Why Streaming Bundles Are All the Rage – and Which Ones Have the Edge | Charts

What is old is new again as the weighty cable bundles that initially drove consumers into the arms of cord-cutting are being carefully repurposed in the streaming era. Entertainment companies are now prioritizing strategic digital bundles and partnerships as they desperately seek to provide consumers with more bang for their buck in the hopes of supersizing subscriber numbers.

Recently, Paramount Global announced that Paramount+ and Showtime would become available in a special new bundle offer for as low as $7.99. The move comes after Disney announced it was expanding its own bundle offers, Walmart partnered with Paramount+, Amazon Prime and Apple One continue offering multiple services in one package and YouTube began exploring streaming distribution opportunities. Overall, it’s clear the so-called streaming wars have entered a new era of engagement.

“It seems like bundles are the new rage in the evolution of streaming TV,” Michael Lyons, chief investment office of JuiceMedia.io, a media activation agency for global brands and direct-to-consumer companies, told TheWrap.

Also Read:

As Streamers Pivot to Advertising, the Big Winners Will Be the Devices You Use to Watch

Why aggregation and bundles have become popular

With so many premium streaming video on demand (SVOD) services, the direct-to-consumer market has become more cutthroat competitive than “The Bachelor” and “The Bachelorette” combined.

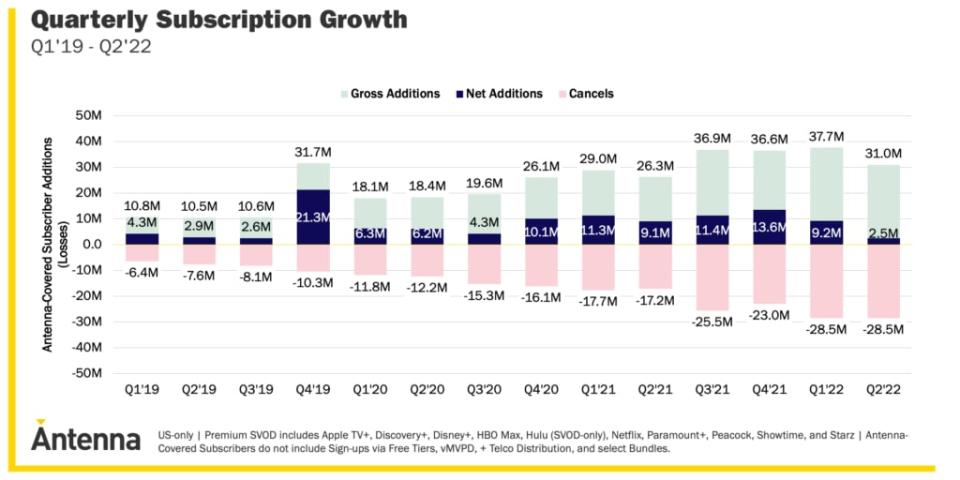

While consumer thirst for content will keep multiple services in play for monthly budgets, audiences will become far more selective as they navigate upcoming financial pressures. In the second quarter, transactional data company Antenna saw U.S. quarterly subscriber growth rates (+1.2%) and absolute volume of net subscriber additions (+2.5 million) drop to all-time lows among the 22 quarters in its data set.

It’s one reason why creative streaming packages — such as the $13 per month Disney bundle that includes Disney+, Hulu and ESPN+, as well as access to promotional Disneyland offers — are growing in importance, though even these popular services may be vulnerable to the changing economic conditions.

“These partnerships and pricing bundles are a bit of a band-aid solution to what is looming in the medium to long-term: rising prices and consumer trade-offs,” Omdia analyst Sarah Henschel told TheWrap.

As the financial pinch squeezes wallets, churn rates — or the number of customers who cancel their subscriptions in a given time period — tend to rise. Earlier this year, research company Kantar also reported that U.S. consumers had stopped adding more streaming services — with the total number of subscriptions leveling off to an average of 4.7.

That’s why entertainment companies are looking to provide subscribers with a roster of services instead of just one pure-play entertainment service. Amazon Prime includes free next day shipping and Prime Video; the Apple One bundle offers Apple TV+ alongside Apple Music, Apple Arcade, iCloud+, Apple News+ and Apple Fitness+. Customers want more value and everyone from Hollywood to Silicon Valley is racing to figure out how to give it to them.

Also Read:

How the Major Streamers Stack Up Right Now – in Subscribers and Revenue | Charts

Overseas, where the over-the-top (OTT) market hasn’t fully formed beyond early leads for Netflix, Disney and Amazon, there may be more opportunities to create bundles that include otherwise fierce competitors in the U.S. For example, Paramount Global and Comcast are partnering on SkyShowtime, an SVOD service that combines entertainment assets from both companies for 22 European territories. However, it’s unlikely the major competitors strike any such cooperative deals in the U.S.

