phone and have it be just as good as if they’re watching it on their TV.”

The post YouTube TV Is Thriving in the Cable Replacement Space as a ‘One-Stop Shop’ for Consumers appeared first on TheWrap.