YouTube Takes Live TV Market Share as Streaming War Escalates

The pay TV business has been in secular decline for years, with multichannel video packages from cable and satellite companies (MVPDs) seeing consistent erosion.

But even amid the subscriber churn in pay TV, the streaming-focused virtual multichannel video providers (vMVPD) — think YouTube TV and Hulu’s live TV tier — have kept increasing market share, with the two leading players in the space seemingly breaking away from the pack.

More from The Hollywood Reporter

YouTube Originals Chief Nadine Zylstra Joins Pinterest to Lead Programming

'The Handmaid's Tale' Pits Elisabeth Moss Against Yvonne Strahovski for Season 5

Hulu Orders Docuseries Inspired By 'RapCaviar' Spotify Playlist

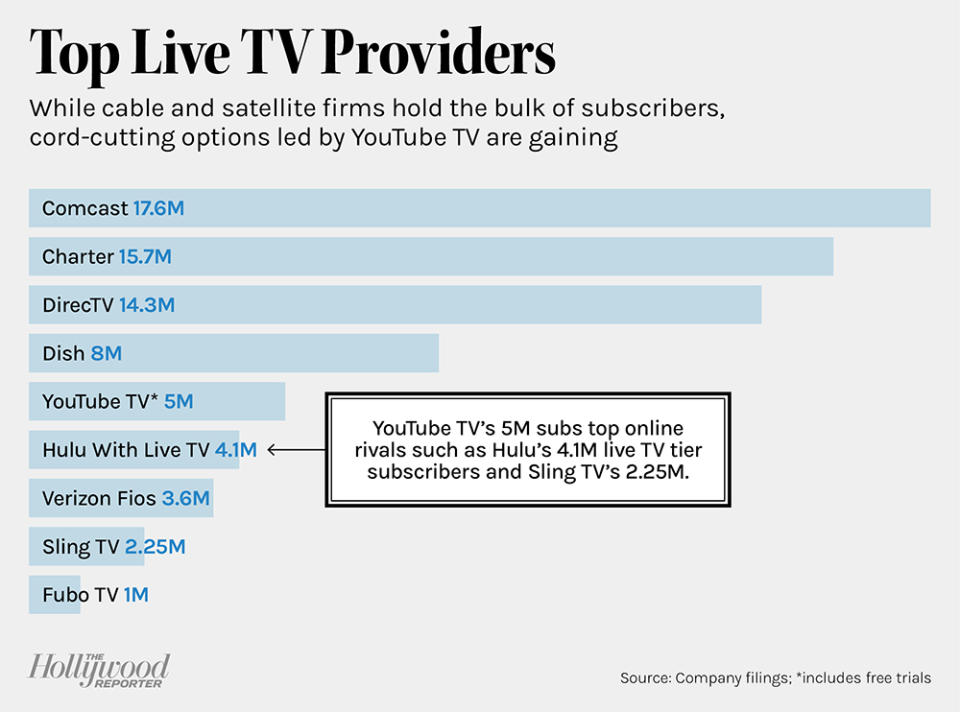

On July 12, YouTube made public new data showing that the major vMVPDs now have a combined 12.4 million subscribers, just shy of 20 percent of the active pay TV universe, and are well-positioned to be the one area where pay TV could see growth, thanks to their slick user interfaces, easy mobility between devices, and seamless sign-up and cancellation processes.

Even though vMVPDs carry many of the same channels as traditional MVPDs (CNN, Food Network, USA, ESPN, etc.), the experience is vastly different (consider cloud DVRs, which let users record as many programs as they want, or overlays that display fantasy sports data on top of live games).

YouTube revealed that its YouTube TV service hit 5 million subscribers, five years after launch. With the caveat that the 5 million figure includes those on free trials, YouTube TV’s latest figures top online rivals such as (Disney-owned) Hulu’s 4.1 million live TV tier subscribers and (Dish-owned) Sling TV’s 2.25 million, per those companies’ latest earnings reports.

But while Sling has seen its subscriber base stagnate (it had 2.5 million at the end of 2020 and 2021, 2.6 million in 2019, and 2.4 million in 2018), YouTube TV and Hulu With Live TV appear to have consistently added subscribers over time (YouTube TV has added some 2 million subscribers since late 2020, the last time it broke out numbers, while Hulu With Live TV was up 8 percent year over year last quarter).

There are other players in the space, but thus far they have been playing to specific niches, compared to the broad-based approach pursued by Hulu and YouTube (consider the Edgar Bronfman Jr.-led FuboTV, with its sports focus, or Philo TV and its less-expensive entertainment push). The exception is DirecTV — now free of AT&T — which is pursuing an aggressive streaming push, though specific numbers remain unclear. Before it began shielding its streaming subscriber numbers, DirecTV was in the same ballpark as Dish’s Sling TV.

The space appears to be evolving to a point where Disney and Google, both of which have other streaming platforms in their stable (Disney+, the primary YouTube service, respectively) that dominate, while the satellite firms and niche players battle it out for the remaining scraps.

According to Leichtman Research Group, the first quarter of 2022 saw the major pay TV providers lose 1.95 million subscribers, compared to 1.91 million a year ago, and 1.96 million in 2020. The major cable, satellite and telecom companies now have a combined 66.7 million subscribers.

That doesn’t mean any one service is resting on its laurels, however. DirecTV, as a pure-play content company, now has a strong incentive to bolster its streaming ambitions, while Philo on July 12 launched a new brand campaign called “Channeling Comfort” to try and steal market share by highlighting its ease-of-use and lower price.

Pricing is, in fact, a key factor in the streaming bundle battle, and it is an area that gives YouTube another leg up over its Hulu competition: At $64.99 a month, the subscription is cheaper than Hulu’s live TV tier, which costs $69.99 a month.

As for the other options: Philo TV starts at $25 per month, Sling TV starts at $35 per month (each with a much smaller channel selection), while FuboTV and DirecTV streaming start at $69.99 per month, consistent with Hulu.

And if the vMVPDs can continue to grow while the legacy players continue to decline, pay TV’s streaming future could arrive even sooner than people may think.

A version of this story appeared in the July 15 issue of The Hollywood Reporter magazine. Click here to subscribe.