Now, as every streaming service chases the lofty subscriber totals of Netflix (220.7 million) and Disney+ (152.1 million), affordable bundling and added-value offers are one way to quickly build up customer bases. It’s why streaming services are often included in internet and phone contract packages, such as Apple TV+’s partnership with T-Mobile and Xfinity customers receiving free Peacock subscriptions.

“This is where streaming services are being used by other industries to add value and allow consumers to have a wider range, without inheriting the cost,” Craig Brown, head of delivery at global marketing agency and Google marketing partner Incubeta, told TheWrap.

Also Read:

How Demand for Netflix’s ‘The Sandman’ Stacks Up Against Other Neil Gaiman Shows | Charts

Who is going to win the bundling wars?

Aggregation, consolidation and bundling are clearly a winning strategy for now, but it remains to be seen who the ultimate aggregators will be: smart TV operators, channel aggregators such as Apple TV and Roku, telecommunications giants or even the direct-to-consumer streamers themselves.

“I suspect that smart TV operators are best positioned to create and own content bundles for consumers,” Henschel said. “They have the opportunity to bring [free ad-supported streaming TV] channels, streaming applications, transactional video storefronts and [ad-based video on demand] services all in one place.”

Despite the clear advantages devices such as Amazon Fire and Samsung TVs may have, Henschel noted that hardware-first TV operators will need to make technological pivots in strategy to find success, which isn’t always a smooth or timely transition.

On the content side of Hollywood’s battle royale, Brown sees a few potential victors holding an edge. “The long-term winners in this are going to be those who can create content across many consumer interests, which puts the likes of Disney, Netflix and Peacock through NBC in strong positions as they have always been content-first businesses,” he said.

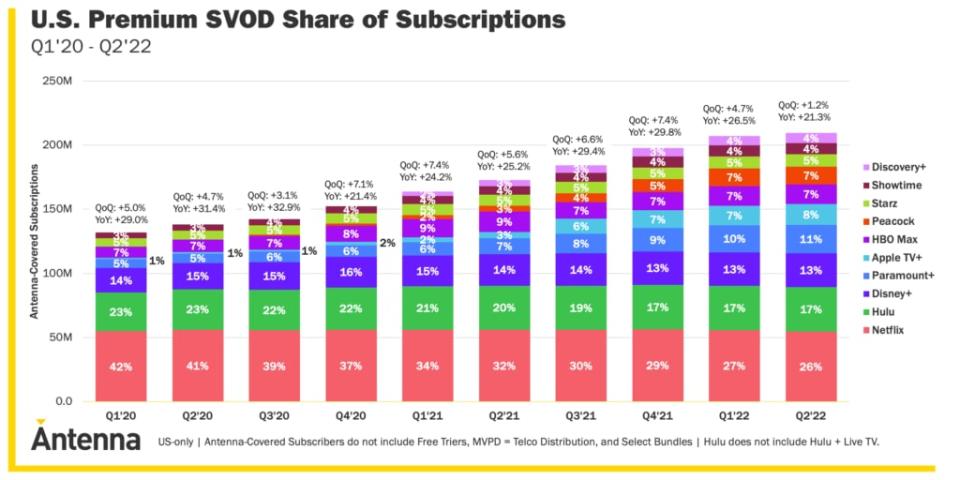

Disney+ and Hulu control a combined 30% of the U.S. premium SVOD share of subscriptions, Netflix controls 26% and Peacock sits at 7%, per Antenna.

Will streaming bundling be just as unpopular as cable bundling?

In the cord-cutting era, virtually oriented distributors like Hulu + Live TV and YouTube TV have supplanted traditional multichannel video programming distributors (MVPDs) such as Comcast, DirecTV and Dish.

But as the streaming industry matures, many viewers have grown frustrated with the complicated game of musical chairs they’re forced to play to keep track of where and when to find their favorite shows. In July, “Criminal Minds” left Netflix for Paramount+, only for a recent announcement to tout the upcoming return of the show to Netflix. Cable’s biggest hit, Paramount Network’s “Yellowstone,” actually streams on Peacock and not Paramount+. Netflix’s Marvel shows disappeared for a few weeks earlier this year before resurfacing on Disney+.

While added-value bundling and aggregation help to streamline the entertainment process by gathering a number of services in one digital location, the approach also runs the risk of overwhelming the consumer much like the bloated and overly complicated cable bundles of yesteryear. It’s a warning sign Lyons has noticed creeping up in the industry.

“Since what is old is new, we can expect come some consumer backlash over the complexity of these new offerings,” he said.

Also Read:

Why Disney Shouldn’t Celebrate Beating Netflix’s Global Subscribers Just Yet | Charts